Today we will talk about what interbank Forex is, as well as how ordinary private traders can access it.

Interbank Forex is a specialized system that unites financial institutions, as well as other major participants in the foreign exchange market. Interbank Forex was created so that its participants could exchange foreign currencies at the optimal rate.

The emergence of such a market was due to the fact that banks in various countries felt the need for a convenient system for conducting conversion transactions, which consist of exchanging one currency for another at current market prices.

Thanks to the rapid development of the Internet, not only banks, but other counterparties interested in conducting prompt exchange operations have gained access to trading on the interbank foreign exchange market.

Interbank Forex trading is carried out using a special network called the Electronic Communication Network (ECN). Currently, several such systems are already operating, the most popular of which are Currenex, Atiax, etc.

The mentioned systems act as liquidity providers. Their participants are financial institutions offering currency exchange at their own price, as well as investment organizations, insurance companies, dealing centers, etc.

The systems automatically analyze market offers and identify the optimal price level for the sale/purchase of various currencies. The received data is sent to all trading participants.

Interbank Forex - how to gain access

Currently, there are a huge number of dealing centers providing private traders with access to trading on the interbank foreign exchange market.

It should be remembered that if you use a regular trading account, then transactions are not entered into the international market, and your broker acts as a counterparty. Thus, your profit is the broker's loss and vice versa.

To gain full access to the interbank foreign exchange market you need. Accounts of this type have a huge number of advantages over regular ones, among which the main one is the ability to trade at non-market prices, formed depending on the current supply/demand ratio.

Unfortunately, ECN accounts are inaccessible to most novice traders, since to open them you need to have a fairly large capital, usually starting from a thousand dollars.

Among the key features of ECN accounts, the following deserve special attention:

- When servicing such accounts, the broker's income is generated from the commission for each transaction concluded. Thanks to this feature, the dealing center is not interested in zeroing out traders’ deposits;

- When using ECN accounts, a trader gets access to the largest liquidity providers, which almost completely eliminates the possibility of requotes;

- When using accounts of this type, the trader can independently select a suitable counterparty.

It is important to remember that some unscrupulous dealing centers issue regular ECN invoices. There are several signs that will help you identify a real ECN account:

- The broker must have verified access to leading ECN systems such as Currenex, Atiax, etc.;

- Access to a tool such as the “glass”, which is a special window that displays a list of all trading participants (the volume of orders for each price);

- The ability to obtain information about the counterparty for the order you opened.

Features of using ECN accounts on interbank Forex

If you decide to use this type of account for trading, then the following recommendations may be useful to you:

- You can earn income on interbank Forex if you have both a large and medium deposit. Thanks to the large flow of liquidity, you can receive significant income not due to the volume of successful transactions, but due to their number;

- ECN accounts do not have any restrictions on the use of scalping or pipsing strategies. This allows the trader to trade as he sees fit, without bypassing short-term transactions;

- Accounts of this type are characterized by the absence of requotes, as well as a continuously changing spread value. For this reason, at the time of the release of important news reports, serious jumps in the price of an asset may occur in both directions. They are capable of knocking out closely placed feet. This feature should be taken into account and, if possible, refrain from trading at the time of news release.

The Moscow Exchange has introduced new trading rules starting today that give companies direct access to the foreign exchange market.

The fact that the exchange was preparing such innovations became known in the fall of 2016. The requirements for direct access to the foreign exchange market are stricter: for access on the terms of full deposit of funds, the company’s capital must be above 1 billion rubles. (about 50 companies), with partial depositing - above 50 billion rubles. (about 10 companies), and also requires a long-term rating of at least BB- from S&P and Fitch and Ba3 from Moody’s.

“Until now, companies gained access to Moscow Exchange instruments through banks. That is, first the companies entered into a deal with the bank, and then the bank can cover the emerging currency risk on the stock exchange,” explains Sergei Romanchuk, head of the Metallinvestbank dealing center. According to him, in large banks, as a rule, some part of the required cash flow is internalized, that is, blocked internally. “Suppose one bank client buys currency, another sells it within a certain period of time. This means that these conversion transactions can be carried out within the bank, without going to the exchange to buy or sell currency,” he says.

In his opinion, direct access of companies to the foreign exchange market will slightly increase trading volumes on the Moscow Exchange, but these will not be “outstanding figures - we are talking about a few percent.” This is due to the strict requirements for companies that the exchange put forward: with a high threshold for equity capital and high credit quality, he explains.

