The short term is a period of time too short for the enterprise to change its production capacity, but long enough to change the intensity of use of these fixed capacities. During the short-term period, the firm is able to change the volume of production, involving in this process additional quantities of changeable resources (the use of more or less human labor, raw materials and other resources) while production capacity remains unchanged (fixed). But how does output change as more and more variable resources are added to the firm's fixed resources?

In its most general form, the answer to this question is given by the law of diminishing returns, which is also called the “law of diminishing marginal product” or the “law of varying proportions.” This law states that when a variable resource (for example, labor) is sequentially added to a firm's constant (fixed) resource (for example, capital or land), the additional, or marginal, product per each subsequent unit of the variable resource, starting from a certain point, decreases.

Rice. 1. 6a and 1.6b illustrate the law of diminishing returns and help to better understand the relationships between total, marginal and average products.

As an additional variable resource (labor) is added to the constant volume of other resources (land or capital), the resulting total product first increases at a decreasing rate, then reaches its maximum and begins to decrease (Fig. 1.6a).

Marginal product (Fig. 1.6b) reflects changes in total product associated with the investment of each additional unit of labor. Marginal product measures the change in total product associated with the addition of each new worker. Therefore, the three phases through which the total product passes also affect the dynamics of the marginal product. When total product grows at an accelerated rate, marginal product inevitably increases. At this stage, additional workers contribute more and more to the total output. Similarly, when total product grows but at a slower rate, marginal product is positive but shrinks. Each worker contributes less to total production compared to his predecessor. When total product reaches its maximum value, marginal product becomes zero. And when total product begins to decline, marginal product becomes negative.

Figure 1.6 Total, marginal and average product curves

The dynamics of the average product reflects the same general relationship “growth - maximum - decrease” between variable labor inputs and production volume, which is characteristic of the marginal product. However, you should pay attention to the relationship between the marginal and average products: where the marginal product exceeds the average, the latter increases; and wherever the marginal product is less than the average product, the latter decreases. It follows that the marginal product curve intersects the average product curve at the point where the latter reaches its maximum.

Fixed, variable and total costs

We already know that over a short period of time, some resources related to a firm's production capacity remain constant. Other resources can be changed. It follows that within the short term, costs can be divided into fixed and variable.

In column (2) of the table. 1.1 the firm's fixed costs are conventionally taken to be 100 dollars. Fixed costs, by definition, exist at any production volume, including zero. In the short term, fixed costs cannot be avoided.

In column (3) of the table. 1.1 we will find that the total amount of variable costs varies in direct proportion to the volume of production. However, the increase in the amount of variable costs associated with an increase in production volume per unit of output is not constant. At the beginning of production expansion, variable costs increase, but their growth rate slows down over time. This continues until the fourth unit of output is produced, but then variable costs begin to increase at an increasing rate for each subsequent unit of output produced.

This behavior of variable costs is due to the law of diminishing returns. Due to the increase in marginal product, the production of each subsequent unit of output will require a smaller and smaller increase in variable resources for some time. And since all units of variable inputs have the same price, the total amount of variable costs will increase at a decreasing rate. But once marginal product begins to decline according to the law of diminishing returns, the production of each subsequent unit of output will require more and more additional variable inputs. The amount of variable costs will thus increase at an increasing pace.

Total costs are the sum of fixed and variable costs for any volume of production. In table 1.1 they are shown in column (4). At zero output, total costs equal the firm's fixed costs.

Variable costs are costs that an entrepreneur is able to manage, that is, change their value over a short period of time by changing the volume of production. Fixed costs, on the contrary, are not subject to ongoing control by the company's management; such costs are unavoidable in the short term and must be paid regardless of production volume.

Specific, or average, costs

Manufacturers are, of course, concerned about their total costs, but they are equally concerned about unit, or average, costs. In particular, it is more appropriate to use indicators of average costs for comparison with the price of the product, which is always set per unit of production. Average fixed, average variable and average total costs are shown in columns (5), (6) and (7) of the table. 1. Let's look at how unit costs are calculated and how they change depending on changes in production volume.

