Let's take a closer look at how to find out which reports to submit to statistics in 2018 and what responsibility organizations bear for failure to provide information to Rosstat.

To find out what forms Rosstat expects from the organization, you need to use the service https://websbor.gks.ru/online/#!/gs/statistic-codes. This site contains official information about how and what reports need to be submitted to statistics on TIN and OKPO.

What statistical reports need to be submitted to Rosstat?

The reporting forms used for monitoring are approved by Rosstat. For each enterprise, the number and composition of reporting is determined individually.

Statistical data must be submitted to Rosstat authorities, regardless of the categories of subjects. Information for statistics is collected using federal and republican statistical surveillance forms. Each region will have its own list of forms.

Statistical reporting can be submitted:

- on paper (in person, through an authorized representative or by mail with a list of attachments);

- via telecommunication channels...

To find out how and what kind of reporting to submit using the TIN, you need to determine which category the business entity belongs to. All enterprises are divided according to the following criteria: small, medium, large.

Research is carried out through continuous and selective observations. Collection of information for continuous observations occurs once every five years. The frequency of reporting for sample studies varies and depends on the form. For example, indicators financial condition submitted to statistical authorities monthly, financial statements and its annexes are submitted to Rosstat once a year, information about wages workers by profession are provided once every two years.

Companies that belong to medium and large ranks fill out the following forms:

- P-1, monthly reporting, which is due by the 4th;

- P-5m, quarterly reporting, due by the 30th of the next month;

- 1-Enterprise, annual reporting, available until April 1st;

- , monthly or quarterly reporting, due by the 15th;

- P-2, annual form is due by February 8, quarterly reporting – by the 20th of the next month.

How to view the list of reports on the website

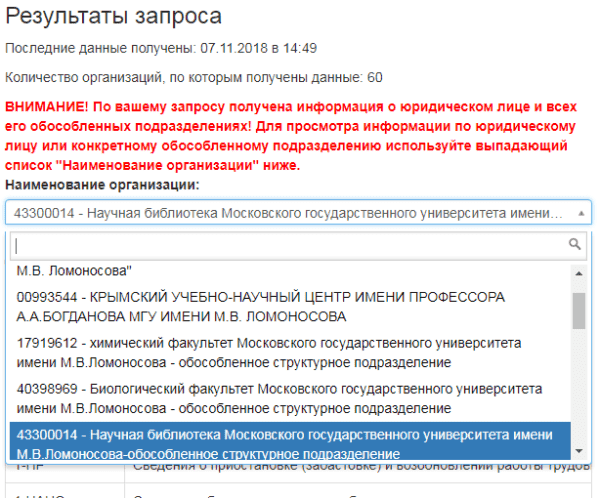

In October 2018, the website for obtaining a list of statistical reports was updated. Now, when you request, you will see information about the legal entity and all divisions. If you wish, you can select a specific division and view the list only for it.

Let's consider how to find out which reports to submit to statistics using TIN, OKPO or OGRN n and the official website of the Reporting Collection System https://websbor.gks.ru/online/#!/gs/statistic-codes. The service can provide information on one of the organization’s parameters, for example, find out that statistics can only be submitted using the Taxpayer Identification Number (TIN), by entering the value in the required field.

This is what the data entry form looks like:

After entering the details, you will see the search results: data on statistics codes and a list of forms for submission.

If your request contains several organizations, all data will be displayed. But you can choose a specific legal entity or a separate division:

For the selected organization, you will see data on statistics codes (click on the picture to open it in full):

At the end of the table there is an “Export” button. Using it you can download the Notice of OK TEI codes (xls) and Information about codes and forms (xls).

If the list of forms on the website is empty, then your organization does not need to submit statistical reporting.

An alternative to obtaining information about a specific organization's statistical reporting is a direct request to local authority state statistics.