Over the next few years, this will help attract up to $1 billion in additional daily turnover in the foreign exchange market, says a representative of the exchange. In 2016, the average daily trading volume on the foreign exchange market was $19.7 billion.

The Moscow Exchange will soon give corporations direct access to the money market. Companies with a capital of RUB 10 billion or more, as well as those with a special liquidity management unit and employees with Central Bank certificates, will have access to the money market on condition of partial deposit of funds. According to the exchange, there are 75 such companies.

Now they will be able to conclude transactions in the money market not through banks, but through the National Clearing Center (NCC, performs the functions of a central counterparty and is part of the Moscow Exchange group). This will allow companies to place money at higher rates, the managing director for money management previously said and foreign exchange markets of the exchange Igor Marich. In the money market, the entry of a new category of participants in the long term, according to the exchange’s estimates, will increase by 20%, now the daily volume of open positions is approximately 1 trillion rubles.

Russian Information Agency TASSImage: evp82 / Shutterstock.com

Financial freedom is a dream that many strive for, but only a few achieve. Today there are many options for investing and possibly making a profitable investment. Warren Buffett is the world's largest American investor, and it was thanks to the secrets of long-term investing that he became one of the richest people on earth. the site is a team of specialists (investors, financiers and traders) who are constantly looking for new investment options.

We constantly research and analyze different options for investing money; we publish the process and results of investments on this portal. Before you invest your money in a new, unknown business, look at our results and experience, this will help you calculate the profit and risks of investing.

You will be able to understand various financial instruments (stocks, mutual funds, real estate, insurance, bank deposits, PAMMs, etc.), and learn how to ensure your financial independence while earning even a little money. Particular attention is paid to investing in the Internet, because The World Wide Web is very confidently gaining momentum and the number of investment proposals is simply huge, and not every investment option can bring good profits, much less provide any guarantees for the invested capital. Follow our current research, which is based only on real experience, and always stay in the black.

Working according to the “user - brokerage system - exchange core” scheme is not suitable for everyone. That is why a technology has emerged that allows for maximum optimization of this chain - direct access to the exchange.

Why is this necessary?

The situation on stock exchanges around the world in recent years has been developing according to one scenario - traders from all over the world have come together in the struggle to achieve the highest speed of trading operations. First of all, this is due to the rise of so-called algorithmic trading, in which operations are performed by special robots.As a rule, robots perform a huge number of such operations in one trading session (from thousands to hundreds of thousands), earning not very much on each of them, but thanks to the volume, providing their owner with a stable income. With this method of trading, speed comes to the fore. If an order sent to the market by your robot is delayed along the way even for a couple of milliseconds, then you may lose profit. And in the same way, if information about the market situation (market data) arrives to the robot with a delay, it will not be able to quickly respond to changes within the framework of a given algorithm, which is also fraught with losses.

To minimize time costs, traders resort to a number of measures, from optimizing their software code to acquiring “wide” communication channels. However, the greatest time gain can be achieved by removing the brokerage system from the order path.

What is direct access to the exchange?

Direct Market Access (DMA) is a technology for high-speed access to exchange platforms, in which an order is submitted directly to the exchange's trading system, bypassing the broker's trading system. All this allows you to significantly reduce the time it takes to deliver an application to the exchange and obtain information about its status.With such an organization of the trading process, a trader can count on a significant gain in time. For example, with a direct connection to the stock and foreign exchange markets of the Moscow Exchange, the application processing time is reduced to 0.5 ms, and in the FORTS and Standard markets – does not exceed 3 ms. When using a brokerage system, orders are processed in a time from 5-10 ms to 150-500 ms, depending on the brokerage system, market type and connection method. Those. through brokerage systems, orders are processed 10-100 times slower than with a direct connection (although this speed is quite satisfactory for many traders).

Naturally, using direct access technology is more expensive (often significantly) and is only suitable for those who perform a large number of transactions per day and are willing to pay for their speed.

Where is it used?

Despite the fact that technically, thanks to direct access to the exchange, traders can carry out trading operations bypassing a broker, “documentary” access is still carried out through broker companies. That is, in order to get the opportunity to directly trade on, say, the stock market of the Moscow Exchange, an investor needs to enter into an agreement with a broker and purchase the service of direct access to the exchange from him.

