Any exchange asset has two prices at any given time: the price announced by the nearest seller and the price appointed by the nearest buyer. Difference between indicated prices called spread.

The smaller the spread value, the better liquidity the instrument has, and vice versa, the spread wider, the less liquid the exchange asset is.

For example, for shares at the best buyer price 128.72 rubles. and the seller's best price is 128.73 rubles. the spread is 0.01 rub. For a pair with a seller price ASK = 0.9298 (you can buy at this price) and a buyer price BID = 0.9297 (you can sell at this price), the spread will be 0.0001 points.

The spread can be fixed or floating

A fixed spread is a constant value and therefore does not change depending on the current market situation. It is set by the broker individually for each instrument and is found only on the market in the section where trading is carried out on micro and mini accounts (service for which is carried out automatically).

The vast majority of instruments are characterized by a floating spread, the value of which varies under the influence of prevailing market factors. However, its “width” is not absolutely chaotic and is always controlled by the exchange (the spread is regulated, whose task is to reduce it to a minimum).

Why is the spread widening?

However, the difference between the most best price to buy and the best selling price is kept within a narrow framework; there are periods when the spread widens. This happens most often in crisis periods, when prices drop sharply, or during periods of rapid growth, when quotes decisively go up.

As noted above, the concept of “spread” is directly related to the concept of “”. So, than more difference, the worse the liquidity turns out to be. Those. when the spread is wide, traders will always buy or sell assets at worse prices than they would like. Accordingly, such transactions will not be profitable for them, and they will not strive to trade such instruments.

During periods of collapse, the exchange deliberately widens the spread, and it becomes unprofitable to make sales, and accordingly the price stabilizes. The same thing happens with unreasonable growth: the widening of the spread makes purchases unprofitable and the influx of buyers decreases.

What is a spread on FOREX

For the foreign exchange market, the spread is a form of broker's commission, and by making a purchase, the trader receives the price worse than the market exactly by the amount of the difference between the purchase and sale prices, this difference is “taken away” by the broker. In order to attract new clients, Forex brokers are constantly striving to reduce the spread.

The difference in the price of various assets, be it currencies, stocks or precious metals, is the only and unique source of earnings on exchanges. It is from price fluctuations that traders make serious money, using various statistical tools and information channels for accurate investment forecasting. At the same time, you can make money both by increasing and decreasing the value of the trade item. In any case, such an important concept as a spread will be involved in such operations - the difference between the best purchase and sale price of an asset at the moment.

Beginners and experienced traders are offered optimal conditions for concluding transactions!

Minimum spread and low commission are the key advantages of the AvaTrade brokerage platform!

What is a spread in simple words

In order to understand what a spread is on the stock exchange, it is enough to imagine any trading operation - for example, buying clothes with further resale. The difference between the original price paid and the money received through speculation is commonly called profit or income. The spread is an analogue of this difference, and in this case the income is received by brokers.

In the foreign exchange market, transactions are not carried out on all positions. Therefore, to evaluate specific trades the concept of spread is used, which essentially reflects liquidity of this market. The greater the difference between the purchase (ask) and sale (bid) prices of a currency, the lower the liquidity of the market. In the sense that it will be very difficult to sell this position quickly and profitably. By analogy with the above example, if you raise the price of a resold coat too high, then it will be quite difficult to sell this product.

What is a spread in trading

What factors influence the size of the spread?

- Liquidity (popularity) of a currency pair. In the most popular tandems, the spread size usually does not exceed 3-5 points, and when trading rare currencies, for example, the Canadian dollar or Swedish krona, this figure can reach 50 points or more.

- The current market situation, which in turn depends on economic and political factors in different countries and in the world community as a whole. Any “hot” news that can affect the rates of leading currencies significantly affects the size of the spread.

- The presence of affiliate programs, the participants of which receive compensation precisely due to the spread. By the way, the rapid growth of affiliate programs in this segment contributes to an increase in the size of this fee, which is an inevitable “headache” for any trader.

Conclusion

By taking into account and tracking the spread in trading, you can more accurately calculate the profitability of each transaction. This parameter is also actively used to evaluate

Hi all!

Today we’ll talk about what a spread is in trading and whether it should be taken into account in trading. So let's begin.

Spread on the stock exchange - what is it?

Spread is the difference between the best bid and bid price. It is available on every instrument and is installed by the exchange. As trading progresses, the spread may change, widen or narrow. The smaller the spread, the higher the liquidity of the instrument. The wider the spread, the lower the liquidity on the instrument. If we want to buy an instrument with a large spread over the market, then we will buy it at a worse price than we would like. Therefore, the value of the spread should always be taken into account in your trading. Especially if we trade low-liquid securities with a large spread.

