In this case, the price of one contract should not exceed 100,000 rubles. Such restrictions do not apply when purchasing goods and services necessary for the needs rural settlements. In this case, SGOS can be determined using the following formula: To understand the principle of calculation, let's look at an example. Government organization has a SGOZ in the amount of 3 million rubles. To purchase from sole supplier no more than 5% can be used. In our example, 5% is 150 thousand rubles. This amount is not enough to cover needs. Therefore, in this case, it is more profitable for the customer to use the limit of 2 million rubles. Then the organization will have the opportunity to purchase up to 100 thousand rubles directly. The organization can spend the remainder of the initial amount (3 million) for procurement in other ways.

The procedure for calculating the total annual volume of purchases

The concept of SGOZ is present only in Law No. 44-FZ, and sports organizations need to know what it is and how to calculate it, because a lot depends on it. According to paragraph 16 of Art. 3 of Law N 44-FZ SGOZ is the total volume approved for the corresponding financial year financial security for the customer to carry out procurement in accordance with the said Law, including for payment of contracts concluded before the beginning of this financial year and payable in the specified financial year. Note: this definition was introduced into Law No. 44-FZ Federal law dated 06/04/2014 N 140-FZ<1 ввиду того, что существовали споры по поводу включения сумм длительных контрактов, заключенных в предыдущем году и продолжающих исполняться в текущем.

Total annual purchase volume

Law No. 44-FZ). FYI. Currently, the form and procedure for posting a report on the volume of purchases from small businesses and socially oriented non-profit organizations have not been approved. * * * To summarize, we once again emphasize that the State Public Health Insurance Fund is quite important, so it is necessary to take its calculation with full responsibility in order to avoid errors when determining the amount of funds that a sports institution can spend on purchasing from a single supplier, small businesses and socially oriented non-profits organizations, as well as procurement through a request for quotation.

How to correctly calculate the state tax according to 44-FZ

If this amount is less, the customer only needs to appoint a specialist who will purchase goods and services. This rule is spelled out in the second part of Article 38 of 44-FZ.

Forum of the Institute of Public Procurement (Moscow)

The concept of total annual procurement volume (AGP) is established by Article 3 of 44-FZ. The calculation of this indicator helps to evaluate the organization’s activities and report to regulatory authorities.

Important

Therefore, each customer needs to remember the features of this indicator. SGOZ - what is it? The total annual volume of purchases refers to the total amount of financial resources that are allocated to an institution for the purchase of necessary goods and services.

It is determined for the financial year. These funds are intended to pay for contacts that are concluded before the start of the reporting period and are due for payment in the financial year under review. The amount of funds allocated must be approved in the estimate or plan of economic and financial activities.

The calculation of this indicator is carried out by summing certain lines of the estimate or plan.

How to calculate the state tax according to 44-FZ?

SGOZ). This is not accidental, because decisions on creating a contract service, determining the amount of money that an institution can spend on purchasing from a single supplier or conducting a request for quotation depend on its size. Today we will talk about what SGOZ is and how to correctly define it for various needs.

What is SGOZ and why is it needed? As you and I know, the purchase of goods, work, services to meet state or municipal needs (hereinafter referred to as procurement) is carried out by sports organizations on the basis of Federal Laws of July 18, 2011 N 223-FZ “On the procurement of goods, works, services by certain types of legal entities "and dated 04/05/2013 N 44-FZ "On the contract system in the field of procurement of goods, works, services to meet state and municipal needs" (hereinafter referred to as Law N 44-FZ).

Cumulative annual procurement volume (AGP)

N 44-FZ).At the end of the year, the customer is obliged to draw up a report on the volume of purchases from small businesses, socially oriented non-profit organizations and place it in a unified information system before April 1 of the year following the reporting year. In this report, the customer includes information: - on concluded contracts with small businesses, socially oriented non-profit organizations; - on the failed identification of suppliers (contractors, performers) with the participation of small businesses, socially oriented non-profit organizations; - on contracts with small businesses, socially oriented non-profit organizations concluded with subcontractors or co-executors, if the customer in the notice established a requirement to involve subcontractors from among such organizations in the execution of the contract (Part.

According to this form, the schedule reflects only purchases for the current financial year, and purchases carried over from the previous year do not need to be reflected in it. Therefore, the SGOZ must be calculated according to the formula: contracts, contracts concluded concluded in contracts concluded in the current financial previous in the current financial year, executed in the SGOZ = financial years, + year, in full + current and subsequent ones in part, executed and years, in part, payable payable payable in the current this period the current year the financial year<2 Федеральный закон от 31.12.2014 N 498-ФЗ «О внесении изменений в Федеральный закон «О контрактной системе в сфере закупок товаров, работ, услуг для обеспечения государственных и муниципальных нужд».