As a result, Russian clients can access mainly the markets included in the Moscow Exchange:

- Stock market– the largest stock market in the CIS countries, Eastern and Central Europe. Access is provided to the Main Market sectors and the Standard market sector.

- Derivatives market(formerly FORTS) is a leading derivatives trading platform in Russia and Eastern Europe.

- Currency and precious metals market– one of the most significant segments of the Russian financial market.

Types of protocols and connection methods

In general, the direct access scheme is as follows: the server with the trading robot is connected to an intermediate server, which is located as close as possible to the core of the exchange trading system. This server has special software installed - the so-called gateways, which are used to transmit orders and market information directly to the trading system. At the same time, various protocols and connection methods are used to perform operations and receive data.Protocol FIX (Financial Information eXchange)– a protocol for the exchange of financial information, which is a global standard for the exchange of data between exchange trading participants in real time. Supported by the world's largest exchange platforms, including the Moscow Exchange.

To obtain market information (Market Data) the protocol is used FAST (Fix Adapted for STreaming)– a standard developed by the creators of the FIX protocol, which allows for significant data compression capabilities for transmitting large volumes of market information with minimal time delays. In addition to the Moscow Exchange, it is used on the NYSE, Nasdaq-OMX and many other global platforms.

Native protocols are also used for direct connection. These protocols arose even before the merger of the MICEX and RTS exchanges into the Moscow Exchange.

Thus, in the markets belonging to the RTS exchange (FORTS - futures and options, Standard), the protocol is used to directly carry out transactions and receive data in connection mode Plaza II.

To carry out trading operations and obtain exchange data on sites that previously belonged to the MICEX exchange (currency and stock markets), a bidirectional gateway is used MICEXBridge (TEAP).

Technically, connecting to the Moscow Exchange is possible in several ways, such as connecting via the Internet, connecting using a universal connection scheme or using the exchange's colocation.

Universal connection diagram

We will look at financial information transfer protocols and connection methods in more detail in one of the following articles.

Software

For those traders who do not use robots for trading, there is the opportunity to trade directly via a trading terminal that is more familiar to them. However, the software that works with the brokerage trading system does not work with direct exchange protocols, so separate programs are created for it (some of them are presented).Additionally, because direct-to-consumer technologies are open, investors can develop the software for themselves. However, since these programs ultimately have almost direct access to the core of the trading system, the exchange has implemented a procedure for certifying trading solutions from third-party developers to eliminate the possibility of a “crazy robot” completely destroying the entire system. This procedure goes through both the development of individual investors and software created by special companies to order.

What else?

If we continue to move along the chain of reducing the time for performing transactions, it becomes obvious that it is necessary to place the trading robot not only logically, but also physically as close as possible to the servers with the core of the exchange trading system.The robot can be located either on a separate server, which can be placed in a rack in a data center (this service is called Colocation), or on a virtual machine (Hosting), which in turn is launched together with the virtual machines of other clients on a server also installed in the data center , next to the exchange servers. Hosting services are, as a rule, provided only by large brokers with their own racks in data centers.

Currently, the trading servers of the Moscow Exchange are located in the M1 data center. Trading robots connected to exchange servers can be located in two zones - the so-called DMA free collocation zone and the direct collocation zone of the exchange.

Placing in the exchange collocation zone has obvious advantages: virtual machines and servers connect directly to the core of the exchange, while from the free zone the connection goes through the intermediate servers MICEX Gate and Plaza II. In addition, receiving data via the FAST protocol and a dedicated channel for connecting to the IOB London Stock Exchange market (trading Russian ADRs in London) are available only from the exchange collocation zone.

One way to significantly reduce infrastructure costs is to place the robot in a free colocation zone. The services provided in it are almost similar to the services of the exchange colocation zone. However, there is only free cheese in a mousetrap; you will have to “pay” for the relative cheapness of deploying a robot with a few milliseconds of increased transaction processing speed.

In addition, since the interfaces for creating direct connection software do not initially imply any graphical capabilities for displaying information about trading, the ability to synchronize orders and positions, orders and positions generated on a direct connection, with the broker’s trading system in real time is practically a necessary thing for control of trade operations. Therefore, many brokers try to provide their clients with such opportunities.