Download the instructions and distribute them to the employees responsible for submitting statistical reports:

Features of working with the service

The list of reports may change from year to year, depending on how the statistics agency makes the sample. Therefore, it is better to clarify at the beginning of the year which reports will need to be filled out.

List of forms statistical observation is formed at the end of the year, but is updated monthly. Organizations operating more than a year, should receive information about the list of statistical reporting forms at the end of the year. Only established companies are required to review such information every month for the first year from their inception.

If the list does not contain any form, then reporting is not necessary. An exception may be cases where the company has received written notice of the need to submit one or another form of statistical reporting. If the organization is informed in writing that a certain form does not need to be submitted, but is listed on the website this form is listed, then it is necessary to follow the written notification and not provide information to Rosstat. In this case, no fines will be charged.

An organization can seek clarification from its territorial statistical office if the list published on the official website differs from what the organization received in writing.

Penalties for failure to provide statistical data

Failure by an organization to provide primary statistical data or provision of false information is considered an offense and entails penalties.

For initial failure to provide or late provision of data, fines are established in the amount of:

- 10 - 20 thousand rubles. For officials;

- 20 – 70 thousand rubles. For legal entities.

Repeated violations are punishable by larger fines:

- 30 – 50 thousand rubles. officials;

- 100 – 150 thousand rubles. legal entities.

Increased fines are applied when an organization has repeatedly failed to submit reports or violated deadlines for submitting any form of statistical reporting.

The application of penalties to the organization does not eliminate the need to provide reporting data to Rosstat authorities.

In 2017, small and medium-sized enterprises will have to take new forms of statistical observation. Rosstat introduced 6 annual reports for individual entrepreneurs and small enterprises, 2 quarterly and 3 monthly.

Federal service State Statistics Service issued Order No. 414 dated August 11, 2016, which approved several updated forms of statistical observation for small businesses. Entrepreneurs in 2017 can expect new annual, quarterly and monthly reports.

What reports has Rosstat updated?

Based on the results for 2016, small businesses and individual entrepreneurs will have to report using the following new forms:

- N 1-natura-BM "Information on production, shipment of products and balance production capacity"

- N 23-N "Information on the production, transmission, distribution and consumption of electrical energy"

- N 4-TER "Information on the use of fuel and energy resources"

- N MP (micro) "Information on the main performance indicators of a micro-enterprise"

- N 1-IP "Information on activities individual entrepreneur"

- N MP (micro)-nature "Information on the production of products by a micro-enterprise."

Every quarter, starting from the period January - March 2017, you will have to submit reports such as:

- N PM "Information on the main performance indicators of a small enterprise";

- N P-5 (m) "Basic information about the activities of the organization."

- N P-1 "Information on the production and shipment of goods and services";

- N PM-prom "Information on the production of products by a small enterprise";

- N 1-IP (months) "Information on the production of products by an individual entrepreneur."

Who must submit new reports?

New reporting forms are not mandatory for all, without exception, representatives of small businesses. You can find out which reports need to be submitted in each specific case using the new one, which was launched in accordance with Decree of the Government of the Russian Federation dated April 22, 2015 No. 381. To use the service, it is enough to have access to the official website of Rosstat and enter the organization’s data such as name, OKPO code or INN. After this, a list of necessary reporting forms, including new ones, will be automatically downloaded to the user’s computer.

The Statistics Service is obliged to inform subjects of official statistical records free of charge about specific reporting forms. If an entrepreneur contacts Rosstat in writing, they will send him a list to the address of his location contained in the Unified State Register of Legal Entities (Unified State Register of Individual Entrepreneurs), or to the address specified in the letter.

The list of reporting forms sent to Rosstat is, as a rule, individual for each enterprise or individual entrepreneur. Some people must submit one or several statistical reports in 2018, while others do not need to submit anything. We will tell you further about how to find out which reports must be submitted to statistics in 2018, what these forms are and what the responsibility is for failure to submit them.

