The regulation on remuneration is one of the local regulations of the company, which establishes the remuneration systems used in the organization, additional payments and allowances of a compensatory and incentive nature, accrual and payment mechanisms wages. The regulations on remuneration are developed by the employer taking into account the economic capabilities of the organization, but in compliance with the guarantees established by labor legislation, and are adopted taking into account the opinion of the representative body of employees (). Let's look at the structure of the wage regulations, analyze the mistakes that employers make when drafting the regulations, and determine whether wage indexation is mandatory for commercial organizations.

The Labor Code does not highlight the provision on remuneration as a separate document, that is, it is not mandatory. In practice, if a company pays employees only official salaries, then the regulations on remuneration are included in the internal labor regulations. Statement separate document It is advisable if, in addition to salaries, employees receive any additional payments or if the company simultaneously has different systems wages.

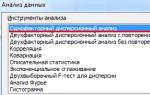

How to draw up a salary clause?

The structure and content of the wage regulations are determined by the employer based on the specifics of the activity, financial capabilities and staff of the company. The main purpose of the wage provision is to comply with the guarantees established by labor laws and industry agreements. The structure of the wage provision may be as follows:

- general provisions;

- wage systems;

- the procedure for calculating wages;

- the procedure for paying vacation pay and temporary disability benefits;

- the procedure for remuneration in conditions deviating from normal (overtime, work on weekends and at night);

- procedure for remuneration when performing additional responsibilities(fulfilling the duties of an absent employee, combining positions, increasing the volume of work, expanding the service area);

- the procedure for paying bonuses (if the provision on bonuses is not included in a separate local regulatory act);

- the procedure for calculating other payments established by the employer based on its financial capabilities and the specifics of the organization (material assistance, gifts, northern bonuses, regional coefficients, additional payments for the nature of the work, for rotation method work, for working in hazardous conditions, etc.);

- procedure, place and timing of payment of wages;

- the procedure for making payments in the event of a due date on a non-working day;

- approval of the pay slip form;

- wage indexation;

- final provisions.

The employer can supplement the provisions on wages: it may also include the procedure and cases of deductions from wages, payment of downtime, preservation of average earnings, social guarantees and compensation, etc.

Errors related to the preparation of wage regulations

Let's look at typical errors and violations related to the design and content of the wage regulations.

Salary payment dates

The Labor Code defines three documents in which the dates for payment of wages must be specified: internal labor regulations, collective agreement, employment contract (). But in practice, there are often cases when these dates are not written down anywhere, that is, the legal requirement is not fulfilled in any document of the employer.

Very often, for the payment of wages, not specific dates are set, but periods, for example: an advance payment is paid from the 20th to the 25th of the current month, the final payment is from the 5th to the 10th of the next month. Also, many employers do not take into account the requirement that wages must be paid every half month (), for example, they set the dates for payment of wages on the 25th and 15th, while the period between these dates is more than 15 days.

Salaries must be paid at least twice a month; even if the employee himself asks to pay him wages once a month, the employer cannot do this, since the employee’s situation worsens in comparison with the established Labor Code. Such violations must be excluded from the bonus regulations.

The procedure for paying wages in the wage regulations

Specifying the procedure for paying wages means that it is necessary to specify how the advance is paid, how it is formed, that is, what part of the wage is paid in what amount and when.

Issues of wages and their payments for employees are among the highest priorities, and if the employer does not disclose all the conditions, the employee will come up with these conditions himself and, if his expectations do not coincide with the actions of the company, he will go with a complaint to labor inspection. The mistake of companies is that they do not pay due attention to paperwork, as a result of which they pay fines due to such annoying shortcomings. So, the regulations on wages must clearly define the procedure for forming the first and second parts of wages and their sizes.

The Labor Code does not explain the concept of an advance, but when determining the procedure for paying wages, employers must take into account that the amount of an advance on wages for the first half of the month is determined by an agreement between the administration of the enterprise (organization) and trade union organization when concluding a collective agreement, however, it should not be lower than the tariff rate for time worked (). Thus, when determining the amount of the advance, one should take into account the time actually worked by the employee, that is, set the advance and the final payment in proportion to the time worked.