All this, of course, costs money and, in comparison with regular access to the exchange through brokerage systems, quite a lot. However, for those investors who have reached a certain level of income, such spending makes sense. According to representatives of the exchange, the owners of robots that won the “Best Private Investor” competition in 2011 spent from 100 to 500 thousand rubles on services related to direct access. per month. However, taking into account the fact that some traders (although there were not so many of them) managed to achieve a profitability of 8000% and earn millions of rubles per month (taking into account all the commissions of the broker and the exchange), these expenses paid off quite quickly.

That's all for today! Thank you all for your attention, we will be happy to answer questions in the comments.

Welcome readers of the financial magazine "site"! In this article, you will learn what a currency exchange is, who provides access to an online currency exchange, and how real-time currency trading is carried out.

At the end of the article, we traditionally answer the most popular questions, and also provide expert advice to beginners on successful trading.

This publication is useful for those who plan to trade on the currency exchange, as well as for those who are interested in finance. If you fall into one of these categories, don't waste time, start reading now.

We will tell you about what a currency exchange is and how trading is carried out on a currency exchange online in this issue.

So, what is a currency exchange?

Currency exchange is a platform on which the purchase and sale of monetary units of various countries is carried out. The currency exchange is often called Forex, but this is not entirely true. We wrote in detail about how to make money on it in a previous article.

Initially The purpose of creating a currency exchange was to provide convenience for exchanging currencies. However, this task gradually faded into the background. Today Forex is primarily used for the purpose of making a profit.

It is not possible to determine the exact turnover of the foreign exchange market. However, studies show that on average it exceeds 4 trillion dollars .

A large number of bidders can be identified:

- individuals;

- investment funds;

- central banks;

- brokers.

Brokers act as intermediaries between the exchange and the trader. In the process of work, they execute trading orders, receiving a reward for this. The broker's commission is charged in the form of spread.

Spread is the difference between the purchase price and sale price of a currency.

The currency exchange operates 24 hours a day on weekdays. At the same time, many modern brokers allow you to simultaneously trade in foreign exchange and. At the latter, work with securities is carried out - shares, bonds and derivatives from them.

An important difference between the Forex market and the stock exchange is trade exclusively via the Internet . There is no special room for trading currencies. There are, of course, special sections on exchanges, For example, on Moskovskaya. However, they are created only for the convenience of trading; currency prices are not formed here.

Important advantage market Forex are special fluctuations in currency prices. They move relatively steadily. If unexpectedly sharp movements occur, prices most often return to a certain range within a certain period of time.

On the stock market some instruments may become completely worthless. This happens during the collapse and bankruptcy of the companies that issued them.

Important! Due to the fact that sharp collapses in the foreign exchange market are much less common, He easier to analyze than stock. The forecasts made turn out to be more accurate.

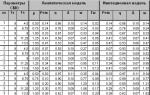

This is not the only difference between the stock and foreign exchange markets. For ease of understanding, we have compared the various characteristics of the markets in the table below.

Comparative table of differences between the foreign exchange market and the stock market:

Forex attracts beginners with its presence leverage . When purchasing currency, the trader deposits only part of the funds into the account; the rest of the money is borrowed from the broker. The amount of funds received depends on the size of the leverage.

Leverage is a ratio that shows how much of his own funds the trader uses in a transaction, and how much he borrows from the broker.

Large leverage is not used in the stock market. Therefore, to trade you have to deposit a fairly large amount of funds. Don't forget that stock market instruments are quite expensive. This is especially true for markets Europe And America.

2. Main functions of a currency exchange 📑

The functions of the currency exchange are determined by the fact that the uncontrolled activities of traders can lead to unpredictable effects.

Don't forget that imbalanced exchange rates provoke serious problems in the economies of various countries.

Below are described 4 main functions of a foreign exchange exchange .

1. Pricing

One of the most important functions of a foreign exchange exchange is pricing . Traditionally, price refers to the agreement between seller and buyer about the value of a particular product.

On the currency exchange this definition is not absolutely reliable. The fact is that the exchange takes into account the opinion not of two participants in the transaction, but of a huge number of people and organizations operating at a particular moment in the market.

Prices are not formed on their own, but are based on many different factors:

- political and economic news;

- military conflicts;

- natural disasters;

- the mood of the market (that is, the majority of trading participants).

It is these factors that determine the degree of fluctuations, predictability and other important phenomena.

The results of price formation are reflected in the charts. The result is an image that allows you to evaluate the change in the value of the instrument resulting from the influence of the market.