Who should report to Rosstat

Statistical reporting is provided for any business entity, regardless of the type of their activity. Large organizations are required to report regularly; they often submit several reporting forms at once. Representatives of small and medium-sized businesses, as well as micro-enterprises, submit statistical reports when they participate in continuous statistical observations once every 5 years, and in the period between that they can be included in the Rosstat sample according to various signs– type of activity, volume of revenue, number, etc. (Resolution of the Government of the Russian Federation dated February 16, 2008 No. 79).

Reports within the framework of sample studies can be submitted quarterly or monthly, and for micro-enterprises only annual statistical reporting is acceptable (Clause 5, Article 5 of Law No. 209-FZ of July 24, 2007).

How to find out which forms of statistical reporting you need to report on

Having formed the sample, the territorial bodies of Rosstat are obliged to notify the individual entrepreneurs and organizations included in it of the need to submit the relevant reports, as well as provide forms for completion. If there was no such notification, individual entrepreneurs and companies can independently find out what forms they will use to report in 2018.

How can I find out from the statistics agency which reports (by TIN, OGRN or OKPO) need to be submitted in 2018? The simplest and quick way– go to the Rosstat website, on the page ]]> statreg.gks.ru ]]> indicate your status (legal entity, individual entrepreneur, branch, etc.) and enter one of the listed details in the special fields. As a result, the system will generate a list of statistical reporting forms that a person must submit, indicating their name, frequency and submission deadline. If the list of statistical reporting forms for 2018 is empty, you do not need to report to Rosstat in this period. Information on the site is updated monthly.

Also, a company or individual entrepreneur can contact the territorial body of Rosstat with an official written request for a list of reports, but this will take much more time (clause 2 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Statistical reporting forms and deadlines for their submission

Statistical forms can be grouped depending on the type of business entity: for example, statistical reporting of individual entrepreneurs, micro-enterprises, medium and small firms, large organizations; there are also forms on which all of the listed entities can report.

Some 2018 statistical reporting may only be intended for certain industries: agriculture, retail, construction, etc. You can also highlight statistical reports presented by the number and composition of personnel, volume of revenue, products produced, etc.

For each statistical form they have established their own deadlines for submission, violation of which threatens with significant fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation): 10 – 20 thousand rubles. for officials, and 20-70 thousand rubles. for the company. Responsibility for repeated violation of deadlines for submitting statistical reports will increase to 30-50 thousand rubles. for responsible officials, and up to 100-150 thousand rubles. for the organization. The same penalties apply when submitting false statistical data.

If there are no indicators for filling out reporting, Rosstat must be notified about this in a letter, and it should be written every time the next reporting date occurs (clause 1 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Along with statistical reports, legal entities are required to submit a copy of their annual accounting reports to Rosstat. Accounting “statistical” reports (including those in simplified forms) are submitted no later than 3 months after the end of the reporting year (for 2017, the deadline is 04/02/2018). For violating the deadline, officials can be fined 300-500 rubles, and the company 3-5 thousand rubles. (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Submission of statistical reporting in 2018

Please note that for almost any economic sector and type of activity, many reporting statistical forms have been developed. Here we provide tables for statistical reporting current in 2018, some of them with deadlines for submission.

|

Type of activity |

Frequency and deadline for submission to Rosstat |

||

Statistical reporting in 2018, submitted regardless of the type of activity: |

|||

|

microenterprises |

|||

|

small businesses |

Quarterly, 29th day after the reporting quarter |

||

|

legal entity other than SMP |

|||

|

1-T (working conditions) |

legal entity other than SMP |

||

|

All types except retail(excluding trade in motor vehicles) |

|||

|

legal entity other than SMP |

|||

|

1-T (working conditions) |

legal entity other than SMP |

||

|

legal entity other than SMP |

|||

|

P-2 (invest) |

legal entity other than SMP |

||

|

Monthly, 28th day after the reporting month Quarterly, 30th day after the quarter |

|||

|

legal entity other than SMP |

Monthly, with MSS above 15 people. – 15th of the next month Quarterly, with SSCh 15 people. and less – the 15th day after the reporting quarter |

||

|

a legal entity with a social capital of more than 15 people, except for self-employed enterprises |