1. Average fixed costs (AFC) of any volume of production are determined by dividing total fixed costs by the corresponding quantity of production:

Since total fixed costs, by definition, do not depend on the volume of output produced, average fixed costs decrease as production increases. As production volume increases, total fixed costs, say $100, are distributed over more and more units of the product produced. In Fig. 1.7, the average fixed cost curve continuously decreases as production volume increases.

2. Average variable costs (AVC) of any volume of production are determined by dividing the total variable costs by the corresponding quantity of production:

Average variable costs initially decline until they reach their minimum, and then begin to rise. Graphically, this is manifested in the concave arc-shaped shape of the average variable cost curve, which is shown in Fig. 1.7.

Since total variable costs are subject to the law of diminishing returns, this should also be reflected in the values of average variable costs that are calculated on their basis. During the increasing returns stage, the production of each of the first four units of output requires fewer and fewer additional variable inputs. As a result, variable costs per unit of product are reduced. When the fifth unit is produced, average variable costs reach their minimum value and then begin to increase, since diminishing returns create the need for more and more variable inputs to produce each additional unit of output.

The convex average product curve is an inverted concave arc of the average variable cost curve.

3. Average total costs (ATC) of any volume of production are calculated by dividing the total costs by the corresponding quantity of production or by adding the average fixed and average variable costs of a particular volume of production:

ATC= TC/Q= AFC+AVC (1.7)

The values of this indicator are given in column (7) of the table. 1.1. Graphically, average total costs are established by adding vertically the curves of average fixed and average variable costs, as shown in Fig. 1.7. Thus, the segment between the curves of average total and average variable costs indicates the value of average fixed costs for any volume of production.

Marginal cost

From column (4) of table. 1.1 shows that as a result of the production of the first unit of product, total costs increase from 100 to 190 dollars. Therefore, the incremental, or marginal, cost of producing this first unit is $90. (column 8), etc.

Marginal costs can also be calculated based on total variable costs (column 3), since total and total variable costs differ only by a fixed amount of fixed costs ($100). Therefore, the change in total costs is always equal to the change in total variable costs for each additional unit of output.

Marginal costs, by their nature, are more directly and immediately controllable than all others. Production volume decisions are typically based on marginal decisions, that is, decisions about whether the firm should produce one more or one less of a product. In combination with the marginal revenue indicator, the marginal cost indicator allows the firm to determine the profitability of a particular change in the scale of production. In Fig. Figure 1.8 shows the marginal cost curve. It drops steeply, reaches its minimum and then rises quite steeply. This reflects the fact that variable costs, and therefore total costs, first grow at a decreasing and then increasing rate.

The marginal cost (MC) curve intersects the average total (ATC) and average variable costs (AVC) curves at the points of the minimum value of each of them. This is explained by the fact that as long as the additional, or marginal, value added to the total (or variable) costs remains less than the average value of these costs, the average value of costs necessarily decreases. And vice versa, when the marginal value is added to the total (or variable) costs and exceeds their average value, then the average value of costs must increase.

The relationship between marginal product and marginal cost is easy to understand from Figure 1.9.

The marginal cost (MC) and average variable cost (AVC) curves are the mirror image of the marginal product (MP) and average product (AP) curves, respectively. Assuming that labor is the only variable cost and the price of labor (the wage rate) remains constant, marginal cost can be calculated by dividing the wage rate by the marginal product. Therefore, as marginal product increases, marginal cost decreases; when marginal product reaches a maximum, marginal cost takes a minimum value; and as marginal product decreases, marginal cost increases. A similar relationship connects the average product and average variable costs.

The short term is a period of time too short to change production capacity, but sufficient to change the intensity of use of these capacities. Production capacity remains unchanged in the short term, and the volume of output can change by changing the amount of labor, raw materials, and other resources used at these facilities. The production costs of any product depend not only on the prices of resources, but also on technology - on the amount of resources needed for production. We will consider how output will change as we introduce more and more variable inputs.