It is also necessary to take into account the timing of payment of wages. If they are established in such a way that an employee who has worked the standard working hours and fulfilled the labor standards, advance payment and wages for the current month are paid only in the next month, the employer may be held administratively liable (;,).

Do not forget to take into account the rights of new employees; they must also receive a salary every half month.

EXAMPLE

The company's payroll dates are the 25th and 10th. If an employee is hired by the company at the beginning of the month, then the first salary payment (advance) will be made to him on the 25th, that is, in violation of the deadline of half a month. We recommend making the first payment to a new employee on the 10th in proportion to the time worked; further he will receive wages for general conditions.

Violation of salary payment deadlines

No circumstances allow an employer to delay payment of wages. On the day specified in the local act, the employee must receive the amount due. For example, the Supreme Court of the Altai Republic, having established that the company did not pay wages on time, rejected the argument that the employer was not at fault due to a shortage cash on current accounts. According to the court, which explained the application procedure, the company’s activities must be carried out in accordance with the requirements of the current legislation and other regulations governing labor relations, and therefore the economic interests of the enterprise must not violate the employee’s rights to receive wages within the time limits established by law (decision Supreme Court Republic of Altai dated January 29, 2015 No. 21-4/2015).

The employer must also take into account the timing of interbank transactions. Delays in wages associated with the transfer of funds are the fault of the employer. In all cases of late payment of wages, vacation pay, calculation upon dismissal, and other payments, the company is obliged to accrue compensation to the employee in the amount of not less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation in effect at that time from amounts not paid on time for each day of delay starting from the next day after deadline payments up to and including the day of actual settlement ().

The form of the pay slip has not been approved

When paying wages, the employer is obliged to notify each employee in writing ():

- O components wages due to him for the relevant period;

- amounts of other accrued amounts, including monetary compensation for violation by the employer of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee;

- the amounts and reasons for the deductions made;

- general monetary amount to be paid.

It is the employer's responsibility to approve the payslip form and issue it to each employee, but it is rare to find a company that fulfills this responsibility. The opinion that payment of wages by transfer to the employee’s bank account exempts the employee from issuing a pay slip is erroneous. The Labor Code does not make the need to issue a pay slip dependent on the method of payment of wages. This is confirmed by judicial practice(post. Fifteenth AAS dated 08/03/2015 No. 15AP-11205/15; ).

Salary indexation

Employers must index wages in the manner established by the collective agreement, agreements, and local regulations (). Wage indexation is designed to provide workers with an increase in real wages due to growth consumer prices for goods and services. Indexation as a guarantee is prescribed in the Labor Code, so the employer must provide for the procedure for its calculation.

The need for a wage indexation clause in the wage regulations is indicated by Rostrud (): if the organization’s local regulations do not establish the procedure for wage indexation, then it is necessary to make appropriate changes (additions) to the local regulations in force in the organization. The Constitutional Court of the Russian Federation also determined that wage indexation should be provided to all persons working under an employment contract (). But labor legislation has not established any requirements for the size, procedure, or frequency of indexation of wages for employees of commercial organizations (). Employers determine the indexation procedure independently; it can be carried out in accordance with the consumer price index or, for example, taking into account the inflation rate specified in the law on federal budget or in the regional budget law, the frequency is also determined by the employer.

The absence of a wage indexation procedure in a local regulation or in a collective agreement is classified as a violation labor legislation, entailing administrative liability (;). Also in the above-mentioned definition (), the Constitutional Court of the Russian Federation indicated that the employer does not have the right to deprive employees of the guarantee provided by law and evade establishing the indexation procedure in a collective or labor agreement or in a local regulatory act.

Let us examine what liability is provided for the most common violations of the wage indexation procedure in practice.

The employer has provided for the indexation procedure in the local act, but does not carry out the indexation itself. The employer is obliged to comply with the terms of the collective agreement, local regulations and the employment contract (). If local acts contain a provision for indexation, but in fact it is not carried out, the employer can be held administratively liable in the form of a warning or the imposition of an administrative fine in the amount of 3,000 to 5,000 rubles

( ; ).