Quarterly, 8th day after the reporting quarter |

||

|

a legal entity with a social capital of more than 15 people, except for self-employed enterprises |

Quarterly, 30th day after the reporting quarter |

||

|

legal entity other than SMP |

Quarterly, 20th day after the reporting quarter |

||

|

All types, except insurance, banks, government agencies, financial and credit organizations |

legal entity other than SMP |

Quarterly, 30th day after the reporting period (1st quarter, half year, 9 months) |

|

|

legal entity, except SMEs and non-profit organizations |

|||

|

All types, except insurance, non-state pension funds, banks, government agencies |

legal entity other than SMP |

||

|

legal entity other than SMP |

|||

Submission of statistical reporting in the field of trade: |

|||

|

Wholesale |

SMEs, except microenterprises |

Monthly, 4th day after the reporting month |

|

|

1-conjuncture |

Retail |

||

|

1-conjuncture (wholesale) |

Wholesale |

Quarterly, 10th day of the last month of the reporting quarter |

|

|

Trade |

legal entity, except micro-enterprises |

||

|

Wholesale and retail trade |

legal entity other than SMP |

||

|

Sale of goods to the public, repair of household products |

|||

|

Trade in certain goods |

Individual entrepreneur and legal entity |

||

|

Retail |

SMEs, except microenterprises |

Quarterly, 15th day after the reporting period |

|

Statistical reporting of organizations providing services: |

|||

|

Paid services to the population |

|||

|

Paid services to the population |

legal entity, legal entities (except for law offices) |

||

|

1-YES (services) |

legal entity, except for microenterprises and non-profit organizations |

Quarterly, 15th day of the second month of the reporting quarter |

|

|

Manufacturing and services |

Individual entrepreneurs and legal entities, except micro-enterprises |

||

What reports should be submitted to statistics for those involved in agriculture: |

|||

|

Agricultural activities |

legal entity, except SMP and peasant farms |

Monthly, 3rd day after the reporting month |

|

|

Sowing crops |

SMP, peasant farm, individual entrepreneur |

||

|

Sowing crops and perennial plantings |

SMP, peasant farm, individual entrepreneur |

||

|

Availability of farm animals |

SMP (monthly), individual entrepreneurs and microenterprises (once a year) |

||

|

1-purchase prices |

Agricultural production |

legal entity other than peasant farms |

|

|

2-purchase prices (grain) |

Purchase of domestic grain for main production |

Menstruation, 15th of next month |

|

|

Agricultural activities |

Monthly, 20th of the reporting month |

||

|

1-СХ (balance) – urgent |

Purchase, storage, processing of grain and its processed products |

Quarterly, 7th day after the reporting quarter |

|

|

10-MEH (short) |

Agricultural activities |

legal entity, except peasant farms and microenterprises |

|

|

Agricultural activities in the presence of sown areas, hayfields, or only perennial plantings |

legal entity, except SMP and peasant farms |

||

Statistical reporting 2018 - deadlines for the mining industry: |

|||

|

Extraction and processing; production and distribution of gas, steam, electricity; fishing, logging |

Individual entrepreneur with 101 or more employees. |

Menstruation, 4th working day of the next month |

|

|

MP (micro) - nature |

Individual entrepreneurs and micro-enterprises with up to 15 people. |

||

|

Individual entrepreneurs with employees from 16 to 100 people, small enterprises |