Production costs in the short term are divided into constant, variable, total, average and marginal. Fixed costs (FC) are costs that do not depend on production volume. They will always occur, even if the company does not produce anything. These include: rent, deductions for depreciation of buildings and equipment, insurance premiums, capital repair costs, payment of obligations on bond issues, as well as salaries to senior management personnel, etc. Fixed costs remain unchanged at all levels of production, including zero. Graphically they can be represented as a straight line parallel to the abscissa axis (see Fig. 1). It is indicated by the FC line. Variable cost (VC) - costs that depend on production volume. These include the costs of wages, raw materials, fuel, electricity, transportation services and similar resources. Unlike constants, variable costs vary in direct proportion to production volume.

Graphically they are depicted as an ascending curve (see Fig. 1), indicated by the VC line. The variable cost curve shows that as product output increases, variable production costs increase. The difference between fixed and variable costs is essential for every businessman. An entrepreneur can manage variable costs, since their value changes over the short term as a result of changes in production volume. Fixed costs are beyond the control of the company's administration, since they are mandatory and must be paid regardless of the volume of production.

Rice. 1.

Total, or gross, costs (total cost, TC) - costs as a whole for a given volume of production. They are equal to the sum of fixed and variable costs: TC = FC + VC. If we superimpose the fixed and variable cost curves on top of each other, we get a new curve reflecting total costs (see Fig. 1). It is indicated by the TC line. Average total cost (average total cost, ATC, sometimes called AC) is the cost per unit of production, i.e. total costs (TC) divided by the quantity of products produced (Q): ATC = TC/Q. Average total costs are usually used for comparison with price, which is always quoted per unit. Such a comparison makes it possible to determine the amount of profit, which allows us to determine the tactics and strategy of the company in the near future and for the future. Graphically, the curve of average total (gross) costs is depicted by the ATC curve (see Fig. 2). The average cost curve is U-shaped. This suggests that average costs may or may not be equal to the market price. A firm is profitable or profitable if the market price is higher than average costs.

Rice. 2.

In economic analysis, in addition to average total costs, such concepts as average fixed and average variable costs are used. This is similar to average total cost, fixed cost, and variable cost per unit. They are calculated as follows: average fixed costs (AFC) are equal to the ratio of fixed costs (FC) to output (Q): AFC = FC/Q. Average variables (AVC), by analogy, are equal to the ratio of variable costs (VC) to output (PO):

Average total costs are the sum of average fixed and variable costs, i.e.:

ATC = AFC + AVC, or ATC = (FC + VC) / Q.

The value of average fixed costs continuously decreases as production volume increases, since a fixed amount of costs is distributed over more and more units of output. Average variable costs change according to the law of diminishing returns. Marginal costs play an important role in determining a firm's strategy in economic analysis. Marginal, or marginal, costs (marginal cost, MC) - costs associated with the production of an additional unit of output. MC can be determined for each additional unit of production by dividing the change in the increase in the amount of total costs by the increase in output, i.e.:

MS = DTS/DQ.

Marginal costs (MC) are equal to the increase in variable costs (VVC) (raw materials, labor), if it is assumed that fixed costs (FC) are constant. Therefore, marginal cost is a function of variable cost. In this case:

MS = DVC/DQ.

Thus, marginal cost (sometimes called incremental cost) represents the increase in costs resulting from producing one additional unit of output. Marginal cost shows how much it would cost the firm to increase output by one unit. Graphically, the marginal cost curve is an ascending line MC, intersecting at point B with the average total cost curve ATC and point B with the average variable cost curve AVC (see Fig. 3). Comparison of average variables and marginal production costs is important information for managing a company, determining the optimal production size within which the company consistently earns income.

Rice. 3.