This, of course, is not a complete list of violations; we have considered only those that apply to all companies. There are also violations related to the specifics of the organization’s activities: for example, regional coefficients, percentage bonuses, bonuses and additional payments for the nature of work, for harmful conditions labor, for shift work, etc.

Aida Ibragimova, Head of Human Resources at KSK Group

The article contains a sample regulation on the remuneration of employees for 2020. It can be downloaded for free in word format. It will be useful to check the current form, which complies with all labor laws.

Attention! Especially for accountants and personnel officers, we have prepared reference books and sample documents that will help formalize labor relations with employees in accordance with the Labor Code of the Russian Federation, correctly pay remunerations and withhold personal income tax from them and insurance premiums. Download for free:

It is convenient to keep track of salaries and personnel in . It is suitable for individual entrepreneurs, LLCs, budgetary institutions, NPOs, banks, insurance organizations, etc. The program includes complete personnel records, timesheets, payroll calculation for any system, sick leave and vacation pay calculators, uploading of transactions in 1C, automatic formation all reporting (FSS, 2-NDFL, RSV, persuchet, etc.) and much more.

The Importance of Workers' Compensation Regulations in 2020

Employers are required to pay their staff. In any company, the salary includes:

- payment for work performed;

- compensatory payments (for example, for special working conditions);

- incentive payments (in particular, bonuses).

At the same time, the details and features of remuneration remain at the discretion of the employer. Therefore, a company or individual entrepreneur, if they want to hire personnel, must establish their own remuneration system and document it.

The employee benefit system can be enshrined in a local act or collective agreement. But most often the rules on payments are set out in specialized form– Regulations on remuneration. It is issued not only by companies, but also by entrepreneurs who have employees.

The company or individual entrepreneur must bring the wage regulations to the attention of all employees upon hiring them - against signature. If it turns out that the staff were not familiarized with the document, the employer faces a fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- entrepreneur - from 1000 to 5000 rubles;

- company - from 30,000 to 50,000 rubles,

In addition, the director will be additionally fined in the amount of 1,000 to 5,000 rubles.

Therefore, it is important for the employer to have confirmation signatures from employees. They can be collected:

- in a special familiarization magazine;

- or on familiarization sheets attached to employment contracts;

- or on the familiarization sheet attached to the Regulations on remuneration.

The latter method is preferable. If the provision is stitched, numbered along with the familiarization sheet and sealed, then it will be easy to confirm that the employee has read it. The familiarization sheet is a regular table containing the surname and initials of employees, their signature and the date of familiarization.

The BukhSoft program automatically generates wage regulations taking into account all changes in legislation. It will take into account the specifics of the activities of any company. The document fully complies with the requirements of Rostrud. You can download and print the document in 3 clicks. Try for free:

Draw up regulations on remuneration in the BukhSoft program →

Salary Regulations Form 2020

In 2020, the provisions on remuneration of workers remain virtually unchanged. As before, the document consists of:

- from general provisions (what issues are regulated by the Regulations, on the basis of what laws it was adopted, etc.);

- main part (details and features of remuneration);

- final provisions (how and when it comes into force, to whom it applies, how to amend, supplement the Regulations, etc.).

To make it easier to navigate the text, the main part of the Remuneration Regulations usually consists of several semantic parts, for example:

- wage system;

- official salary;

- additional payments;

- allowances;

- bonuses;

- financial assistance;

- calculation and payment of wages;

- salary indexation;

- employer's responsibility. Here we are talking about the consequences for a company or individual entrepreneur if they do not pay or delay wages. Firstly, the employer will be fined (individual entrepreneur - in the amount of 1,000 to 5,000 rubles, company - in the amount of 30,000 to 50,000 rubles). Secondly, the directors will be punished with a fine in the amount of 10,000 to 20,000 rubles. In addition, employees may not report to work if the delay exceeds 15 days.

