Accounting and taxes Fixed assets growth rate

- reflects the relative increase in fixed assets due to their renewal.

Fixed assets growth rate formula

Fixed assets growth rate = (Cost of newly introduced fixed assets - cost of retired fixed assets) / Cost of fixed assets at the end of a given period

Synonyms

Fixed assets growth rate

Was the page helpful?

- More found about the growth rate of fixed assets

- Methodology for analyzing certain types of non-current assets according to Form No. 5 “Appendix to the Balance Sheet” of the accounting (financial) statements Balance of fixed assets at the beginning of the period Growth rate of fixed assets Increase in receipts - disposal of fixed assets Balance of fixed assets at the beginning

- Analysis of long-term financial decisions of the corporation based on consolidated statements Growth rate of non-current assets % - 7.58 Fixed assets commissioning ratio % 14.04 22.86 Growth ratio

- Problems of analysis of fixed assets of an enterprise Table 4 - Calculation of renewal rates for the disposal of the increase in fixed assets of OJSC APZ for the period 2012-2013 Indicator 2012

- Features of the analysis of the organization's fixed assets Table 2. Indicators of the state of fixed assets of LLC XXX Indicators 12/31/14 12/31/15 Absolute growth p p Growth rate % Coefficient

- Methodological approaches to conducting an analysis of funds based on the financial statements of an insurance company. Identification of key sources of income and main areas of expenditure. Money II Interrelation between net profit and cash growth Carrying out... Interrelation between net profit and cash growth Analysis of the reasons leading to the emergence of a deficit of excess cash in the organization III... Calculation, interpretation and analysis of the dynamics of the cash efficiency ratio Calculation, interpretation and analysis of dynamics positive cash flow profitability ratio

- Property status To assess the property status of an enterprise, indicators are used: the amount of economic assets at the disposal of the enterprise, the share of the active part of fixed assets, the depreciation rate, the renewal rate, the retirement rate, the growth rate of real assets, the share of current assets

- Analysis of cash flows as a tool for assessing the availability of funds at an enterprise using the example of OAO Nizhnekamskneftekhim Dsexp - expenditure of funds - Net cash flow adequacy ratio Kdchd To dchd NDP Dkz where NPV -

- Features of the analysis of fixed assets and financial investments based on new reporting forms (explanations for the balance sheet and profit and loss statement) If fixed assets predominate in investment assets and their growth, then the direction of the investment strategy is real investments for the development of one’s own production base If.. Indicators of the state of fixed assets, especially the input coefficient characterizing investment activity, largely determine the future state of the company’s production potential and its competitiveness.

- Assessing the impact of the tax system on the efficiency of industrial innovation Here 1.123 is the sales growth rate. Similarly, labor costs and insurance payments are calculated. Net positive... Negative cash flow is the increase in working capital and investment in fixed assets. The discount rate for the project is 15% per

- Analysis of the movement of fixed assets using the example of OJSC Generating Company OJSC Generating Company for the period 2012-2014, the main coefficients characterizing the movement of fixed assets presented in Table 1 were calculated. 1 Table 1 Name of indicator Calculation formula Period 2012

- Depreciation charges and their role in the formation of the investment potential of an enterprise In case of loss-making production, it is possible to use reducing factors to the current depreciation rates. The use of accelerated depreciation of fixed assets in depreciation policy enterprises will allow

- Methodology for analyzing the property status of a commercial organization based on balance sheet data Since almost all financial ratios characterizing the property position are industry specific, they do not have universal recommended values Output... Growth rate % Growth rate % Amount thousand rubles Share % Amount thousand rubles Share % Amount... Intangible assets 2 Fixed assets 3. Construction in progress 4 Long-term investments in tangible assets and 5. Long-term financial

- Methodology for analyzing the consolidation of a cash flow statement Annual growth rate % Share of factors in the change cash flows% Previous year Reporting year Previous year... Assessing the structure of inflows and receipts, it can be noted that the main source of income in the absence of information on cash receipts from operating activities is the attraction... For further calculations, namely the calculation of coefficients based on the cash flow statement necessary Additional Information table 9 Table 9.

- Problematic aspects of managing the company's own capital At the same time, the company's own capital has inherent disadvantages: limited volume of attraction and, consequently, opportunities for significant expansion of operating and investment activities enterprises during periods of favorable market conditions at certain stages of its life cycle high cost in comparison with alternative borrowed sources of capital formation unused opportunity to increase the profitability ratio equity by attracting borrowed funds financial resources since without such involvement it is impossible to ensure that the coefficient is exceeded financial profitability activity of the enterprise over... An enterprise using only its own capital has the highest financial stability its autonomy coefficient is equal to one but limits the pace of its development because it cannot ensure the formation... An enterprise using only its own capital has the highest financial stability; its autonomy coefficient is equal to one but limits the pace of its development because it cannot ensure the formation of the necessary additional volume of assets during periods favorable market conditions and does not use financial opportunities to increase profit on invested capital. Operating enterprises must have a sufficient amount of equity capital that will provide... It is assumed that it should be sufficient to form not only fixed capital but also its own working capital. Thus, protective and regulatory functions will be ensured capital