Monthly, 4th working day after the reporting month |

||

|

1-nature-BM |

legal entity other than SMP |

||

|

Mining, manufacturing, air conditioning, gas, steam, electricity |

small businesses |

Quarterly, 10th of the last month of the quarter |

|

|

legal entity other than SMP |

Monthly, 10th of the reporting month |

||

|

Mining, manufacturing, air conditioning, gas, steam, electricity, water supply, sanitation, waste collection and disposal, pollution removal |

legal entity, except micro-enterprises |

||

List of statistical reporting for the oil and gas industry: |

|||

|

1-TEK (oil) |

Production of oil, associated gas and gas condensate |

legal entity other than SMP |

|

|

1-TEK (drill) |

Well drilling |

legal entity other than SMP |

|

|

2-TEK (gas) |

Availability of gas wells on the balance sheet |

legal entity other than SMP |

|

|

Oil production and refining |

legal entity other than SMP |

Quarterly, 30th |

|

|

1-motor gasoline |

Production of motor gasoline and diesel fuel |

legal entity other than SMP |

Weekly, 1 day after the reporting week, until 12 noon. |

Construction statistics - reports in 2018: |

|||

|

Construction |

legal entity, except micro-enterprises |

Quarterly, 10th day of the second month of the reporting quarter |

|

|

Construction |

legal entity, except micro-enterprises |

Monthly, 25th of the reporting month |

|

|

12-construction |

Construction |

legal entity other than SMP |

|

Statistical reporting of transport enterprises: |

|||

|

Operation and maintenance of urban electric transport |

|||

|

65-autotrans |

Transportation of passengers by buses and passenger taxis |

legal entity, except micro-enterprises |

|

|

1-TR (motor transport) |

Transportation of goods by road; non-public roads on the balance sheet |

legal entity, except micro-enterprises |

|

|

Air transportation |

legal entities and their separate divisions |

Quarterly, 15th day after the reporting quarter |

|

|

Monthly, 7th day after the reporting quarter |

|||

|

Monthly, 15th day after the reporting quarter |

|||

|

32-GA and 33-GA |

Quarterly, 7th day after the reporting quarter |

||

|

1-TARIFF (auto), 1-TARIFF (ha), 1-TARIFF(more), 1-TARIFF (yellow), 1-TARIFF (pipe), 1-TARIFF (internal water) |

Transportation of goods by road, air, sea, railway, pipeline, water transport |

Monthly, 23rd of the reporting month |

|

Deadlines for statistical reporting for the tourism and hotel business: |

|||

|

Tourist activities |

Individual entrepreneur and legal entity |

||

|

Services of hotels and similar accommodation facilities |

legal entity other than SMP |

Quarterly, 20 days after the reporting quarter |

|

In addition to tax reporting, legislative acts provide for the obligation of a business entity to submit reports to statistics. Which forms to submit are determined by Rosstat independently and communicated to companies and entrepreneurs. Currently, there is a service where you can use your Taxpayer Identification Number (TIN) to view reports to statistics in 2018, a list of forms and deadlines for submission.

Legal norms establish the obligation to submit statistical reports to Rosstat. Moreover, what kind of reports need to be submitted depends on the status of the business entity, the type of activity performed, size, etc.

If a company does not operate, its reporting obligation does not disappear. She still has to fill out the forms and send them to statistics. If she does not have indicators, then she must prepare a letter with explanations and submit it to Rosstat.

Submission of reports to statistics in 2018 is also provided for organizations classified as small businesses and subject to preferential tax treatment. For these entities, the list of forms that need to be sent to statistics has been significantly reduced.

Attention! To find out which reports need to be sent to the statistical authorities, you need to go to the website of this authority (http://statreg.gks.ru/), enter your TIN, or OGRN, or.

After this, the “Reporting to statistics by TIN” service will display a list of forms required for submission, as well as the deadlines by which subjects must send them to the statistical authorities.

Also, organizations should not forget that they must all submit financial statements to Rosstat at the end of the year. It is submitted to statistics after it is accepted by the tax authorities, that is, with a mark of acceptance by them.