In order for the wage regulations to remain relevant and always comply with the law, it is important for employers to take into account changes in labor legislation in a timely manner and reflect them in the document.

Regulations on remuneration and bonuses for employees: sample 2020

The following form of wage regulations is only one of possible options. Depending on the remuneration system, the list of additional payments and allowances for a particular employer, the document will be different, sometimes more concise.

- Find out how to correctly draw up regulations on bonuses for employees >>

- See how to draw up internal labor regulations (sample)>>

- See correct inner

The regulation on remuneration is a local regulatory act (LNA), which is a set of remuneration rules in force for a particular employer. The regulations on wages prescribe various salary nuances, such as, for example, established days for payment of wages, the procedure for deduction from wages, etc.

By the way, some employers in the LNA prescribe not only the procedure for remuneration, but also the procedure for paying bonuses to employees. Thus, the provision on remuneration is transformed into a provision on remuneration and bonuses for employees.

The procedure for adopting regulations on remuneration

As a rule, the wage regulation is adopted by the employer once, and then, if necessary, changes are made to it.

Keep in mind that when adopting a regulation on wages, the opinion of the trade union (if there is one) must be taken into account (Article 135 of the Labor Code of the Russian Federation).

Please note that the regulations on remuneration must be familiarized with the signature of each employee upon hiring, as well as each employee in the event of changes to this regulation (Articles 22, 68 of the Labor Code of the Russian Federation). Moreover, when hiring an employee, it is necessary to familiarize them with this LNA even before signing the employment contract (Letter of Rostrud dated October 31, 2007 No. 4414-6).

Regulations on remuneration: sample

There is no approved form for the wage regulations. Therefore, each employer can develop its own form of such a provision.

You can view a sample salary clause.

We also provided a sample of the Regulations on the remuneration of employees.

Regulations on remuneration of employees since 2017

On January 1, 2017, amendments to the Labor Code came into force (Federal Law dated July 3, 2016 No. 348-FZ). Thanks to these amendments, microenterprises have the right to completely or partially refuse to adopt local labor regulations. Accordingly, starting from 2017, microfirms may not adopt regulations on wages and material incentives for employees.

Regulations on employee remuneration must be developed and approved by all employers. Read on to learn why and how to do this.

Regulatory regulation of the provisions on remuneration and bonuses for employees - 2019-2020

The main purpose of creating the Regulations on remuneration and bonuses for employees is to reflect the mechanisms in accordance with which wages are calculated and paid at the enterprise.The regulations are developed by the employer taking into account the specifics economic activity, financial capabilities and staff of the company. This document cannot contradict the Constitution of the Russian Federation, labor legislation and other regulations regulating wage issues.

For example, when a remuneration system is established in municipal and state institutions, one of the regulatory documents is the Unified Recommendations. They are approved by the Russian tripartite commission in the form of a decision, documented in a protocol and signed by representatives of the parties - the Government of the Russian Federation, the All-Russian Association of Trade Unions and the All-Russian Association of Employers (in 2019, recommendations apply adopted by decision dated December 25, 2018, protocol No. 12).

This document often serves as a guideline for drawing up regulations at enterprises of various organizational and legal forms.

Main source legal regulation The organization's regulations are Art. 135 Labor Code of the Russian Federation. However, in order to prescribe the optimal conditions establishing this type relationships, you need to take into account and take into account other regulatory documents, namely:- unified tariff and qualification reference books for jobs and professions;

- regulations on remuneration approved by the ministry to which the employing organization is subordinate (for example, for cultural institutions such a regulation was approved by order of the Ministry of Culture of the Russian Federation dated March 28, 2019 No. 349);

- law "On minimum size remuneration" dated June 19, 2000 No. 82-FZ, etc.

The main functions of the wage regulations and the scope of its legal regulation

To understand the meaning of the document, it is necessary to determine the areas of its legal regulation. The provision contains rules governing a specific aspect of individual or collective labor relations, and therefore refers to local regulations.The main function of such acts is a source of information for employees of the organization about the procedure and rules for calculating and paying wages. Having a limited scope, such acts specify legal acts, taking into account the characteristics and working conditions at a particular enterprise. In other words, this document regulates relations within one enterprise.