- Comprehensive analysis of the efficiency of using intangible assets TPR - the growth rate of the share of a specific type of intangible assets The share of the active part of intangible assets 10 NMAach HMAtotal... The ratio of intangible assets and fixed assets 14 NMA OS where the intangible asset value from the non-current assets section of reporting... Algorithm calculation Depreciation coefficient 7, 13 or utilization coefficient of intangible assets 10 An to NMAn to where

- Determination of the optimal capital structure: from compromise theories to the APV model NWC - investments in the increase in net working capital Ca - investments in fixed assets and intangible assets For calculation

- On the issue of managing the own and attracted financial resources of organizations An organization using only its own capital has the highest financial strength; its autonomy coefficient is equal to one but limits the pace of its development since it cannot ensure the formation... Using borrowed capital, an organization has a higher financial potential for its development due to formation of an additional volume of assets and opportunities to increase the financial profitability of activities through the use of the effect financial leverage However, the activity is such... However, the activity of such an organization in to a greater extent generates financial risk and the threat of bankruptcy, which increase as the share of borrowed capital in the total amount of capital used increases. The main source of financing investments in fixed capital Russian organizations in 2013 the funds raised were

- Methodology for analyzing form No. 3 “Report on changes in capital” of accounting (financial) statements Result from the revaluation of fixed assets 1.4.3. Net profit 1.4.4. Reorganizations legal entity 2. Retirement of equity capital consists of... Based on the results of analytical calculations, a conclusion is drawn about the main factors that determined the receipt and disposal of equity capital commercial organization and their influence on the change... Next, coefficients characterizing the movement of receipt, disposal, increase in equity capital of a commercial organization as a whole are calculated and analyzed, as well as the determining factors

- Methodology for assessing the business activity of an agro-industrial complex enterprise based on cash flow indicators. An assessment of financial activity can be carried out based on a comparison of interest receivable and interest payable, as well as growth authorized capital to its value at the end of the reporting period. Investment activity can be determined by... Investment activity can be determined on the basis of the fixed asset renewal ratio, i.e. the more fixed assets the organization receives, the greater

In the process of analyzing the organization's fixed assets, among other coefficients, movement indicators are calculated. One of these indicators is the growth rate of fixed assets. We will tell you how to calculate it in our consultation.

How to calculate the increase in fixed assets of an organization

To determine the increase in fixed assets for the reporting period, information is needed on the cost of fixed assets (fixed assets) of the organization at the end of the reporting period, fixed assets put into operation, as well as fixed assets disposed of during the same period. The increase in fixed assets for the reporting period is the difference between fixed assets put into operation and retired objects. Using these data, the growth rate of fixed assets (K PR) is calculated as follows:

K PR = OS PR / OS K,where OS PR is the amount of increase in fixed assets during the reporting period;

OS K - the cost of the organization's fixed assets at the end of the reporting period.

This coefficient characterizes the relative increase in the value of fixed assets due to their renewal. Naturally, the increase implies an excess of the value of newly introduced fixed assets over retired ones. If the difference between the received and retired fixed assets is negative, the coefficient will characterize not the increase, but the outflow of fixed assets from the organization.

There is no standard for this coefficient. This means that the organization studies this indicator in dynamics, as well as in relation to other ratios characterizing the movement of fixed assets.

Other indicators of the movement of fixed assets of the organization

Other coefficients of movement of fixed assets of the organization include the following:

- fixed assets receipt ratio;

- fixed asset retirement ratio;

- coefficient of renewal of fixed assets.

The fixed assets receipt ratio (FRP) is calculated for all fixed assets received during the reporting period, regardless of whether they were put into operation during this reporting period or not. For this, the following formula is used:

K P = OS P / OS K,where OS P is the cost of fixed assets received by the organization during the reporting period.

In contrast to the receipt ratio, the retirement ratio of fixed assets is calculated. It is found as the quotient of dividing the cost of retired fixed assets for the reporting period by the cost of fixed assets at the beginning of the reporting period:

K V = OS V / OS N,where OS B is the cost of fixed assets that left the organization during the reporting period;

OS N - the cost of the organization's fixed assets at the beginning of the reporting period.

Another coefficient characterizing the movement of an organization's fixed assets is the renewal coefficient (K O). It shows for the reporting period the share of fixed assets put into operation in the total value of fixed assets at the end of the reporting period:

K O = OS BB / OS K,where fixed assets - the cost of fixed assets put into operation during the reporting period.