From Fig. Figure 3 shows that the marginal cost (MC) curve depends on the value of average variable costs (AVC) and gross average costs (ATC). At the same time, it does not depend on average fixed costs (AFC), because fixed costs FC exist regardless of whether additional output is produced or not. Variable and gross costs grow along with product output. The rate at which these costs increase depends on the nature of the production process and, in particular, on the extent to which production is subject to the law of diminishing returns in relation to variable factors. If labor is the only variable, what happens when output increases? To produce more, a firm must hire more workers. Then, if the marginal product of labor declines rapidly as labor input increases (due to the law of diminishing returns), more and more costs are needed to speed up output. As a result, variable and gross costs rise rapidly along with an increase in production volume. On the other hand, if the marginal product of labor decreases slightly as the quantity of labor used increases, costs will not increase as quickly as output increases. Marginal and average costs are important concepts. As we will see in the next chapter, they have a decisive impact on the firm's choice of production volume. Knowledge of short-term costs is especially important for firms operating in conditions of significant fluctuations in demand. If a firm is currently producing at a level at which marginal cost rises sharply, uncertainty about future increases in demand may force the firm to make changes to its production process and likely induce additional costs today to avoid higher costs tomorrow.

Economic costs. Internal and external costs. Economic profit.

Production costs and enterprise profit

The most important factor What determines a company's ability and desire to put a product on the market is production costs.

Using Specific Resources for the production of one good means the impossibility of producing another good. Costs in the economy are directly related to the denial of the possibility of producing alternative goods and services.

Imputed (economic) costs of any resource are equal to its value under the best of all possible uses.

Cash expenses, which the company carries out in favor of some external organizations are called explicit costs. Expenses for consuming one's own, internal resources are implicit costs. For example, for the owner of a small store where he works himself, there are obvious costs for purchasing goods, but there are no obvious costs for renting premises and wages. Implicit costs in this case represent the income that the owner of this store could receive if he rented out this premises and received wages somewhere.

Minimum fee for such a resource as entrepreneurial ability, necessary to keep the store owner in his store, is called normal economic profit, which is also an element of implicit costs.

So, economic costs are considered to be all payments, external and internal, incl. normal profit necessary to attract and retain resources within a given business.

Economic profit is different from accounting profit.

Accounting profit = total revenue - explicit costs

Economic profit = total revenue - economic costs

Economic costs = explicit costs + implicit costs (including normal profit)

Economic profit is income received in excess of normal profit.

All resources are somewhat conditional used in production can be divided into two large groups: resources, the value of which can be changed very quickly (for example, costs of raw materials, materials, energy, hiring labor, etc.) and resources, change the volume of use. the implementation of which is possible only over a sufficiently long period of time (construction of a new production facility).

Based on these circumstances, Cost analysis is usually carried out in two time periods: in the short term (when the amount of some resource remains constant, but production volumes can be changed by using more or less resources such as labor, raw materials, materials, etc.) and in the long term period (when you can change the amount of any resource used in production).

The difference between The short-term and long-term periods exactly correspond to the difference between constant and variable factors of production.

Variable factors of production— factors of production, the quantity of which can be changed within the short-term period (for example, the number of employees).

Fixed factors of production- factors whose costs are specified and cannot be changed within the short-term period (for example, production capacity). Thus, in the short term, an entrepreneur uses both constant and variable factors of production. In the long run, all factors of production are variable.

So, in the short term there are:

. fixed costs(TFC) the value of which does not depend on the volume of output ( depreciation charges, interest on a bank loan, rent, maintenance of the administrative apparatus, etc.). We are talking about the costs of resources related to constant factors of production. The amount of these costs is not related to production volumes. Fixed costs exist even when production activities at the enterprise are suspended and the volume of production is zero. An enterprise can avoid these costs only by completely ceasing its activities;

. variable costs(TVC), the value of which varies depending on changes in production volume (costs of raw materials, materials, fuel, energy, wages of working personnel, etc.). We are talking about the costs of resources related to variable factors of production. With the expansion of production, variable costs will increase, since the company will need more raw materials, materials, workers, etc. If the company stops production and the output volume (Q) reaches zero, then variable costs will decrease almost to zero, while fixed costs will remain unchanged.