Traders who have been analyzing the market for many years can identify trends price changes . They are mainly influenced by the largest market participants. They are usually called majority shareholders, which include central banks, as well as the largest investment funds.

2. Calculation and adjustment of prices

By the way, you can trade financial assets (currency, shares, cryptocurrency) directly on the stock exchange. The main thing is to choose a reliable broker. One of the best is this brokerage company .

If speculators are given free rein, they can collapse the exchange rate. Therefore prices are controlled by Central Banks. They use intervention , which refers to the purchase and sale of foreign currencies. Other tools are also used to adjust prices.

It is important to understand! In fact, traders profitable that Central banks regulate exchange rates. Thanks to control, their fluctuations occur within a certain corridor.

At the same time, speculators have the opportunity to make good profits by concluding transactions in the areas overbought And oversold. In order to determine these levels, traders use various indicators.

In some cases, the Central Bank may refuse to control the exchange rate of its currency. The result could be a drastic unpredictable a jump that leads to losses for many traders.

EXAMPLE: This is exactly the situation that happened with Swiss franc at the beginning 2015 year. Up to this point, the currency in question was quite stable. When the central bank stopped fixing its value, the rate changed dramatically.

In a short time, the value of the currency increased by 1 ⁄3. Subsequently, it gradually returned to its previous level, but stability was lost forever.

3. Organization of auctions

The foreign exchange exchange brings together participants in currency trading. Among them prevail brokers And traders.

The first are engaged in creating favorable conditions for conducting. For this purpose, brokers provide speculators special terminals , which allow you to analyze the market and place orders, earning money.

4. Selection of trading participants

Only major market players can influence the value of currencies. However, with the development of the Internet, absolutely everyone has the opportunity to take part in trading. It is enough to open a special account and deposit a minimum amount into it.

But don't forget that beginners very often succumb to emotions. They are often overcome by greed or fear. The result is deposit drain , the market forces out inexperienced traders through natural selection.

The currency exchange is a rather complex economic organism. It performs important functions in the regulation of value, as well as the organization of currency trading.

3. What are currency trading on the stock exchange 📈

The instruments of the currency exchange are currency pairs(for example EUR/USD). Their name consists of two currencies (euro/dollar). To make money on the currency exchange, just open a position on purchase, expecting an increase in value, or on sale while waiting for it to decrease ↓ .

Naturally, most small traders do not know how to correctly predict the further movement of quotes on the market. They open trades when the trend is already actively developing.

Experts note that quite often a market reversal follows an active increase in the number of transactions in one direction. In other words, don't follow the crowd . If there is a change in the direction of movement of quotes, you can get a huge loss.

Many people believe that trading on the foreign exchange market is not difficult. This opinion has developed due to the fact that there is only 2 categories of currency transactions – purchase And sale .

But the main difficulty of trading is the inability of most traders to correctly determine the right moment to enter and exit the market. To trade successfully, you need to know techniques for predicting further price movements.

To select the time of purchase and sale, special methods are used, which are divided into 2 large groups:

- fundamental analysis;

- technical analysis.

Predicting exchange rate movements using fundamental analysis implies careful study of the economy as a whole .

Many traders use news trading. They analyze upcoming events in the economies of various countries and, based on them, make forecasts regarding changes in the value of currencies. Often unexpected developments lead to a sharp change in quotes.

During fundamental analysis, the following indicators are monitored:

- inflation and unemployment rates;

- GDP size;

- key rates of Central banks.

Important to keep in mind that fundamental analysis gives good results exclusively over a long-term time period.

Worth considering! Traders who trade for short periods do not carefully study the economic situation. It is more important for them to determine who is stronger in the market - bulls or bears. The former make a profit when the value of currencies rises, the latter – when they fall↓. Helps determine the prevailing mood in the market technical analysis.

Conducting technical analysis of currency pairs

Technical analysis requires mandatory comprehensive study of the current market situation . Its purpose is to predict the future movement of quotes based on historical price data.

There are a huge number of technical analysis tools:

- support and resistance levels;

- trend lines;

- various indicators;

- Japanese candlestick figures, etc.

A beginner, regardless of what time periods he plans to work on, should learn the basics of the two groups of analysis. However, in most cases, technical analysis is easier to understand.