Do I need to take the spread into account?

I always include the size of the spread in the risk per trade. On liquid futures it can be ignored, since it is minimal. But with shares of 2-3 tiers the picture is completely different. Many people are afraid to trade such securities, including because of large spreads. But if you approach the matter correctly, then you can also make money from illiquid assets. By the way, the spread on each instrument may change during trading. Let's take illiquid assets as an example. When the market opens, especially after a gap, the spread can be much larger. Therefore, at such moments it is especially dangerous to open a position, since it will be possible to open a position on the market at an extremely unfavorable price for us. Yes, and actually close it too. Although there is an option to simply place a request to close at the best price and wait for it to be executed.

The main thing when trading low-liquidity stocks is to choose the right instruments and not trade complete slag. Personally, I trade instruments with a turnover of more than 4-5 million. Although if there is a situation that is interesting to me on a less liquid security, I can consider the entry point on it as well. At the same time, I always put the spread at risk and always try to look at the density in the order book from below, with which I can cover the position if something happens. Since there are situations where the spread seems to be small, but the glass at the bottom is empty and there is simply no one to cover the entire volume.

Here is another small example on EnelRos paper, which I bought by the way. After a quick buyback before the market closed, the spread widened very much. And it was possible to close this paper before closing only at an extremely unfavorable price. Therefore, I had to wait until it opened the next day and try to sell it at a better price, which I successfully succeeded in :)

I’ll end here, if you have any questions, leave them in the comments.

Don't miss new articles — subscribe to blog news.

Sincerely, Stanislav Stanishevsky.

What is a spread on the stock exchange?

Good day, friends! Last month, my friend Maxim actively persuaded me to go with him to a course where they teach the basics of stock trading.

I didn’t have much free time, so I had to refuse. But then, at every meeting, Maxim told me about stock exchange terms.

Now I know almost everything they teach there. And saved a lot of time. I even had a desire to tell you something. For example, about the spread on the stock exchange - what it is and how it is determined. In fact, now it will be very interesting. Let's begin!

Any exchange asset has two prices at any given time: the price announced by the nearest seller and the price appointed by the nearest buyer. The difference between these prices is called the spread.

Warning!

The lower the spread value, the better liquidity the instrument has, and vice versa, the wider the spread, the less liquid the exchange asset is.

For example, for GAZPROM shares at the best buyer price of 128.72 rubles. and the seller's best price is 128.73 rubles. the spread is 0.01 rub. For the USD/CHF pair, with a seller price ASK=0.9298 (you can buy at this price) and a buyer price BID=0.9297 (you can sell at this price), the spread will be 0.0001 points.

The spread can be fixed or floating

A fixed spread is a constant value and therefore does not change depending on the current market situation.

It is set by the broker individually for each instrument and is found only on the FOREX market in the section where trading is carried out on micro and mini accounts (service for which is carried out automatically).

The vast majority of instruments are characterized by a floating spread, the value of which varies under the influence of prevailing market factors.

However, its “width” is not completely chaotic and is always controlled by the exchange (the spread is regulated by market makers, whose task is to reduce it to a minimum).

Why is the spread widening?

However, the difference between the best buy price and the best sell price is not always kept within a narrow range; there are times when the spread widens. This happens most often during periods of crisis, when prices drop sharply, or during periods of rapid growth, when quotes decisively go up.

As noted above, the concept of “spread” is directly related to the concept of “liquidity”. So, the greater the difference, the worse the liquidity.

Attention!

Those. when the spread is wide, traders will always buy or sell assets at worse prices than they would like. Accordingly, such transactions will not be profitable for them, and they will not strive to trade such instruments.

During periods of collapse, the exchange deliberately widens the spread, and it becomes unprofitable to make sales, and accordingly the price stabilizes. The same thing happens with unreasonable growth: the widening of the spread makes purchases unprofitable and the influx of buyers decreases.

What is a spread on FOREX

For the foreign exchange market, a spread is a form of broker's commission, and when making a purchase, the trader receives a price worse than the market by exactly the amount of the difference between the purchase and sale prices, this difference is “taken away” by the broker. In order to attract new clients, Forex brokers are constantly striving to reduce the spread.

source: http://site/stock-list.ru/spread.html

What is a spread in trading

During exchange trading, a trader is constantly surrounded by charts of various assets, quotes of exchange instruments, as well as various types of technical and basic research carried out with these assets.

If the charts represent the history of transactions made with an asset, then the quotes show at what prices traders are willing to buy/sell this asset and in what volume.