Based on the provisions of Part 1 of Art. 135 and art. 372 of the Labor Code of the Russian Federation, the Regulations are drawn up taking into account the opinions of representative bodies, employees of the enterprise, as well as trade unions.

What should be the form and validity period of the document?

The regulation does not have a standard form, so each enterprise forms it independently, establishing and thinking through own structure and remuneration algorithms - taking into account regional and industry specifics, but within the framework of federal legislative norms.By general rules labor relations Regulations from the moment of its publication at the enterprise become mandatory for execution by both the employer and employees.

The validity period of the Regulation is determined by the employer. As a rule, the document is valid indefinitely and is subject to adjustment in cases where:

- the enterprise plans to open new types of activities that will require the involvement of specialists from various professions;

- The terms of remuneration for existing employees of the company are changing.

The provision may exist in the form of an annex to the employment contract or adopted as an independent regulatory act.

Legal requirements for document structure

The law does not establish unified requirements regarding the structure of the Regulations. The recommended structure of the Regulations includes several sections: This section provides the terminology used in the Regulations and its interpretation. Revealed general principles actions of the Regulations. References are given to regulations governing labor legislation, on the basis of which the remuneration system established by the Regulations was developed. Other general issues are also discussed.- The procedure for remuneration and conditions for making payments

- Additional payments, allowances and others compensation payments

- Bonuses and incentive payments

- Employer's liability

- Final provisions

Important! The given list of sections of the Regulations may be supplemented and modified by the employer.For example, sections on financial assistance and salary indexation can be added.

Issuance of an order approving the wage regulations

The developed layout of the Regulations is agreed upon with the heads of the personnel department and finance department(chief accountant). Provisions of Art. 162 of the Labor Code of the Russian Federation prescribe this document to be coordinated with the trade union, if it is created at the enterprise.After approval of the Regulations with the financial and HR department an order is issued approving the regulations on wages signed by the first head of the organization.

A completed example of this order can be downloaded below.

In accordance with the requirements of Art. 22 of the Labor Code of the Russian Federation, each employee must be familiar with the contents of the Regulations upon signature.

WITH ready-made sample The wage regulations can be found here.

Typical mistakes when drawing up regulations

Based on the analysis of sample regulations on remuneration and bonuses for employees adopted by some companies in 2019, we can identify the main mistakes that employers make when drafting them.To the most typical mistakes refers to ignoring the requirements of Art. 136 Labor Code of the Russian Federation. According to the provisions of this norm, local acts of the enterprise must necessarily contain information about the date of payment of wages at the enterprise. However, in practice this requirement is often not fulfilled.

In addition, the provisions of this norm contain a requirement to pay wages twice a month. Even if the employee expresses a desire to receive a salary once a month, the employer does not have the right to do this, since a one-time payment of salary will violate the requirement of labor legislation regulating the frequency of its payment.

Important! It is unlawful to provide for any penalties in the Regulations for improper performance of duties by an employee. Labor legislation provides in this case only disciplinary liability.The employee can be reprimanded or reprimanded, as well as fired. It is also permissible to provide in the Regulations conditions that allow not to assign a bonus to an employee or to reduce its size for certain disciplinary offenses. It is necessary to prove non-fulfillment of labor duties with references to written documents with which the employee is familiarized with signature (employment contract, internal work schedule, job description).

If the Regulations on the remuneration of workers of the 2019-2020 model contain the above violations, they must be excluded.

Thus, the Regulations on remuneration and bonuses are useful for both employers and employees.

With its help, it is much easier for employers to justify to the tax authorities the inclusion of various expenses in expenses. salary payments. In accordance with the requirements of Art. 255 of the Tax Code of the Russian Federation, companies are allowed to include in costs labor costs, including incentives and bonus payments established at the enterprise by local regulations. The provision allows you to combine in one document all the rules and conditions in accordance with which employees are paid.