Attention! Also, statistics periodically conducts sample studies, as a result of which subjects included in the sample must submit the prescribed forms. Rosstat officially notifies the business entity about this.

Reporting to statistics in 2018, list of forms and deadlines for submission

| Form name | Who serves? | Submission deadline |

| Monthly | ||

| Information about fuel reserves ( 4-stocks) 0607019 | OOO | Until the 2nd day of the month after the reporting month. Not issued on April 1st, May 1st and June 1st |

| Information about the production of products by an individual entrepreneur ( 1-IP (month)) 0610001 | IP | |

| Information on the production and shipment of goods and services ( P-1) 0610013 | OOO | On the 4th working day after the reporting month |

| Information on the production of military (defense) products ( Appendix 2 to form No. P-1) 0610054 | OOO | On the 4th working day after the reporting month |

| P (services)) 0609707 | OOO | On the 4th working day after the reporting month - if the average number of employees is more than 15 people |

| 1-manufacturer prices) 0616007 | LLC, individual entrepreneur | On the 22nd day of the reporting month |

| Information about the production of products by a small enterprise ( PM-prom) 0610010 | LLC, individual entrepreneur | On the 4th working day after the reporting month |

| Information on average prices for purchased industrial organizations grain for main production ( 2-purchase prices (grain)) 0616021 | OOO | Until the 15th day of the month after the reporting month. |

| Purchase price information individual species goods ( 2-purchase prices) 0616008 | OOO | Until the 18th day of the month after the reporting month. |

| Information on manufacturer prices for mineral fertilizers (1-producer prices (fertilizers)) 0616022 | OOO | On the 22nd day of the reporting month |

| Survey business activity organizations of mining, manufacturing, production and distribution of electricity, gas and water ( 1-DAP) 0610019 | OOO | Until the 10th day of the reporting month |

| Information on the production and supply of military (defense) products ( 1-PO) 0610053 | OOO | Until the 5th day of the month after the reporting month. |

| Information on residues of explosive materials for industrial use ( 1-VM (urgent)) 0607033 | OOO | |

| Information on the production, shipment and balances of explosive materials for industrial use ( 1-PS (urgent)) 0610033 | OOO | On the 5th day after the reporting month |

| Quarterly | ||

| P-5 (m)) 0610016 | OOO | Until the 30th day of the month after the reporting quarter |

| Information on the costs of production and sale of products (goods, works, services) ( 5-Z) 0608014 | OOO | Until the 30th day of the month after the reporting quarter. It is necessary to fill out the form 3 months, half a year, nine months in advance |

| Information on the main performance indicators of a small enterprise ( PM) 0601013 | OOO | Until the 29th day of the month after the reporting quarter |

| Information on book publishing activities ( 1-I) 0609503 | OOO | Until the 5th day of the month after the quarterly report |

| Information about the activities of the insurer ( 1-SK) 0608012 | OOO | After 35 days after the reporting quarter |

| Questionnaire for surveying the transportation activities of entrepreneurs - owners of trucks ( No. 1-IP (truck)) 0615069 | IP | The specific deadline is determined by Rosstat. |

| Volume information paid services population by type ( P (services)) 0609707 | OOO | On the 15th working day after the reporting quarter - if the average number of employees is less than 15 people |

| Survey of business activity in the services sector ( 1-YES (services)) 0609708 | OOO | On the 15th day of the second month of the reporting quarter |

| Survey of business activity of small enterprises in mining, manufacturing, production and distribution of electricity, gas and water ( DAP-PM) 0610017 | OOO | Until the 10th day of the final month in the reporting quarter |

| Information about production, shipment and prices for medicines (2-LEK (industrial)) 0610032 | OOO | |

| Release and shipping information medical products(medical equipment and products medical purposes) (1-medical products) 0610082 | LLC, individual entrepreneur | On the 20th day after the quarterly report |

| Information on the production and shipment of folk arts and crafts products by a small enterprise ( P-NHP-M) 0610099 | OOO | Until the 15th day after the quarterly report |