Let's look at this formula using an example. For a sports organization, the SGOZ is equal to 3,000,000 rubles.

Now everything is clear and understandable: if a contract is concluded in the current year and will be executed over several years, the SGOZ will include only that part of the contract amount that, in accordance with the established limits (for budgetary institutions - in accordance with plans for financial and economic activities) will paid this year.<1 «О внесении изменений в Федеральный закон «О контрактной системе в сфере закупок товаров, работ, услуг для обеспечения государственных и муниципальных нужд». Почему важно правильно определить размер СГОЗ? Потому что от него зависят:1) расчет объема закупок у субъектов малого предпринимательства, социально ориентированных некоммерческих организаций.

Let us remind you that according to Art. 30 of Law No. 44-FZ, customers are required to purchase from these organizations in an amount of no less than 15% of SGOZ; 2) the need to create a contract service.

How to calculate the state tax taking into account part 1 1 of article 30 of the federal law

However, for calculating the SSP in order to determine the amount of funds that a sports institution must spend on purchases from small businesses and socially oriented non-profit organizations, this formula is not suitable. Let us recall that, by virtue of Part 1 of Art. 30 of Law N 44-FZ, customers are required to purchase from small businesses, socially oriented non-profit organizations in the amount of not less than 15% of SGOZ by: - holding open tenders, tenders with limited participation, two-stage tenders, electronic auctions, requests for quotations, requests for proposals , in which procurement participants are only small businesses and socially oriented non-profit organizations.

The Ministry of Finance also explained the need to include in the SGOZ funds to pay for the contract when ordering from a single supplier for an amount not exceeding 100,000 rubles (clause 4, part 1, article 93). What information is not included Based on Part 1 of Art. 30 there is a list of government orders that are not included in the calculation of the indicator.

These are government purchases from small businesses and socially oriented non-profit organizations (SMP and SONKO):

- For the defense and security of the country.

- For providing loans.

- In the field of nuclear energy use.

- From a single supplier on the basis of Part 1 of Art. 93 laws.

- With closed methods for determining the supplier.

Goals of the State Public Defense Order Taking into account the total annual volume of procurement, Article 44 of the Federal Law on contract service (Part 1 of Art.

Attention

The development of a methodology for calculating the State Insurance Cost was initiated by legislators in connection with a large number of disputes that swirled around the need to include the cost of long-term contracts issued last year and executed this year. After the introduction of this term, the situation became clearer. If the contract is executed in the current year, and its execution is planned for the next year, then the SGOZ includes only the amount that is paid in the current reporting period.

How to calculate SGOZ according to 44-FZ The definition of SGOZ plays an important role in planning the purchase of goods and services. This indicator is required for the following:

- Deciding on the need to form a contract service.

If it turns out that the SGOZ exceeds one hundred million rubles, then the creation of a contract service is necessary.

Types of procurement.

Methods for determining the need for material resources.

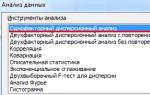

There are two methods for establishing the need for material resources:

1) on a planned basis;

2) based on the consumption of materials from previous periods.

The first method requires the integration of sales planning, production and procurement of material resources. The initial data for determining material needs using this method are: product production plan, design specifications, recipes by which the need for materials per unit of production is calculated, consumption rates of material resources. The need for each material is established by multiplying the planned quantity of production by the material consumption rate.

The second method of determining the need for material resources is associated with taking into account warehouse balances of materials and constant replenishment of stocks by regulating delivery times or batch sizes, as well as taking into account the costs of material resources of previous periods.

After determining the need for each type of material resources, a possible type of purchase is established. The type of purchase is determined by the marketing department. The following types of procurement are known:

Directly from the manufacturer;

Wholesale through an intermediary or exchange;

Small batches in retail stores.

Direct purchases of material resources, as a rule, are carried out with large volumes of consumption.

Through a wholesale company, materials and raw materials are purchased in small quantities or urgent purchases are made to ensure uninterrupted production.

Purchases through exchanges are very common.

and auctions. Through them, industrial enterprises purchase raw materials, the prices of which experience sharp seasonal and market fluctuations. Thus, most agricultural raw materials are purchased by enterprises in the food, leather and textile industries.