Along with analyzing the movement of fixed assets in organizations, indicators of the presence and condition of fixed assets are usually examined (for example, fixed assets are calculated), (in particular, capital productivity) and other ratios.

fixed assets growth rate

where Fk is the cost of fixed assets at the end of the year, thousand rubles.

Fn - cost of fixed assets at the beginning of the year, thousand rubles.

The desired value of this coefficient is above one. In this case, there is an increase in OS, otherwise there is a decrease;

renewal rate

where Fpost is the cost of fixed assets received during the period, thousand rubles.

This ratio characterizes the share of new fixed assets in their total balance at the end of the period. The growth of the indicator is a positive trend;

fixed assets renewal period

Characterizes the average asset renewal period in years. The decline in this indicator is assessed positively;

retirement rate

where Fvyb is the cost of fixed assets retired during the period, thousand rubles.

This ratio characterizes the share of retired fixed assets relative to their total balance at the beginning of the period. The increase in this indicator can be interpreted in two ways. On the one hand, this is a negative trend, indicating a reduction in production potential, on the other hand, in conditions of technical re-equipment this is a normal phenomenon;

wear factor\

where A is accumulated depreciation on fixed assets, thousand rubles,

Ffirst - initial cost of fixed assets, thousand rubles.

This ratio shows what part of the fixed assets is completely worn out, i.e. transferred its cost to the products. The maximum value of the coefficient is 1. The growth of the indicator is a negative trend;

fitness factor

where Fost is the residual value of fixed assets, thousand rubles.

![]()

Table 5 Data on the movement and technical condition of fixed assets

|

Index |

Indicator level |

||

|

Change |

|||

|

Renewal factor |

88688/645098=0,14 |

19940/659147=0,03 | |

|

Renewal period, years |

559834/88688=6,31 |

645098/19940=32,35 | |

|

Attrition rate |

3324/559834=0,01 |

5890/645098=0,01 | |

|

Wear rate |

166865/645098=0,26 |

201189/659147=0,31 | |

|

Usability factor | |||

The information in Table 5 shows that during the reporting year, the technical condition of fixed assets at the enterprise deteriorated somewhat due to a decrease in the renewal of fixed assets.

Efficiency of using basic production assets characterized by a system of general and specific indicators.

General indicators reflect the level of use of the entire set of fixed production assets of the organization and its production divisions.

Particular indicators evaluate the application individual species fixed assets or characterize any aspect of their functioning in the production process.

Equity return

where P is the organization’s profit, thousand rubles;

ROF shows how much profit is received per 1 ruble. OS. An increase in the ROF indicator indicates an increase in the efficiency of use of the analyzed assets;

Capital productivity

where N is sales revenue, thousand rubles;

F - average annual cost of fixed assets, thousand rubles.

Capital productivity shows how many products are received per 1 ruble. fixed assets. The growth of the indicator is a positive trend;

Advice from an Expert - Business Consultant

Photos on the topic

In order to calculate the growth rate for any financial indicator, it is enough to know its numerical expression at different times and be able to apply a simple formula. Just follow these simple ones step by step tips, and you will be on the right track in your business.

Brief Step-by-Step Business Guide

So, let's get down to action, setting ourselves up for a positive result.Step - 1

Select the financial indicator whose growth rate you need to calculate. Remember that the growth rate shows in which direction the indicator has changed over time, so you need to know two values, for example, the size of gross revenue in 2010 and 2011. Having done this, move on to the next steps.

Step - 2

Calculate the growth rate. To do this, divide the indicator for the new period by the indicator for the previous period. Subtract 1 from the resulting value and multiply by 100%. For gross revenue, the formula is: (Gross Revenue 2011/Gross Revenue 2010-1)*100%. Having done this, move on to the next steps.

Step - 3

Do not confuse the growth rate with the growth rate, the latter is calculated using the formula: (Gross revenue 2011/Gross revenue 2010)*100%. The growth coefficient always has a positive sign, even if, for example, gross revenue (or any other financial indicator) fell from 100 conventional rubles in 2010 to 50 in 2011. The calculated growth coefficient is 50%, and growth -50% . Having done this, move on to the next steps.

Step - 4

Test yourself. Before calculating the growth rate, compare the financial indicators of the two periods. If the data of an earlier period is greater than that of a later period, it means that there has been a real reduction in the value under study, and the growth coefficient will be negative. On the contrary, if the indicator has increased over time, then the growth coefficient will have a positive sign. Having done this, move on to the next steps.

Step - 5

Please note that you can use the growth rate not only in cases where there are two consecutive values of the same financial indicator. The calculation of growth and gain coefficients is also carried out to compare data from a specific period of one year, for example, a month or quarter, with data from the same period of the previous year. That is, you can see whether the gross revenue of October 2011 increased compared to the gross revenue of October 2010.