| Information on the shipment of goods, works and services related to nanotechnology ( 1-NANO) 0610012 | OOO | |

| Information about the production of missile and space technology (1-RKT) 0610100 | OOO | Until the 30th day after the quarterly report |

| 1-P (fish)) 0610075 | LLC, individual entrepreneur | Until the 30th day after the quarterly report |

| Semi-annual | ||

| Information on the activities of publishing periodicals mass media (1-I (media)) 0609516 | OOO | Until January 15 and July 15 for the past six months |

| Annual | ||

| Basic information about the activities of the organization ( 1-enterprise) 0601009 | OOO | |

| Information on the main performance indicators of a micro-enterprise ( MP (micro)) 0601016 | OOO | Until February 5 after the end of the reporting year |

| MP(micro)-nature) 0601024 | OOO | |

| Usage Information intellectual property (4-HT (list)) 0604013 | OOO | Until January 25 after the end of the reporting year |

| Information on the use of fuel and energy resources ( 4-TER) 0610068 | OOO | Until February 16 after the end of the reporting year |

| Information about the use of information and communication technologies and production computer technology, software and provision of services in these areas ( 3-inform) 0604018 | OOO | Until March 25 after the end of the reporting year |

| Information about socially oriented activities non-profit organization (1-SONKO) 0608028 | OOO | Until April 1 after the end of the reporting year |

| Activity information self-regulatory organization auditors ( 3-audit) 0609712 | OOO | Until April 1 after the end of the reporting year |

| Information on the volume of paid services provided to the population by an individual entrepreneur ( No. 1-IP (services)) 0609709 | IP | |

| Information about the activities of an individual entrepreneur ( 1-IP) 060101 | IP | Until March 2 after the end of the reporting year |

| Information about the production of products by a micro-enterprise ( MP (micro)-nature) 0601024 | IP | Until January 25 after the end of the reporting year |

| Information about technological innovations of a small enterprise ( 2-MP innovation) 0601011 | OOO | Until April 9 after the end of the reporting year - once every two years |

| Information on the volume of paid services to the population ( 1-services) 0609703 | OOO | |

| Information on manufacturer prices industrial goods(services) ( 1-manufacturer prices) 0616007 | LLC, individual entrepreneur | Until March 11 after the end of the reporting year |

| Information on production, shipment of products and balance of production capacity ( 1-nature-BM) 0610035 | OOO | |

| Information on the production and shipment of composite materials ( appendix to form No. 1-natura-BM) 0610034 | OOO | Until February 10 after the end of the reporting year |

| Information on the production of DOC and PSF chemicals subject to declaration and control under the Convention ( 1-XO) 0610086 | OOO | Until January 27 after the end of the reporting year |

| Information on the production and consumption of chemicals of lists 2 and 3, subject to declaration and control under the convention ( 2-XO) 0610087 | OOO | Until January 25 after the end of the reporting year |

| Information about audit activities (2-audit) 0609711 | LLC, individual entrepreneur | Until March 1 after the end of the reporting year |

| Information about stationary organizations social services for elderly citizens and disabled people (adults and children) ( 3-social security (consolidated)) 0609318 | LLC, individual entrepreneur | Until February 10 after the end of the reporting year |

| Information on the cost and profitability of military (defense) products ( 1-SR) 0610052 | OOO | Until April 1 after the end of the reporting year |

| Information on fish catch, extraction of other aquatic biological resources and withdrawal of objects of commercial aquaculture (commercial fish farming) ( 1-P (fish)) 0610075 | LLC, individual entrepreneur | Until February 15 after the end of the reporting year |

| Information on the current market value of mineral reserves ( 1-RSPI) 0609062 | LLC, individual entrepreneur | Until April 1 after the end of the reporting year |

There is also a separate liability for failure to submit or violation of the deadline. financial statements to Rosstat:

- a legal entity faces a fine of 3000.00 - 5000.00 rubles.