4. What are the advantages of trading on the currency exchange - 4 main advantages ➕

Most traders begin their acquaintance with stock trading with Forex, where the main instruments are currency pairs. This market has a number of benefits before the stock market. Let's take a closer look at them.

1) Availability of leverage

In the Forex market, currencies are sold by so-called lots. This means that you cannot make a transaction with multiple monetary units.

The size of one lot is 1,000 units, therefore, any transaction must be a multiple of one thousand.

Naturally, not all individuals have the opportunity to deposit into their account an amount sufficient to purchase at least one currency lot.

Helps solve the problem leverage . It is a ratio that shows how much of his own funds the trader uses in a transaction, and how much he borrows from the broker. The maximum leverage value usually does not exceed 1:500 .

On the one hand, leverage allows you to earn more by using in trading an amount that exceeds what the trader has available. However, we should not forget that this also increases the riskiness of trading.

EXAMPLE: So, if the shoulder is set at the level 1:10 , and the trader opens a trade using all his funds, the fall at 10% will lead to complete loss of deposit.

2) Possibility of remote trading

Stock exchanges initially operated on the floor; much later they began to operate online. At the same time, Forex was immediately created as a market operating via the Internet.

There is no need to leave your home to trade currencies. It is enough to install a special program on your computer or any mobile device called trading terminal . After this, you need to carry out an analysis and you can open a deal.

Not only trading is carried out via the Internet in Forex. You can also receive news online and study analytics.

3) 24/7 trading

Trading in the stock market is carried out in sessions; the exchange is closed at night. In contrast, the currency exchange operates 24 hours a day. The market is closed only on weekends. Even during a break in the operation of the currency exchange, the exchange rates of currency pairs change.

Often after a weekend, under the influence of serious events, traders observe a break in the rate of a currency pair. This situation is called gap. However, it occurs less frequently than on the stock exchange. This is due to the fact that Forex is closed only on weekends and holidays.

A clear example of a stock market gap (price gap)

On some days, trading on a specific instrument is not carried out, since the pair includes a currency where a national holiday occurs.

4) Source of additional income

Some traders use in trading short time intervals. They monitor the market on time frames that are several minutes long.

Traders who make money on the slightest price changes are called scalpers, and the strategies they use are scalping. Such speculators are forced to spend a lot of time near the computer.

Not everyone has the desire to devote a huge amount of time to trading. The currency exchange allows you to trade with minimal costs. This can be achieved by working with medium and long term time intervals. Such trading can be a great opportunity to earn extra money.

Thus, Forex has a number of advantages over the stock exchange. Experts recommend for beginner traders to work specifically in the foreign exchange market.

The main stages of conducting currency trading online (in real time)

5. How trading is carried out on the online currency exchange - 5 main stages 📝

Many beginners, when deciding to get involved, do not know where to start. It is worth understanding that you will not be able to achieve stunning success right away.

However, there is a way to speed up the infusion process– just use it instructions from professionals . It describes the stages that a trader will have to overcome at first in order to achieve success.

Stage 1. Choosing a broker

It is important to consider the choice of a brokerage company as seriously as possible. If a trader opens an account with a fraudster, he will almost completely end up without money.

Today there are a large number of reliable brokerage companies operating in Russia. To choose the best broker, you need to take into account not only favorable rates, but also its other characteristics. One of the best is this broker.

When choosing a brokerage company, you should pay attention to the following points:

- period of work on the market;

- reputation;

- availability of a license;

- insurance guarantees;

- reviews.

By the way, there is a separate material on our website where it is presented - we recommend that you familiarize yourself with it.

Stage 2. Opening a trading account

Usually, beginners easily open a trading account, since this procedure is quite simple and understandable to everyone.

To open a trading account, you just need to do a few steps:

- registration of a personal account;

- filling out a short form;

- transfer of funds to deposit.

Each broker independently sets the minimum amount with which you can start trading.

Stage 3. Analysis of the market situation

Once the account is opened and funds are deposited into it, the trader can begin trading.

Important to consider! You should not immediately open a deal based solely on intuition. This can only be done when working with .

When concluding transactions to buy or sell currency, you should rely on the results of the analysis. Most reliable brokers conduct special classes using methods of fundamental and technical analysis. Most often they are absolutely free.

Stage 4. Development of a trading strategy

Some advertisements claim that they can offer beginners the optimal strategy that will bring huge income always and on any financial instrument. You shouldn't believe this, there are no such trading plans (strategies).