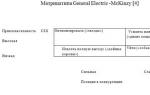

|

Coefficient |

Formulas for calculation |

Legend |

|

Renewal of fixed assets, To update |

K obn = C in / C k |

Св - the initial cost of newly introduced fixed assets for the analyzed period C to - cost of fixed assets at the end of the same period |

|

Disposal of fixed assets To select |

To select = From select / From start |

From selected - the cost of retired fixed assets for the analyzed period From beginning - the cost of fixed assets at the beginning of the analyzed year |

|

Increase in fixed assets K pr |

To pr = (C in -C select)/C to | |

|

Depreciation of fixed assets To wear |

K purl = C purl / C p |

From wear and tear - the cost of depreciation of all fixed assets or individual types C p - the initial cost of all fixed assets or individual types |

|

Validity of fixed assets K g |

K g = (C p -C purl)/C p |

See above for symbols |

The ratio can also be calculated by subtracting the wear percentage from 100%. Analysis of the technical condition of fixed assets is carried out by comparing the coefficients with each other. For example, when comparing the renewal ratio with the retirement ratio of fixed assets, if the ratio of the coefficients is less than one, then fixed assets are used primarily to replace obsolete ones; if the ratio is greater than one, new fixed assets are directed to replenish existing ones.

Analysis of technical and economic indicators of the use of fixed assets includes: analysis of indicators of equipment use by quantity; shift ratio analysis; general analysis of capital productivity; factor analysis capital productivity; analysis of the efficiency of development of fixed assets. The main cost indicator characterizing the level of use of fixed assets is the capital productivity indicator (F), that is, the output of finished products per ruble of fixed assets. Capital productivity is defined as the ratio of the volume of production (OP) in monetary terms to average annual cost fixed assets (C sg): F=OP/C sg. As indicators of production volume, you can use gross, commodity and sold products

at negotiated prices. The change in capital productivity (F change) for an enterprise for a certain reporting period compared to the base period is determined by the following formula: F change = OP from /S - OP b /S.

The volume of production at the enterprise depends on changes in:

1. average annual cost of fixed assets;

2. level of capital productivity.

Since the calculation of the capital productivity indicator for all fixed assets does not take into account the impact of changes in their type structure, the capital productivity indicator is also calculated in relation to the active part of fixed assets (F act) using the formula: F act = OP/ C, where C is the average annual cost of the active part fixed assets. It is also recommended to calculate the capital productivity indicator as the ratio of profit (P) to the average annual cost of fixed assets: F = P/C sg

The level of capital productivity is influenced by various factors, including: specific gravity active part of fixed assets; level of production cooperation; level of production specialization; product price level; equipment use in terms of time and power. The influence of individual factors on capital productivity is determined similarly to the calculation of changes in capital productivity due to the shift coefficient, where instead of the shift coefficient, the calculation is carried out according to the corresponding factor for the base and reporting period. The level of provision of workers with fixed assets is determined by the capital-labor ratio (FL). It shows what the cost of fixed assets falls on each employee, and is calculated by the formula: FV = C sg / H pp, where H pp is the number of industrial production personnel at the enterprise. Obviously, if the capital-labor ratio grows at a higher rate than labor productivity, then this leads to a decrease in capital productivity and causes the need for additional capital investments. In practice, when planning the need for fixed assets, the capital intensity indicator (CI) is used, which is calculated using the formula: FC = C sg /OP. This indicator characterizes the required amount of fixed assets to obtain 1 ruble of products. A general indicator of the efficiency of use of fixed assets is the percentage ratio of the increase in labor productivity (PT change) to the increase in the capital-labor ratio (FW change) of one worker: E = PT change / FW change. This ratio shows how many percent of the increase in labor productivity accounts for 1% increase in the capital-labor ratio. This indicator can be used both for a separate division and for the company as a whole to analyze the use of fixed assets. The use of fixed assets can be considered effective if 1% increase in the capital-labor ratio accounts for at least 1% increase in labor productivity.

Two groups of measures can be recommended to increase the level of use of fixed assets. The first group is recommendations, the implementation of which does not require significant capital investments, and their implementation can be carried out in a relatively short period of time. This group may include recommendations for: reducing the amount of idle equipment; reduction of intra-shift and whole-day equipment downtime for various reasons; increasing the equipment shift ratio; establishing the rhythm of production; increasing the level of cooperation and specialization of production; improving the work of auxiliary and maintenance services and workshops of the enterprise; improving logistics and operational production planning; studying market needs, possibilities for rapid production changeover; improving material incentives for workers and other measures.

The second group is recommendations, the implementation of which depends not only on the enterprise, but on many external circumstances, requiring certain capital investments and a longer time for their implementation. This group may include recommendations for: improving technological processes; increasing the level of computerization and automation of main and auxiliary production processes; increasing the level of technical condition and maintenance of fixed assets; technical re-equipment of individual workshops and sections of the enterprise.