The difference between fixed and variable costs are essential for every businessman: he can manage variable costs, fixed costs must be paid regardless of production volumes, even if production is suspended.

In addition to fixed and variable costs in the short term, another type of costs is distinguished - gross (total, total, total). Gross costs (TC) - the sum of fixed and variable costs calculated for each given volume of production: TC= TFC+ TVC.

Gross costs (TC) - This the sum of fixed and variable costs.

Since TFC are equal to some constant, the dynamics of gross costs will depend on the behavior of TVC, i.e., it will be determined by the law of diminishing marginal productivity (therefore, the graph of the TVC and TFC functions is not a straight line).

The law of diminishing returns states, that, starting from a certain moment, the sequential addition of units of a variable resource to a constant, fixed resource gives a decreasing additional product per each subsequent unit of a variable resource.

Figure 1.

In addition to gross costs The entrepreneur is interested in the costs per unit of production, since it is these that he will compare with the price of the product in order to get an idea of the profitability of the company. Costs per unit of output are called average. This group of costs includes:

Average Fixed Cost (AFC) determined by dividing total fixed costs (TFC) by the quantity produced. AFCs fall as production increases

AFC = TFC / Q

Average Variable Cost (AVC) are determined by dividing total variable costs (TVC) by the quantity produced. AVCs first fall to their minimum and then begin to rise because TVCs obey the law of diminishing returns.

AVC = TVC/Q

Average Total Cost (ATC) are calculated by dividing the sum of total costs by the quantity of production or as the sum of AFC and AVC.

ATC = TC / Q = AVC + AFC

Average fixed cost schedule presented hyperbole(picture below). The graph of average variable costs is an irregular parabola with upward branches. Two segments can be distinguished on this curve. On the first, AVC decreases, on the second, they increase. Such dynamics of average variable costs are associated with the action of the law of diminishing marginal returns. While the return from each subsequent unit of a variable resource increases (the area of increasing marginal return in the figure below), average variable costs fall.

As volumes increase production of additional product begins to decline - the marginal return of each subsequent unit of a variable resource falls - therefore, to further increase production, an increasing amount of variable resources is required, and average variable costs AVC increase. The schedule of average total costs is obtained by vertically summing two curves - AFC and AVC. In this regard, the dynamics of the ATS will be related to the dynamics of average fixed and average variable costs. While both are decreasing, ATCs are falling, but when, as production volume increases, the growth of variable costs begins to outpace the fall in fixed costs, ATCs begin to increase.

Figure 2

Marginal cost (MC) are the additional costs associated with producing one more unit of output.

MC = change in TC / change in Q

Must be taken into account that marginal costs largely depend on variable costs, therefore, similar to the situation with variable costs, as well as with average variable and average total costs, two segments are distinguished on the MC graph: a segment with negative dynamics and a segment with positive dynamics, which is also explained by the existence of the law of decrease vay marginal return. The next feature of the marginal cost graph is that it intersects the average variable and average total costs graphs at their lowest points (A and B).

The basis of any economic decision must contain an answer to the question of the correlation between what is spent on a particular project and what can be obtained from its implementation over and above the costs incurred. This result is determined by profit.

Before deciding how many products or products to produce, a company must conduct a cost analysis. Costs in general represent payments for purchased factors of production.

Costs are divided into two main groups. Explicit costs include cash payments for factors of production to suppliers. They are fully reflected in the company's accounting records, which is why they are sometimes called accounting costs. Implicit costs include the opportunity costs of using resources that belong to the enterprise.

The sum of explicit and implicit costs represents economic costs. Not all costs incurred by an organization should be included in accounting costs. This is due to the fact that a certain share of costs is incurred by the company at the expense of profits. Examples could be income tax, bonuses paid by the company out of profits, financial assistance to workers, etc.