Thanks to the Regulations, workers gain additional guarantees timely payment of established compensations and allowances and, if necessary, may demand their payment in court.

The regulation plays a crucial role in formalizing and regulating the relationship between employee and employer regarding remuneration. The regulation can improve the employee’s rights to remuneration, provide additional guarantees and payments. Worse or limit labor rights compared to impossible.

Like any other regulatory legal act, the provision must be fully consistent with the current legislation of the Russian Federation, and in the event of changes in legislation, it must be reviewed and amended in a timely manner.

Regulations on remuneration and its sections

General provisions

The “General Provisions” section establishes the subject composition, that is, those persons to whom it applies. IN large company separate provisions on payment may be adopted for employees of branches and central office, for managers and employees of blue-collar professions. For example, the regulation on the remuneration of truck drivers, the regulation on the remuneration of dental clinic workers.

Examples:

2.3. This Regulation applies to employees who are in an employment relationship with the Company on the basis of concluded employment contracts both at their main place of work and those working part-time.”

2.6. For the purposes of these Regulations, all positions of the Company's employees are differentiated in accordance with the Regulations on the distribution by categories and levels of positions of LLC "Company" into the following categories and levels:

The regulations indicate documents - legal basis to adopt regulations on remuneration in a particular company. In municipal and budgetary institutions, such documents are decrees of the government, legislative bodies of constituent entities and municipalities. Approved ones are often used standard samples provisions on remuneration developed specifically for employees of budgetary institutions. For example, regulations on the labor of healthcare workers, regulations on remuneration of municipal employees.

The basis for developing regulations on remuneration for employees of educational institutions are also the legislative acts of the subject and industry recommendations.

Example:

1.1. These Regulations have been developed on the basis of:

1.1.1. Labor Code of the Russian Federation;

1.1.2. Decree of the Government of the Moscow Region No. 483/23 dated July 3, 2007. “On remuneration of workers municipal institutions Healthcare of the Moscow Region" (as amended as of December 30, 2014)

1.1.3. Decree of the Government of the Moscow Region No. 385/17 of May 26, 2014. “On amendments to the Decree of the Government of the Moscow Region No. 483/23 of 07/03/2007”

The salary regulations are approved not only by the head of the company, but also by others executive bodies, in the manner prescribed by the charter. Local regulations establishing remuneration systems are adopted by the employer taking into account the opinion of the representative body of employees ( Art. 135 Labor Code of the Russian Federation).

As a rule, an order is issued approving the wage regulations, which indicates the validity period of the document, responsible persons, and the procedure for application and revision.

The “General Provisions” section also defines the terms used in the normative act, excluding their inaccurate or double interpretation.

Remuneration system

The section “Remuneration System” sets out the main methods of remunerating employees within a particular company. This could be a time-based bonus wage system, piecework wages, etc. Usually, closed lists are avoided in the regulations on wages and bonuses for employees; it is advisable to make reference norms to the employment contract specific employee. An employee’s employment contract may contain individual, additional or other conditions for remuneration. According to Article 132 of the Labor Code of the Russian Federation, any kind of discrimination is prohibited in establishing and changing wage conditions.

Components of an employee's salary

The regulations on remuneration explain the methods of remuneration used for the employee. The legal significance of this section is that in it the employer establishes the components of wages - the constant and variable part of the remuneration.

According to Article 129 of the Labor Code of the Russian Federation, wages (employee remuneration) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). IN corporate position it is necessary to clarify and specify the types of remuneration and payments specified in the article.

An example from the regulations on remuneration of employees of educational institutions:

Hourly wage teaching staff educational institution applies in the following cases:

- when paying for hours performed to replace teachers and other teaching staff absent due to illness or other reasons, lasting no more than two months;

- when paying for hours pedagogical work performed by teachers when working with children at home undergoing long-term treatment, in excess of the tariff established for them;

- when paying for hours of teaching work in the amount of 300 hours in another educational institution(in one or more) in addition to the academic load performed part-time on the basis of tariffs.