- The director will pay 300.00 -500.00 rubles for this violation.

- entrepreneurs can be held liable 100.00 – 300.00 rub.

What type of reporting is submitted to Rosstat?

Submission of reports to Rosstat is regulated by two laws:

- “On Accounting” dated December 6, 2011 No. 402-FZ (Article 18), which prescribes submitting to statistical authorities a copy of the accounting reports generated by persons obligated to submit them to the tax authority (i.e., legal entities). This obligation does not apply only to public sector organizations and the Bank of Russia. All forms included in the reporting must be submitted (and their lines must be coded), as well as auditor's report(if the statements are subject to mandatory audit).

- “On official statistical accounting...” dated November 29, 2007 No. 282-FZ, regulating the organization of statistical accounting in the Russian Federation and, in particular, the collection of statistical data. The sources of statistical information are (Article 8) legal entities, government agencies, individual entrepreneurs, foreign companies working in the Russian Federation, individuals (including foreigners and stateless persons). Moreover, only the last group (individuals) provides statistical data to the statistics body voluntarily. The rest are required to do this using special forms of statistical observation (statistical reports). However, for small and medium-sized businesses (clause 4 of Article 8), there is a simplified procedure for providing such reporting, provided for by the Law “On the Development of Small and Medium-Sized Businesses...” dated July 24, 2007 No. 209-FZ.

Consequences of failure to submit a statistical report

A small enterprise can be exempted from the obligation to submit statistical reports only if it lacks data to fill out the form. But even in this case, it is better to notify the statistics agency about the reason for not submitting the report (Rosstat letter dated January 22, 2018 No. 04-4-04-4/6-SMI), since the fines for failure to provide information to Rosstat are significant (Article 13.19 of the Code of Administrative Offenses of the Russian Federation) :

- for a primary violation:

- from 10 thousand to 20 thousand rubles. for officials;

- from 20 thousand to 70 thousand rubles. for legal entities;

- in case of repeated offense:

- from 30 thousand to 50 thousand rubles. for officials;

- from 100 thousand to 150 thousand rubles. for legal entities.

Failure to provide accounting records to the statistics body is also fraught with fines (Article 19.7 of the Code of Administrative Offenses of the Russian Federation):

- from 300 to 500 rub. for officials;

- from 3 thousand to 5 thousand rubles. for legal entities.

If you do not receive information from Rosstat about statistical reports mandatory for the subject of observation, it makes sense to independently check the fact of inclusion or non-inclusion in the sample. This can be done in two ways:

- by contacting the territorial statistics office directly;

- requesting information on Rosstat website in the section “List of reporting business entities”.

The list available on the website is constantly updated, and situations are not excluded when it may not contain reports that are mandatory for submission and, on the contrary, those that do not need to be submitted will be included. Rosstat must notify the reporting entity in writing of both additions to the list and exclusion of reports from it so that the latter does not have to pay fines (Rosstat letter dated July 26, 2016 No. 04-04-4/92-SMI).

If data about the list is taken only from the site, it is recommended to save a screenshot of this list. It can serve as an excuse in case of failure to submit a mandatory report that is not reflected in the register (Rosstat letter dated February 17, 2017 No. 04-04-4/29-SMI). And if Rosstat, upon request, issued a list of reports that differs from that posted on the website, then you need to follow the list received from territorial body statistics in response to a request (Rosstat letter dated January 22, 2018 No. 04-4-04-4/6-SMI).

The register generated on the Rosstat website allows you to download from it the forms required for the report.

Small enterprises, like all other business entities, are subject to the obligation to submit reports to Rosstat. However, they have a simplified procedure for providing such reporting, which involves two types of observations: continuous, carried out once every 5 years, and selective, carried out in relation to not every small business representative. Due to the simplified procedure, the obligation to submit statistical reports does not always arise for small enterprises.