The opportunity cost of production can be measured through the cost of the greatest lost opportunity that was used to create factors of production. Also, opportunity costs act as the difference in profit that could be obtained with more efficient use of resources and the actual profit received.

Not all costs or expenses can be classified as opportunity costs. When implementing any method of using resources, costs that the enterprise necessarily bears are not considered alternative. This may include renting premises, costs of registering an enterprise. These costs are not opportunity costs; they do not participate in the process of economic choice.

Fixed and variable costs in the short term

Fixed production costs (TFC) are the costs of using fixed factors of production. They do not depend on production volumes and are determined by the quantity and price of constant resources used.

Production costs in the short term relate to the very existence of the enterprise; they are paid by it even when no products are produced at all. Fixed costs consist of depreciation charges for buildings and structures, equipment, salaries of management personnel, insurance premiums and rental payments.

Production costs in the short run also include variable costs (TVC). These are the costs that arise from the use of variable production factors. Their value depends on the volume of products produced, and as output increases, this type of cost increases. These include the costs of raw materials, electricity, and wages of key workers.

Average costs

If we add up fixed and variable costs, we get total costs. They are sometimes called gross, total, or total costs. They are determined for the short-term period using the following formula

TC= TFC+ TVC

Production costs in the short term can characterize the overall level of production costs of an enterprise. Average production costs characterize the level of costs for each unit of production. We can also distinguish average constants (AFC) and variable costs (AVC). Average fixed costs reflect the costs of fixed production resources with which a unit of products is produced. They can be determined through the ratio of fixed costs and production volume:

AFC= TFC/Q

Average variable costs reflect the costs of variable production resources with which a unit of products is produced. Their formula looks like this:

AVC=TVC/Q

Average and marginal costs in the short run

Average production costs in the short term may reflect the costs of fixed and variable resources. Then we can talk about the average total production costs, in accordance with which a unit of output is produced. Average total production costs by the ratio of total costs to production volume:

ATC=TC/Q

Let's also consider the concept of marginal costs, which are the increase in total costs associated with the production of an additional unit of products. Marginal production costs characterize the rate at which total variable costs increase with expanded production volume.

Ministry of Education and Science of the Russian Federation

Federal Agency for Education

State Educational Institution of Higher Professional Education All-Russian Correspondence Financial and Economic Institute

Department of Economic Theory

Test

by discipline "Economic Theory"

Option No. 15

Teacher - Smirnova K.N.

Student - Krokhina. E.V.

Faculty: Management and Marketing

Specialty: organization management

I year, 5th group, evening

Personal file number: 09MMD12535

Kaluga 2010

Introduction

2. Total, average and marginal costs

Conclusion

Introduction

Production costs are a rather serious and pressing problem today due to the fact that in market conditions the center of economic activity moves to the main link of the entire economy - the enterprise. It is at this level that products needed by society are created and necessary services are provided. Here the issues of economical use of resources, the use of high-performance equipment and technology are resolved. The enterprise strives to reduce production and sales costs to a minimum.

Since costs are the main limiter on profit and at the same time the main factor influencing the volume of supply, decision-making by the company’s management is impossible without an analysis of existing production costs and their value for the future. This applies both to the release of already mastered products and to the transition to new products. If the costs are not calculated, then there is a very high probability that they will be more than the income, i.e. the company will suffer reduced profits and even losses. And if a company falls into a financial crisis, it can be very difficult to get out of it. Any company, before starting production, must clearly understand what profit it can expect. To do this, she will study demand and determine at what price the products will be sold, and compare the expected revenues with the costs to be incurred.

1. Company costs in the short term

The costs of acquiring the production factors used are called production costs. Costs are the expenditure of resources in their physical, natural form, and costs are the valuation of the costs incurred.

All costs are divided into transformation and transaction.