Quotes are reflected in a special table, which in stock exchange jargon is called a “order book”. In the “glass”, buyers and sellers wait their turn to execute orders, and the prices for purchasing an asset are always lower than the prices for selling.

In the “glass” prices are located from top to bottom, that is, at the very bottom there will be the most low price to buy an asset, and at the very top is the highest selling price.

As soon as the buyer’s price matches the seller’s price (or vice versa), a deal will be concluded for the corresponding volume - this is the principle of a two-sided impersonal auction, on the basis of which transactions are made at exchange auctions.

What does the term "spread" mean?

The “glass” always contains the best buy price (also called Bid), which is slightly lower than the best sell price (also called Ask). The spread on the exchange is precisely the difference between the Ask price and the Bid price. It is present in any order book and will have a different value, which will also characterize the liquidity of the asset.

Advice!

The fact is that each asset has its own price step (the minimum difference in price currency by which one order must differ from another).

For liquid assets, the spread is approximately equal to the price increment (but can increase, especially during periods of high volatility), while for illiquid assets, the spread can be much larger.

The spread is not a fixed value, but only shows the temporary consensus of buyers and sellers regarding the price of an exchange asset.

The spread can be compared to the situation in a classical market, when the seller is ready to sell his product at a certain price, and the buyer wants to buy it cheaper. And until the buyer and seller agree on a single price, they will be divided by the spread, and the transaction will remain invalid.

But exchange trading is, first of all, trading where it makes sense to bargain, especially since spreads allow you to get more favorable prices when used correctly.

Previously, there was a whole group of intraday traders - spreaders, who traded liquid assets. If the spread increased, then they placed their order with a minimal difference, and if it was executed, they tried to immediately close the deal at a slightly more attractive price.

For example, if they want to buy an asset for 100 rubles and sell it for 101 rubles, then the minimum price step is 1 ruble. And if suddenly the best price for sale was unexpectedly 105 rubles, and not 101 rubles, spreaders put on sale at 104 rubles, expecting a buyer at their price.

Options for working with spreads

Spreads exist not only in stocks, but also in other exchange instruments. The spread exists in any “glass”.

But if trading using the above-described system on highly liquid assets is quite difficult (an extremely high reaction is required), then on assets with slower behavior, the presence of a spread allows you to realize one of the main properties of the market - the ability to trade.

Warning!

There are a lot of assets (for example, among bonds) that may have sale prices, but there may be (almost or completely) no purchase prices. In this case (the bond meets the reliability criteria), you can set your purchase price in the “glass” and calmly wait to see whether it will be fulfilled or not.

Also, this behavior can be used if there is a large spread in an asset - you can bargain and offer a slightly better price by placing your order as Bid or Ask.

Thus untapped cash it will be possible to “store” (money is also reserved for applications) in applications at attractive prices, so that if they are realized, profit will be practically guaranteed.

Moreover, in addition to spreads in the “glasses” there are also calendar spreads. A calendar spread means the difference in prices of distant and nearby derivative instruments (often we are talking about futures) by expiration date, but for the same asset.

Such spreads can be either a result of seasonal demand or a feature of the instrument. For example, dividend spreads between a stock and the corresponding futures.

Because futures do not pay dividends, they are often traded as the stock price minus dividends. Calendar spreads can appear as a type of inefficiency during the evening session if there is strong news that moves the market during the evening session.

The fact is that in the evening session, all activity is mainly focused on the futures that are closest in terms of expiration date, and further ones may be deprived of attention, which allows, if there is an increased difference in prices, to buy a cheaper and sell a more expensive asset, thereby receiving a financial difference and carrying out an arbitrage transaction.

Spreads exist in any asset, but you can make money on them in various ways. The spread on the stock exchange is the difference between the sale and purchase prices, which, in turn, is the basis of any market.

source: https://www.opentrainer.ru/articles/chto-takoe-spred-v-treydinge/

What is a spread when trading on the stock exchange?

The difference is how the translation sounds from English word spread What is this in economics? Spread is an American term and has an economic meaning.

On in simple language, the forex spread is the difference in prices - (ask) purchases and (bid) sales of a pair of currencies. The criterion for market liquidity is the size of the spread. With its high value, liquidity is low.

Is a spread a loss?

When opening a deal, the trader buys lots, which immediately leads to a loss with the spread value. This transaction can be moved to the point where it becomes break-even if there is a change in quotes in the direction of the transaction by at least 3 points. Well, to get income, even more.

That is, the spread commission is withdrawn automatically at the time the transaction is opened. The spread from an honest broker is the main source of income. Stock exchanges regulate market liquidity and limit spreads. When it reaches the maximum, trading with the machine stops.