1.16. In St. Petersburg, starting from January 1, 2017, the minimum wage is set at 16,000 rubles. In this case, the tariff rate (salary) of a 1st category employee should not be less than 13,500 rubles

Permanent part- this is the salary established employment contract, staffing table. This is what we are talking about in Article 136 of the Labor Code of the Russian Federation(current edition - ).

Tariff rate- a fixed amount of remuneration for an employee for fulfilling a standard of work of a certain complexity (qualification) per unit of time, without taking into account compensation, incentives and social payments.

Salary (official salary)- a fixed amount of remuneration for an employee for performing labor (official) duties of a certain complexity per calendar month, excluding compensation, incentives and social payments.

Basic salary (basic official salary), basic wage rate- minimum salary (official salary), wage rate for an employee of a state or municipal institution carrying out professional activity by profession of a worker or position of an employee included in the corresponding professional qualification group, excluding compensation, incentives and social payments.

Variable part- these are various bonuses, allowances, bonuses, coefficients, compensation, incentives, incentive payments. In this part of the wage regulations, an important component is the establishment of conditions and terms for payment of variable parts of the wage plan.

As conditions, we can identify indicators specific to a particular company: fulfillment of the personal sales plan, length of service, results of the quarter and year, “closing” of contracts, absence of claims from customers, absence disciplinary sanctions in relation to the employee, labor intensity.

The deadlines can include both specific dates and periods during which management makes the appropriate management decision.

Examples:

4.10. For specialists who have graduated government agencies higher or secondary vocational education and those hired for the first time in the year of graduation to work in their acquired specialty (hereinafter referred to as young specialists), an additional payment of 3,000 rubles is established.

5.4. For use at work foreign language The employee is given a bonus in the amount of 15 percent of the salary (official salary). The specified allowance is established for Employees in whose job responsibilities includes contacts with foreign partners or work with foreign literature.

The most common formulation of the condition for payment of the variable part in commercial companies is that the employer has a financial opportunity (profit, savings on the wage fund, etc.) in a certain amount, as well as the procedure for assigning the variable part to payment (payment terms, availability or absence of employee disciplinary action, etc.). This formulation fully complies with the requirements of the law.

Examples:

4.3. The company, based on the decisions of the General Director, has the right to establish other types of bonuses, additional payments and allowances.

5.1. One-time (one-time) bonuses are paid:

- in connection with professional holidays, based on the results of work for the year - at the expense of the Organization’s profit;

- in other cases provided for by the Regulations on bonuses - from the wage fund.

5.2. The amount of one-time (one-time) bonuses is established by order (instruction) of the head of the Organization, depending on the performance results of each Employee. Amount of one-time (one-time) bonuses maximum size not limited.

Do not forget about the in-kind form of remuneration, if it exists within a given company. establishes that, in accordance with a collective agreement or employment contract, upon the written application of an employee, remuneration may be made in other forms that do not contradict the law Russian Federation and international treaties of the Russian Federation.

The share of wages paid in non-monetary form cannot exceed 20 percent of the accrued monthly wage.

Payment of wages in bonds, coupons, in the form of promissory notes, receipts, as well as in the form of alcoholic beverages, narcotic, poisonous, harmful and other toxic substances, weapons, ammunition and other items in respect of which prohibitions or restrictions on their free circulation have been established , not allowed.

Other sections of the regulations on payment and bonuses for employees

The wage regulations may contain other sections.

Procedure for accrual and payment of remuneration

This section may establish special types of payments - annual quarterly bonuses, payments during work, work, amounts and conditions for the payment of financial assistance to employees in difficult life situations.

An example from the regulations on remuneration of workers in healthcare institutions:

7.2. For duty at home, including at night, for doctors and paramedics medical personnel additional payment is made at the rate of 50 percent of the official salary for the actual time on duty.

The provisions of this section streamline the document flow on the basis of which various payments are made (, orders, the procedure for considering employee applications).

Example:

5.11. With the exception of a petition to the General Director of the Company or a person authorized by him, the employee does not have the right to demand, insist or force the employer to exercise his right to provide him with social benefits and guarantees, compensation, additional payments and allowances not provided for by current legislation.