Transformation costs - include the direct costs of a company (or enterprise) for processing raw materials into finished products intended for sale on the market.

Transaction costs are associated with protecting an entrepreneurial position in market transactions and are not associated with the process of value creation. They create goods that are valuable for an individual or a collective agent of the economy (enterprise, firm, association). These include the costs of finding the necessary business information, negotiating, concluding contracts, and protecting brand names and trademarks. It is also believed that a type of this kind of costs are losses from the so-called opportunistic behavior of counterparties, when they conduct the negotiation process with greater benefit for themselves.

There are two approaches to estimating costs: accounting and economic. Both accountants and economists agree that a firm's costs in any period are equal to the value of the resources used to produce the goods and services sold during that period. The company's financial statements record actual or external (“explicit”) costs, which represent cash costs to pay for the production resources used (raw materials, materials, labor, etc.). However, economists, in addition to explicit ones, also take into account internal “implicit” costs; they are also called costs of missed (lost) opportunities. “Lost opportunity costs” mean the costs and losses of income that arise when choosing one of the options for production or sales activities, which means abandoning other possible options. Thus, opportunity cost can be viewed as the amount of income that factors of production could have provided to the firm if they had been more profitably used in alternative options.

Accordingly, a distinction is made between accounting profit and net economic profit. As a rule, economic profit refers to the difference between total revenue and external and internal costs.

Short term- this period of time is too short to change production capacities, but sufficient to change the intensity of use of these capacities. Production capacity remains unchanged in the short term, and the volume of output can change by changing the amount of labor, raw materials, and other resources used at these facilities. The production costs of any product by a given firm depend not only on the prices of the necessary resources, but also on technology - on the amount of resources needed for production. It is this, that is, the technological aspect of cost formation, that interests us at the moment.

Over the short run, a firm can change its output by combining varying quantities of inputs with fixed capacities. How will output change as more and more variable resources are added to the firm's fixed resources? In the most general form, the answer to this question is given by the law diminishing productivity which reflects the relationship between an increase in production and the costs of a variable factor, with all other factors remaining constant. According to this law, the increase in production achieved with a uniform increase in the variable factor, upon reaching a certain level, will decrease as the ratio between the variable and constant factors increases.

You can find different names for the law of diminishing returns:

"law of diminishing marginal productivity", "law of diminishing marginal product", "law of diminishing returns". This is due to the fact that the law of diminishing returns reflects how the additional or marginal product changes as a variable factor increases while others remain constant. Sometimes the law of diminishing returns is also called the “law of varying proportions” or “law of varying proportions.” In this case, it is emphasized that the law of diminishing returns also reflects how production changes when the ratio between variable and constant factors in production changes

It is easy to see that the law of diminishing returns primarily reflects changes in the total, average and marginal products of variable costs.

In other words, if the number of workers servicing machinery increases, then the growth in output will occur more and more slowly as more workers are involved in production.

2. Total, average and marginal costs

In the short run, production costs can be divided into fixed and variable.

Fixed costs (F C ) – These are the monetary costs of resources that make up the constant factors of production. The amount of fixed costs does not depend on the volume of production; these include the costs of operating buildings, structures and equipment, administrative and management expenses, and rent. Fixed costs exist even when the firm does not produce anything, does not carry out any production. Therefore, fixed costs are sunk costs that create the basis for the company’s losses.

Variable costs (V C ) – these are the monetary costs of resources that make up the variable factors of production. Their value changes with changes in production volume; they usually include the costs of materials, raw materials, and wages.

General costs (TS ) - these are the total costs of producing a certain volume of products. Since in the short term a number of input factors of production (primarily capital) do not change, some part of the total costs also does not depend on the number of units of variable resource used and on the volume of output of goods and services. Consequently, for any production volume Q, total costs are the sum of total fixed and total variable costs:

Opportunity costs of full-time education include:

a) tuition fees;

b) the cost of textbooks;

c) the salary that could be received by working instead of studying;

d) all of the above options are correct.