In the foreign exchange market, the spread is calculated in points for any time period for each specific product. This is done to unify calculations various options financial instruments.

Accurate calculation of the spread requires taking into account its features. Forex spreads are fixed and float. The broker provides the client with a choice of spread type.

Fixed

This is a constant value and does not depend on market changes. These types of accounts are used when trading with robots or advisors.

Another option for a spread with fixation is the possibility of expanding it (ECN accounts). By warning of significant news, brokers have the right to increase the spread value.

The formation of a fixed spread does not occur chaotically. When thinking about it, they resort to the help of dealing companies and apply it primarily to two types of foreign exchange market accounts: micro accounts and mini accounts.

Floating

The spread that floats is the most common. Its fluctuations under the influence of market conditions occur within a certain range. The broker indicates only its lower limit. Typically, the floating option, when the market is calm, has a value of 2-5 points for popular pairs.

Advice!

But the news release can excite him up to 50 points or more. The floating type is typical for most monetary institutions and brokers on behalf of electronic systems.

It is clear that it is the spread value that is the most powerful criterion when choosing a broker. According to the rule of logic, which you cannot go against, choose a broker for business relations you need one that offers a lower spread value. It's more profitable for you.

The spread (its value) has become a stumbling block here and one can note a persistent tendency towards a decrease in its indicators by several times. Nowadays it is quite difficult to find a broker who would differ greatly from others in terms of the quality of services provided, including the size of the spread.

The trading conditions on the currency exchange are approximately the same for everyone. However, with patience and time, you can find among the reliable ones that, albeit slightly, provide slightly better conditions.

How to return part of the spread

There is a chance to return a certain part of the broker's commission. Many traders use this.

The meaning of such an operation is to register a trader and enter his data into the client database on one of the spread return services.

This service from your broker receives royalties as an affiliate. Just part of these funds will be used to compensate you for your loss. The refund amount will depend on the specific agreement between the broker and the refund service.

source: http://site/fx-binar.ru/chto-takoe-spred-na-birzhe/

Spread is the difference between the purchase and sale prices

A spread (spread from spread “scatter”) on the stock exchange is the difference between the best prices of orders to sell (ask) and to buy (bid) at the same point in time for any asset (stock, commodity, currency, futures, option).

The word "spread" is also called:

- The difference in prices of two different similar goods traded on open markets(for example, the difference in prices for oil of different grades).

- A synthetic derivative financial instrument (DFI), usually consisting of two open positions that have opposite directions and/or different underlying assets and/or different expiration dates.

- Difference in yield levels for various financial instruments.

On the stock exchange

In exchange practice, spreads are measured in points, not in money. For example, if the current quote of the euro against the US dollar (EUR/USD) is indicated as 1.2345/1.2350, then the spread will be $0.0005 or 5 points.

Warning!

Measuring in points makes spreads on different trading items more comparable.

To ensure market liquidity, exchanges usually set a maximum spread. If this limit is exceeded, trading may be stopped. The smaller the spread, the more liquid asset, and vice versa.

Fixed

In some cases, when one market operator provides both purchase and sale simultaneously, he creates a fixed spread that does not change when the quote fluctuates.

The more liquid the market, the more often a fixed spread occurs. This is most often observed in currency trading (a fixed difference between the purchase and sale price of a currency), especially with intermediaries in the international foreign exchange market.

In the stock market, a fixed spread occurs when margin trading CFD contracts. There is often a caveat that the spread may be widened in certain market situations.

source: http://site/whatismoney.ru/spread/

What is a spread in trading

The difference in the price of various assets, be it currencies, stocks or precious metals, is the only and unique source of earnings on the exchanges. It is from price fluctuations that traders make serious money, using various statistical tools and information channels for accurate investment forecasting.

At the same time, you can make money both by increasing and decreasing the value of the trade item. In any case, such an important concept as a spread will be involved in such operations - the difference between the best purchase and sale price of an asset at the moment.

In simple words

In order to understand what a spread is on the stock exchange, it is enough to imagine any trading operation - for example, buying clothes with further resale.

Attention!

The difference between the original price paid and the money received through speculation is commonly called profit or income. The spread is an analogue of this difference, and in this case the income is received by brokers.

In the foreign exchange market, transactions are not carried out on all positions. Therefore, to evaluate specific trades, the concept of spread is used, which, in essence, reflects the liquidity of a given market.

The greater the difference between the purchase (ask) and sale (bid) prices of a currency, the lower the liquidity of the market. In the sense that it will be very difficult to sell this position quickly and profitably.