Trading strategy assumes development of rules for entering and exiting the market. It is important to decide which method will be used to determine when to open trades. In addition, the strategy obliges you to establish under what conditions to record profits and losses.

The next moment becomes trading strategy check. This can be done using historical data on the value of currency pairs. There is another option - demo account . Most modern brokers offer them. This account allows you to check the performance of your trading strategy, without risking real money.

It is also important at this step assess the possible level of risk. To do this, it is assumed that the market went in the direction opposite to the trader’s expectations and did not return back.

Important, so that the loss on one transaction does not exceed 2% of the deposit amount. If this rule is violated, the risk of complete drainage of funds from the account increases significantly.

Stage 5. Start of trading

Only after the trading strategy has been developed and tested can you begin trading online. In principle, there are usually no difficulties with this.

First of all, you should choose transaction volume. Next, if the trader expects further growth, he purchases a currency pair by pressing the button Buy. If the speculator expects the exchange rate to fall, he sells the currency by pressing Sell.

In the trading process, it is important to abandon emotions as much as possible. You should not deviate from the developed trading rules and make transactions under the influence of intuition alone.

By strictly adhering to the plan described above, even a novice trader can start trading. It is only important to treat this as a job without risking your own money.

Don't forget that stock exchange is not a casino , therefore, trading only on the basis of intuition inevitably leads to the loss of the deposit.

6. Who provides access to online currency trading (in real time) - TOP 3 popular brokers 📋

Sometimes choosing a good broker can be difficult due to the presence of a huge number of companies on the Russian financial market. Advice from experts who make up the reviews of the best brokerage companies . Below is one of them.

1) FXclub

Forex Club

has been operating in the CIS since 1997, he became the first broker here. Since that time, the Forex Club has absorbed many small market participants and grown into a large group of companies.

Forex Club

has been operating in the CIS since 1997, he became the first broker here. Since that time, the Forex Club has absorbed many small market participants and grown into a large group of companies.

Today FXclub offers a huge number of investment programs, strategies and conditions that are suitable for both beginners and experienced traders. Many experts believe that the Forex Club provides the best analytical support for traders.

Among the company's services you can find the following:

- investment ideas;

- trading ideas and recommendations;

- forecasts from a well-known analytical agency;

- trading signals;

- daily analysis of the situation on the foreign exchange market.

Customers are stimulated using various bonus programs:

- for the first and each subsequent replenishment of the trading account;

- interest on the balance of funds on deposit;

- for each attracted trader.

By registering on official website of the brokerage company, you can start conducting currency trading online.

2) Finam

One of the most important benefits

broker Finam

is the presence licenses, issued by the Russian Central Bank. Traders registered with Finam can work not only with currencies, but also with securities issued both in Russia and abroad.

One of the most important benefits

broker Finam

is the presence licenses, issued by the Russian Central Bank. Traders registered with Finam can work not only with currencies, but also with securities issued both in Russia and abroad.

Beginners are unlikely to be able to start collaborating with Finam:

- Firstly , You will have to pay for most training courses here.

- Secondly, The minimum amount to open an account is higher than many other brokers.

3) Alpari

Alpari

is a broker that provides its clients with quality training programs. First of all, beginners are advised to take basic courses and only then begin to study programs dedicated to specific trading strategies.

Alpari

is a broker that provides its clients with quality training programs. First of all, beginners are advised to take basic courses and only then begin to study programs dedicated to specific trading strategies.

The training programs offered at Alpari can be:

- free (most programs);

- paid;

- shareware.

Conditionally paid classes are a unique development of the broker. You can access them by topping up your account with a certain amount. In most cases, it is enough to make a deposit 100 dollars .

However, for more experienced traders there are classes that require a deposit to access. 1,000 dollars . At the same time, the money will not be spent even when necessary they can be removed.

When choosing a broker, experts advise beginners to refer to ratings from professionals. In this case, you will not have to analyze a huge number of characteristics for all companies. It is enough to study the description of brokers and choose the right one.

7. How to successfully trade on the currency exchange online - TOP 4 useful tips 💎

Beginners in trading have to simultaneously master a large amount of information - nuances of starting trading, basics of analysis, characteristics of brokers.

In a large flow of information, you can easily get confused and lose money. Helps make the task easier advice from professionals .