The correct answer is c)

Thus, when studying at a full-time university after school, a girl misses the opportunity to work during this period as a secretary (and not as a loader or watchman) and receive the appropriate salary. The secretary's salary will be for her the alternative cost (opportunity costs) of studying full-time at a university.

The firm's fixed costs are:

a) costs of resources at prices in effect at the time of their acquisition;

b) minimum production costs of any volume of production under the most favorable production conditions;

c) costs that the company bears even if the product is not produced;

d) implicit costs;

e) none of the answers are correct.

The correct answer is c)

Fixed costs include costs that a company has, regardless of the volume of products produced.

Ground rent will increase, other things being equal, if:

a) the price of land decreases;

b) demand for land is growing;

c) demand for land is decreasing;

d) the supply of land is growing;

d) under any of these conditions.

Explain your answer.

The price of land is related to land rent. Ground rent is a payment for the use of land and other natural resources, the supply of which is strictly limited.

Rent must be distinguished from ground rent. Rent is the price of land services. It includes rent, depreciation on buildings and structures, as well as interest on invested capital. If the owner of the land has made some improvements, then he must reimburse the cost of these structures and receive interest on the capital expended (after all, he could put the money in the bank and live in peace, receiving interest).

As demand increases, the price increases, and hence the rent.

In the long-term time interval, zero economic profit is obtained by:

a) firms operating under conditions of perfect competition

b) firms operating under conditions of monopolistic competition

c) firms operating in an oligopoly

d) firms operating under conditions of pure monopoly.

Operating under conditions of perfect competition brings zero profit in the long run. Since as soon as profit appears, new market participants appear who increase supply, reducing prices.

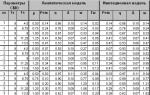

Calculate the costs from the table: total TC, constant FC, variable CS, marginal MC, average ATC, average constant AFC and average variable AVC.

|

Issue pcs. |

TFC |

TVC |

|||||

Formulas for solution:

MC = ∆TC /∆Q = ∆TVC /∆Q

ATC = TC/Q

AFC = TFC /Q

AVC = TVC /Q

Conclusion

The firm's costs in any period are equal to the cost of the resources used to produce the goods and services sold during that period. The profit of an enterprise depends on the price of the product and the cost of its production. The price of products on the market is a consequence of the interaction of supply and demand. Here, the price changes under the influence of the laws of market pricing, and costs can increase or decrease depending on the volume of labor or material resources consumed.

The specific composition of costs that can be attributed to production costs is regulated by law in almost all countries.

In enterprises, the cost structure is often understood as the relationship between fixed and variable costs, which allows one to analyze the structure and draw conclusions about the quality of production.

The most important ways to reduce production costs is to determine the optimal amount of purchased resources consumed in production - labor and material. As well as reducing the labor intensity of products and increasing productivity.

The basic premise of modern economics about production costs: in order to obtain more of any good, it is necessary to provide potential producers and suppliers of this good with a certain incentive that would encourage them to transfer resources from the sphere of their current use to the production of what we want. It is necessary that the benefits of such a transfer exceed the costs of it, i.e. exceeded the value of the opportunities that potential entrepreneurs would have to give up.

List of used literature

1.Economic theory: key issues: Textbook/PEOD ed. Doctor of Economics, Professor A.I. Dobrynin. – 3rd ed., add. – M.: INFRA-M, 1999

2. Economic theory. Textbook. Ed. I.P. Nikolaeva. - M.: Finstatinform, 1997.

3. Economics of organizations (enterprises): Textbook for universities. Ed. prof. V.Ya. Gorfinkel, prof. V.A. Shvandira. - M.: UNITY-DANA, 2003

4. Kurakov L.P., Yakovlev G.E. course of economic theory: Textbook. 4th ed. – M. Helios ARV, 2005.

5. E. Popov, V. Lesnykh Transaction costs in a transition economy//World Economy and International Relations. - 2006.