By analogy with the above example, if you raise the price of a resold coat too high, then it will be quite difficult to sell this product.

What is a spread in trading

The spread on the Forex exchange is the difference in the purchase and sale of each currency in a currency pair. In essence, this is the trader’s direct initial loss, which must be covered in the process of further trading.

Let's give an example on the popular EUR\USD pair with the current quote 1.2668/1.2672. From the difference in the prices of these currencies, it is clear that the spread in this case for one lot is 4 points, that is, $40.

Therefore, when you open an order, for example, for 4 lots, your “minus” will be $160. To compensate for this loss, it is necessary for the currency pair quotes to change in your favor by at least 4 points.

And only further progress will bring you net income. Therefore, the spread on the Forex exchange is sometimes compared to the inevitable mandatory commission, which is the main income of large brokerage companies and private brokers.

Unlike currency exchanges on stock markets The maximum allowable spread value is always set, upon reaching which trading ends.

What are they?

On the foreign exchange Forex market spread comes in the following forms:

- a fixed fee, which is a constant value regardless of currency fluctuations. In some cases, an expandable spread is used, which can be increased manually by the broker depending on investment, economic and financial forecasts;

- floating spread - indicated by the broker within the lower limit and can fluctuate under the influence of changes in the value of currencies in a wide range upward.

In most cases, Forex uses a floating spread, which in emergency situations can reach 50 points or more. The average range of this parameter in a calm market is from 2 to 5 points.

What factors influence its value?

Liquidity (popularity) of a currency pair. In the most popular tandems, the spread size usually does not exceed 3-5 points, and when trading rare currencies, for example, the Canadian dollar or Swedish krona, this figure can reach 50 points or more.

Advice!

Current market situation, which in turn depends on economic and political factors in different countries and in the world community as a whole. Any “hot” news that can affect the rates of leading currencies significantly affects the size of the spread.

Availability of affiliate programs, the participants of which receive compensation precisely due to the spread. By the way, the rapid growth of affiliate programs in this segment contributes to an increase in the size of this fee, which is an inevitable “headache” for any trader.

By taking into account and tracking the spread in trading, you can more accurately calculate the profitability of each transaction. This parameter is also actively used to estimate volatility, which allows you to make accurate predictions about the most profitable rates.

But the most important thing is that the spread size is one of the important criteria when choosing brokerage company, on the platform of which you will work on the Forex exchange.

source: https://www.avatrade.ru/education/trading-for-beginners/chto-takoe-spred

What is a spread in the foreign exchange and stock markets?

Quite often we can see a loss in the MT4 terminal. Beginners can be confused and don’t understand why they entered at the same price and then found themselves in the red. But before you familiarize yourself with and understand the prices for opening orders, you need to study and understand the basic concepts of online trading.

Spread is the difference between bid (buyer's price) and ask (seller's price). It's rare that their prices match. After all, the buyer wants to purchase the goods at a lower price, and the seller’s interest is to sell at an inflated price.

On the market, goods are sold at a price that both parties agree upon. If the buyer agrees to the seller's offer, then a transaction occurs.

To make it easier for you to understand, I’ll give you an example: trading is held on the stock market. Sergey wants to buy shares of a huge famous company and offers for one piece - 145 rubles. Then he submits an application and indicates the number of shares (for example, 750). If no one has offered a larger amount, then the price designated by Sergey becomes the bid price.

At this moment, there is no seller who would agree to give up the shares at the bid price, but there is a person who would sell the goods at their established price, let’s say 144 rubles.

Warning!

He submits his bid, and the price indicated in it becomes the ask price, since it is the lowest of all those offered.

Now you can determine the difference between these two prices, it is called the spread, which in this case is equal to 1 ruble. If there is a person who buys shares for 144 rubles and sells them to Sergei for 145 rubles, then for each share there will be a loss of 1 ruble.

Species

There are 2 types of them in the foreign exchange market:

- floating;

- fixed.

Floating characterizes the difference between the sale and purchase prices of the exchange rate, where the broker maintains the minimum spread until volatility increases.

Fixed is the difference between buying and selling, which the broker specifically sets at a particular value, and this does not depend on the current volatility of the currency pair.

Also, with a fixed spread, you see the number of points that make up the cost of each trade.

But not everything is as smooth as it seems. There is also a disadvantage: trading costs are constantly high.

This option is perfect for traders who sell through automated systems.

What is a floating spread? It is chosen mainly by scalpers and ECN brokers. They receive a small income with a fairly high degree of probability.