For each material, a purchase type is selected. Having determined the type and set specific terms of purchases, you should calculate the volume of purchases for each material.

parties;

q is the size of the purchase lot;

P is the price of a unit of raw materials;

h- costs of storing a unit of raw materials in a warehouse throughout the year

Plan development procurement ends with the preparation of the enterprise supply budget

In the process of logistics planning, cost analysis is carried out in order to reduce costs. To conduct a cost analysis, the supply department of an enterprise must have one or more specialists in cost analysis and market research for raw materials. The main task of these specialists is to reduce the cost of material resources, improve their quality by changing suppliers, replacing materials with alternative ones, and concentrating the volume of purchases. Conducting a cost analysis involves the cooperation of the supply department with other departments of the enterprise.

39. The concept of an enterprise supply budget. (printout)

The development of a procurement plan ends with the preparation of an enterprise supply budget, which includes:

· procurement budget (volume and cost of procurement);

· a total cost budget that includes materials acquisition costs, inventory holding costs, and overhead costs.

In the process of planning the material supply of an enterprise and in order to reduce costs, a cost analysis should be carried out, the results of which are used in coordinating the procurement plan with the production cost estimate.

The procurement plan for material resources is agreed upon as follows. The logistics department of the enterprise transmits to the economic department data on purchase prices for material resources and a plan for the purchase of material resources in natural units of measurement. The economic department determines acceptable prices for the purchase of material resources, taking into account the profitability of production, as well as a plan for the purchase of material resources agreed with the production cost estimate. The production cost estimate determines all the costs of implementing the production program. The material costs in the cost of production include:

· raw materials and basic materials;

· auxiliary materials;

· purchased products and semi-finished products;

· fuel and energy from outside;

· wear and tear of low-value and fast-wearing items;

· other material costs.

The cost of material resources included in the cost of production excludes the cost of used returnable waste, which includes the remains of raw materials, materials formed during the production process and which have lost completely or partially their consumer qualities.

Returnable waste can be assessed:

· or at the full price of the original material resource, if they are sold externally for use as a full-fledged resource;

· or at a reduced price, if they are used for basic production at increased consumption rates or are used for the manufacture of consumer goods or household items.

40. Determination of economically feasible batches of purchases of material resources. (printout)

When determining the most appropriate production program for market conditions, one should take into account customer demand for the company’s products, as well as products available in stock, and take into account sales data in previous periods.

With stable consumption of material resources, it is advisable to use statistical forecasting method. The main thing for this method is to determine the needs of the future period based on indicators of the past. After determining the need for material resources, a procurement plan is developed. This procurement plan is needed for the rational purchase of material resources. Drawing up a procurement plan means determining the volume of purchases for a certain period.

The volume of purchases is determined by the formula:

L = V - He - Mz,

where V is the enterprise’s need for material (raw materials) for a certain period

It is the balance of material in the warehouse at the beginning of the period;

Mz - a batch of materials ordered to the supplier, but not received at the warehouse

Thus, material support is focused on creating inventories, but at the same time the level of industrial inventories in the warehouse of the logistics department is taken into account. Inventory-oriented procurement has positive and negative aspects. TO positive include:

· use of price incentives (price discounts for large buyers);

· certain protection from market conditions.

TO negative include:

· significant working capital is spent;

· increase in interest on loans when inventories increase.

Therefore, the task is to determine the economically feasible level of inventories, since the size of inventories affects the final results of the enterprise. It is beneficial for the logistics department to purchase raw materials and materials in large quantities, since this allows them to receive discounts on the wholesale price. But an increase in the purchase batch leads to an increase in inventories and the need for working capital, and storage costs increase. Therefore, in order to reduce the costs of an enterprise, it is necessary to calculate economically feasible batches for the purchase of material resources from suppliers.

The costs associated with the purchase of material resources of a certain type can be represented by the following formula:

where C is the total annual costs of organizing procurement, delivery

materials and storage of stocks in a warehouse;

A – costs for organizing one order and supplying the purchased

parties;

V is the enterprise’s annual need for a certain type of material;

q is the size of the purchase lot;

P is the price of a unit of raw materials;

h is the cost of storing a unit of raw materials in a warehouse during the year.

The above formula includes three types of costs:

· annual costs for organizing the purchase and supply of material resources. These costs include the costs of organizing and placing orders, determining the need for resources, concluding an agreement with a supplier, organizing acceptance and quality control of incoming materials;

· annual costs for the purchase of materials: C x V;

· costs of storing inventories in a warehouse during the year:

.

.

Thus, the calculation of an economically feasible purchase batch, which can be achieved by minimizing the annual costs of organizing purchases, delivering materials and storing stocks in a warehouse, can be represented by the following formula:

41. Determining the needs of workshops for material resources.

Providing workshops and production sites with material resources is the final stage of logistics. In order to use it effectively, each workshop of the enterprise must receive as many material resources as they need to complete the production task. Therefore, it is advisable to set a limit for the supply of raw materials and supplies to workshops for a certain period.