It is advisable to fix the form in the regulations on remuneration ( Art. 136 Labor Code of the Russian Federation), place and procedure for payments (cash office, bank card employee).

Sources of funds for paying wages

The section regulates the formation of the wage fund, the payment fund for the fixed and variable parts of wages.

Wage indexation

It is highly desirable to include a section on indexing in the regulation. If government bodies, organs local government, state and municipal institutions carry out wage indexation in the manner established by the relevant regulatory legal acts, then other employers - in the manner established by the collective agreement or local regulations ( Art. 134 Labor Code of the Russian Federation). Labor legislation does not provide for a uniform method of wage indexation for all employees. The mechanism for indexing workers' wages is determined taking into account the procedure for its establishment: when budget financing- centrally, for other employers - by collective agreement and locally.

An example from a salary regulation:

3.3. Wage indexation is carried out annually for all employees within the limits of the Budget of Income and Expenses of LLC "Company" approved by the Board of Directors for the corresponding financial year. For newly hired employees, wage indexation is carried out in the generally established manner, regardless of the number of full (partial) months worked by them in the year for which indexation is carried out for the first time.

3.4. The amount of indexation of an employee's wages is determined as the result of multiplying the employee's cash income subject to compensation and the indexation percentage, divided by 100%.

3.5. The percentage of wage indexation is determined by order general director. The order is issued no later than the 15th day of the month following the end of the year for which indexation is carried out.

3.6. Wages, calculated taking into account indexation, are paid to employees starting from the first January of the corresponding financial year.

New in wage legislation in 2020

Deadlines for payment of wages and bonuses

Editorial Federal Law dated July 3, 2016 N 272-FZ Article 136 of the Labor Code of the Russian Federation It is established that wages are paid at least every half month. The specific date for payment of wages is established by a collective agreement or employment contract no later than 15 calendar days from the end of the period for which it was accrued.

The Labor Code of the Russian Federation does not determine how much wages should be paid to an employee for half a month.

As follows from the letter of the Ministry of Labor of Russia dated 02/03/2016 N 14-1/10/B-660 and the letter of Rostrud dated 09/08/2006 N 1557-6, when determining the amount of wage payment for half a month (including advance payment), it is necessary to take into account, in in particular, the time actually worked by the employee (the work actually performed by him).

In order to develop a regulation on wages in 2020, it is necessary to take into account the Letter of the Ministry of Labor of Russia dated August 23, 2016 No. 14-1/B-800, according to which the following application is proposed Article 136 of the Labor Code of the Russian Federation- the payment date is established by the company’s internal regulations no later than 15 calendar days from the end of the period in which it was accrued.

The employer has every right to independently regulate the timing of payment of various bonuses. For example, establish that the calculation of the so-called “thirteenth” salary, that is, a bonus based on the results of the year, is made annually in March of the next year, payment - in April of the next year.

Additionally, on September 21, 2016, an explanation was published by the Russian Ministry of Labor on the new terms for payment of bonuses, according to which the requirements for limiting the terms of payment of wages to fifteen calendar days apply only to payments to the employee of accrued wages, which are made at least every half month.

The variable part of wages and various incentive payments are one of the components of wages and are paid for periods other than those established by the Labor Code of the Russian Federation (month, quarter, year, etc.).

The Ministry of Labor in its clarification assures that if local regulations specify the period in which bonuses are calculated and issued, then such terms will fully comply with current legislation, which will avoid fines. However, consistent judicial practice after entry into force new edition Article 136 of the Labor Code has not yet formed.

Unified recommendations for establishing the labor of employees of state and municipal institutions for 2020

The decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations dated December 23, 2016 (Minutes No. 11, published on December 29, 2016) approved unified recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of state and municipal institutions at 2020 They were developed by the Russian Tripartite Commission for the Regulation of Social and Labor Relations in accordance with Article 135 of the Labor Code of the Russian Federation in order to ensure uniform approaches to regulating wages of employees of public sector organizations.