Factors that influence size

One of the most important factors on which the size of the spread depends is foreign exchange liquidity. More well-known currency pairs are traded with low spreads. As for rare ones, they rise to tens of points.

Attention!

It is very important to remember that the difference between prices on the exchange is closely related to the monetary units that are used.

Another, no less significant factor is the transaction amount. The high cost comes with the usual tight spreads.

How to ensure profitable trades

Every trader should focus his attention on changes in the spread. The greatest productivity will be if the maximum number market conditions fully taken into account.

The success of a trading strategy is based on effective assessment market odds and certain financial conditions transactions. You have to analyze everything possible risks and estimate the cost of the transaction.

So that you do not end up losing, be sure to do comprehensive analysis, and besides this, you must clearly understand what a spread is.

Since its value can change, the strategy must be quite flexible. In this case, it will be possible to adapt to market movements.

source: https://investbro.ru/spred-na-birzhe-chto-ehto-takoe/

What is a spread in Forex and stock exchange

This is the difference between the Ask purchase price and the Bid sale price, comes from the English. spread – increase, expansion. This difference is income, a broker's commission, a kind of service fee for the trader.

The simplest example: when you come to an exchange office to buy currency, the bank sells it at more high price than he buys. The difference between the purchase and sale prices is the spread, the bank's commission, and its income.

Advice!

It’s the same with spreads on the stock exchange, Forex, cryptocurrencies, whatever. The meaning of this concept in the financial world is the same.

Thus, the spread is your direct cost for opening each transaction, and knowing what it is and how to work with it is simply necessary, because you must know your costs, this is the basis.

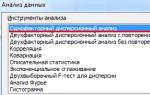

How to find out the spread

By default, the spread is not displayed anywhere in the MT4 terminal. To find it out, you can:

As for setting up the terminal, we will do this right now, fortunately it will only take a few seconds.

In the MetaTrader terminal window, right-click on the chart, call up the context menu and select the last item “Properties”, or simply press F8 on the keyboard.

In the “General” tab, check the “Show Ask line” checkbox, as shown in the picture.

By default, only the “Bid” price is shown in the terminal, we have enabled the display of “Ask” as well, the distance between these two lines is the spread and now we can see it visually.

When a trader opens a buy position, he enters the market at the “Ask” price, and when he makes a sale, he enters the market at the “Bid” price. Remember the exchanger analogy? There are also 2 prices posted there - Demand and Supply, everything is the same here. In other words:

- Bid – the price at which we open a sell order

- Ask – the price at which we open a buy order

- The difference between these prices is the spread

And so, you can find out the spread on Forex either using an indicator, or configure the terminal accordingly.

Types and which one is better

There are two types of spreads – floating and fixed. The easiest one to trade is fixed. Everything is very clear with him; at any time of the day or night, his meaning does not change. This has its pros and cons.

Advantages of a fixed spread:

- Unchangeable and therefore predictable. Easier for beginners.

- Easier to manage risks. You will not be at all worried about the widening of spreads during news or other disturbances in the market; you will be insured against such situations. Your pending orders are not activated due to the widening of the spread, and stops are not knocked out either.

For trading with advisors, in most cases a fixed spread is more convenient.

Cons: Among the disadvantages, I would highlight the fact that the trader’s expenses when using a fixed spread are often higher.

Warning!

The point is that if your trading strategy gives a lot of signals and you enter the market often (several times a day), then the costs for a fixed spread will be significantly higher than for a floating one. At the same time, if you trade rarely and open trades on higher timeframes, then the type of spread plays practically no role for you.

Therefore, when choosing a trading account, consider what your strategy is and how often you open trades to save on spreads.

Now about the floating spread. It is constantly changing. In a calm market there will be less, shortly before and during the release of important news, the spread can increase sharply and opening a position at this time can be very unprofitable.

In addition, the width of the spread depends on the currency pair. On popular currency pairs such as EURUSD, GBPUSD and other majors, the spread is usually minimal. At the same time, on exotic, rarely traded currency pairs, it can be many times higher. This also needs to be taken into account.

Advantages of a floating spread:

- You can choose the moment when it is narrowest and enter the market, thus saving your money

- Better suited for those traders who open positions frequently, this also allows them to save significantly

Cons: An unexpected spread widening can knock out your stops or activate pending orders; this introduces an additional risk factor into trading and therefore complicates money management somewhat. This expansion is not uncommon during important news releases.

So which spread is better, floating or fixed? It depends on your trading style. If you like to trade intraday and open a lot of transactions, then a floating spread will be more profitable for you, because you can choose the moment when it is narrow and save money this way.

But, at the same time, you get risks associated with a possible expansion of the spread in inopportune moment.

If you are trading medium or long term, then this issue is not particularly important for you, since in any case the costs will be only a fraction of a percent of your transaction. But, in general, in terms of financial costs, a floating spread will still be more profitable.

If you prefer high-frequency intraday trading (scalping, pipsing), then the costs when using a floating spread will be much lower. Simple example:

Attention!

With a fixed spread of 2 points and 10 completed transactions, the trader will pay the broker 20 points.

With a floating spread, the range of which usually fluctuates between 0.4 - 0.8 points in a calm market and popular currency pairs, the expense will be approximately 6 points.

A fixed spread is the choice of those who prefer predictability and want to eliminate the risks associated with expansion. And for many trading advisors, a fixed spread is also preferable for the same reason. But you will have to pay extra for these amenities.

My advice: if you want less risk and are willing to overpay for it, choose a fixed spread. If you are ready to bear additional risks associated with widening the spread in order to save money or make many transactions within a day, choose a floating one.

Check with your broker for the availability of a Rebate program - a partial refund of the spread on the Forex market, so you will cover part of the costs.

List of currency pairs with small spreads

Different brokers have different spread values, including depending on the type of trading account. Below I will give a small list of currency pairs with traditionally small spreads.

EURUSD

GBPUSD

USDCHF

USDJPY

The euro-dollar is in the lead, as it is the most popular currency pair among traders. The remaining three are inferior in popularity, but are also actively traded. As a result, they have fairly narrow spreads.

USDCAD

AUDUSD

Two more dollar pairs are Canadian and Australian.

EURGBP

EURCHF

EURJPY

This is not an exhaustive list; more specific information can always be found in the trading terminal. And let’s touch on one more point that confuses many beginners.

Why is any order opened immediately at a loss?

Beginners sometimes move, how is this possible, I just opened an order, and it is already in a slight minus, although the price has not yet moved even a couple of points?

The whole point, again, is in the spread, it is automatically added to our deal and you receive a minus equal to the size of the spread at the time the position was opened.

It turns out that when opening any deal, the trader first earns money for the broker, because he needs to cover the spread, and only then begins to earn money himself.

Spread return on Forex

But high costs are partially compensated by the so-called rebate - the return of part of the costs of the spread or commission. This is such a bonus for a trader, so ask about the availability of a similar program at your broker, you can directly ask technical support: -Do you have a rebate?

Or look for it yourself, usually this information is somewhere in the bonus section or something similar.

In this thorough and detailed article, we’ll talk about the very concept spread, what it means, how to recognize it and take it into account in your trading. Let's find out what types of spreads there are, which one is better to choose and some other nuances of working with spreads on the stock exchange, Forex, and cryptocurrencies. Every trader should know this!

What is a spread on Forex and the stock exchange

This difference between the purchase price comes from the English. spread – increase, expansion. This difference is income, a broker's commission, a kind of service fee for the trader.

The simplest example: when you go to an exchange office to buy currency, the bank sells it at a higher price than it buys. The difference between the purchase and sale prices is the spread, the bank's commission, and its income.

It’s the same with spreads on the stock exchange, Forex, cryptocurrencies, whatever. The meaning of this concept in the financial world is the same. Thus, the spread is your direct cost for opening each transaction, and knowing what it is and how to work with it is simply necessary, because you must know your costs, this is the basis.

How to find out the spread

By default, the spread is not displayed anywhere. To find it out, you can:

- - this way you will see exact numbers.

- Enable its display in the “Market Watch” window, as shown in the screenshot above.

- Make minimal adjustments to the terminal - this way you can estimate the size of the spread purely visually.

As for setting up the terminal, we will do this right now, fortunately it will only take a few seconds.

In the MetaTrader terminal window, right-click the mouse, call up the context menu and select the last item “Properties”, or simply click F8 on the keyboard.

In the MetaTrader terminal window, right-click the mouse, call up the context menu and select the last item “Properties”, or simply click F8 on the keyboard.

In the “General” tab, check the “Show Ask line” checkbox, as shown in the picture.

By default, only the price is shown in the terminal "Bid", we turned on the display and "Ask", the distance between these two lines is the spread and now we visually see it.

By default, only the price is shown in the terminal "Bid", we turned on the display and "Ask", the distance between these two lines is the spread and now we visually see it.

When a trader opens a buy position, he enters the market at the “Ask” price, and when he makes a sale, he enters the market at the “Bid” price. Remember the exchanger analogy? There are also 2 prices posted there - Demand and Supply, everything is the same here. In other words:

- Bid – the price at which we open a sell order

- Ask – the price at which we open a buy order

- The difference between these prices is the spread

And so, you can find out the spread on Forex either using an indicator, or configure the terminal accordingly.

Types of spreads and which one is better

There are two types of spread – floating And fixed. The easiest one to trade is fixed. Everything is very clear with him; at any time of the day or night, his meaning does not change. This has its pros and cons.

Advantages of a fixed spread:

- Unchangeable and therefore predictable. Easier for beginners.

- Easier to manage risks. You will not be at all worried about the widening of spreads during news or other disturbances in the market; you will be insured against such situations. Yours are not activated due to the expansion of the spread, and they also do not get knocked out.

- For trading with advisors, in most cases a fixed spread is more convenient.

Cons:

- Among the minuses, I would highlight the fact that the trader’s expenses when using a fixed spread are often higher.

The fact is that if yours gives a lot of signals and you enter the market often (several times a day), then the costs of a fixed spread will be much higher than for a floating one. At the same time, if you trade rarely and open trades at , then the type of spread for you is plays virtually no role.

Therefore, when choosing a trading account, consider what your strategy is and how often you open trades to save on spreads.

Now about floating spread.

It is constantly changing. In a calm market there will be less, shortly before and during the release of important news, the spread can increase sharply and opening a position at this time can be very unprofitable. In addition, the width of the spread depends on the currency pair. On popular currency pairs such as EURUSD, GBPUSD and others, the spread is usually minimal. At the same time, on exotic, rarely traded currency pairs, it can be many times higher. This also needs to be taken into account.

Advantages of a floating spread:

- You can choose the moment when it is narrowest and enter the market, thus saving your money

- Better suited for those traders who open positions frequently, this also allows them to save significantly

Cons:

- An unexpected widening of the spread can knock out your stops or activate pending orders, this introduces an additional risk factor into trading and therefore makes it somewhat more difficult. This kind of expansion is not uncommon during release.

So which spread is better, floating or fixed?

It depends on your trading style. If you like to trade intraday and open a lot of transactions, then a floating spread will be more profitable for you, because you can choose the moment when it is narrow and save money this way. But, at the same time, you get risks associated with a possible widening of the spread at the wrong time.

If you are trading medium or long term, then this issue is not particularly important for you, since in any case the costs will be only a fraction of a percent of your transaction. But, in general, in terms of financial costs it will still be more profitable floating spread.

If you prefer high-frequency intraday trading (scalping, pipsing), then the costs when using a floating spread will be much lower. Simple example:

- With a fixed spread in 2 point and 10 completed transactions, the trader will pay the broker 20 points.

- With a floating spread, the range of which usually fluctuates within 0.4 – 0.8 points in a calm market and popular currency pairs, the cost will be approximately 6 points.

A fixed spread is the choice of those who prefer predictability and want to eliminate the risks associated with expansion. And for many trading advisors, a fixed spread is also preferable for the same reason. But you will have to pay extra for these amenities.

My advice: if you want less risk and are willing to overpay for it, choose a fixed spread. If you are ready to bear additional risks associated with widening the spread in order to save money or make many transactions within a day, choose a floating one.

Check with your broker for program availability Rebate– partial return of the spread on the Forex market, so you will cover part of the costs.

List of currency pairs with small spreads

Different brokers have different spread values, including depending on the type of trading account. Below I will give a small list of currency pairs with traditionally small spreads.

EURUSD

GBPUSD

USDCHF

USDJPY

The euro-dollar is in the lead, as it is the most popular currency pair among traders. The remaining three are inferior in popularity, but are also actively traded. As a result, they have fairly narrow spreads.

USDCAD

AUDUSD

Two more dollar pairs are Canadian and Australian.

EURGBP

EURCHF

EURJPY

Several cross rates with the euro.

This is not an exhaustive list; more specific information can always be found in the trading terminal. And let’s touch on one more point that confuses many beginners.

Why is any order opened immediately at a loss?

Beginners sometimes move, how is this possible, I just opened an order, and it is already in a slight minus, although the price has not yet moved even a couple of points? The whole point, again, is in the spread, it is automatically added to our deal and you receive a minus equal to the size of the spread at the time the position was opened. It turns out that when opening any deal, the trader first earns money for the broker, because he needs to cover the spread, and only then begins to earn money himself.

Spread return on Forex

But high costs are partially compensated by the so-called rebate - the return of part of the costs of the spread or commission. This is such a bonus for a trader, so ask about the availability of a similar program at yours, you can directly ask technical support: -Do you have a rebate?

Or look for it yourself, usually this information is somewhere in the bonus section or something similar.

Video lesson