Setting a limit on materials involves limiting their release into production in accordance with the justified needs of the workshops. Limitation increases the responsibility of workshops for the economical use of materials, streamlining the work of warehouse facilities and increases the ability to control the use of resources in production.

The limit must correspond to the actual needs of workshops for materials and is set based on consumption rates and the size of workshop inventories. Vacation limit material resources for the workshop are calculated using the formula:

Lts = Pts + Z – Of,

where Pc is the workshop’s need for a certain material for manufacturing

necessary products;

Z - stock of material that is constantly in the workshop;

Of – the actual balance of unspent material at the beginning

the period for which the limit is set.

Material stock, which is constantly located in the workshop, is calculated by the formula:

where C is the average daily consumption of material;

t is the time interval between deliveries of raw materials to the workshop.

The limit on the supply of materials to workshops can be calculated for a month or a quarter, which depends mainly on the type of production. The holiday limit for workshops should be set by the logistics department of the enterprise. In addition to the supply of materials to workshops according to the limit, there may be over-limit supply, as well as replacement of some materials with others associated with design changes in manufactured products in the technological process (unlimited supply).

42. Selection of potential suppliers: sources of information, selection procedure, selection criteria, scoring method.

All other things being equal, it is preferable to use the services of local suppliers. The selection of suppliers should begin with an analysis of the material needs of the enterprise and the ability to satisfy them in the market. After studying the market, you need to draw up a specification for the necessary types of material resources. The specification must include the name and characteristics of the materials, requirements for them.

The specification must include all characteristics and standards of the required material. After drawing up the specification

Sources of information for compiling a list of suppliers is a study of the market for raw materials. When there are few suppliers (2 or 3), the criteria for choosing the most suitable one are comparative production capacity, prices for purchased materials, and reliability of suppliers. The supplier that most fully meets the above criteria is selected.

There are certain features when choosing suppliers of raw materials. When the level of competition among suppliers of raw materials is low, the determining factors for choosing suppliers are: the cost of raw materials and the volume of purchases.

With increasing competition, one should take into account the conditions of the raw materials markets (demand, supply, prices), as well as tariffs for the transportation of raw materials, customs and tax legislation that determines the cost of purchasing raw materials outside of Belarus.

When there are many suppliers, it is advisable to make the selection in two stages. At the first stage, a preliminary selection of suppliers is carried out. Supplier selection criteria in the table.

Criteria for pre-selection of suppliers:

1.Production capacity.

2.Remoteness of the supplier

3.Form of calculations.

4.Product quality (according to specification)

5. Unit price

6. Possibility of equipment re-adjustment

7.Supply contents

8.Packaging

9. Batch size

After analyzing suppliers, some of them that do not meet the requirements are excluded from the table.

At the second stage, a more expanded list of supplier selection criteria is taken

What takes into account the concept of the total annual volume of purchases (AGP) according to 44-FZ for calculating the amount of purchases from SMP, SONKO, what is not taken into account, and we also provide step-by-step instructions for calculating the volume of purchases and a calculator.

What is SGOZ according to 44-FZ

The concept of total annual procurement volume (AGP) is given in Article 3 of Law 44-FZ. This is the amount of funds that were allocated to the customer for procurement procedures, as well as for payment of contracts concluded previously. The amount of funds is approved in the estimate or plan of economic and financial activities.

Calculation of this indicator is necessary for reporting and compliance with legal requirements. Be careful: an error in calculations can lead to extremely negative consequences - increased attention from the FAS, unscheduled inspections and fines.

The calculation methodology was developed after an increased number of disputes around the need to include in this volume the cost of long-term contracts that were concluded last year and must be paid in the present.

How to calculate SGOZ according to 44-FZ

Let's consider the basic rules for calculating SGOZ according to 44-FZ. The total volume takes into account:

- the cost of contracts that the parties signed last year, but the customer must transfer payment this year;

- the total price of contracts that the parties signed this year and the obligations under which will be fulfilled this year (short-term contracts);

- the cost of contracts that were signed this year, but will be partially fulfilled in the next period (only the part that will be paid this year is included in the SGOZ).

When calculating, you do not need to take into account the salaries of employees, their travel allowances, funds that go to pay taxes and other mandatory fees, funds for compensation for damage that the customer caused to individuals or contractors in the course of work. As a result, the total annual volume of purchases is formed from the amounts allocated to pay for goods, work and services. The figure is identical to the limits on budget obligations.

What is this for?

Firstly, to make a decision on the creation of a contract service (if the volume is more than 100 million rubles) or the appointment of a contract manager (if the indicator is less than 100 million rubles) - this is stated in Part 2 of Article 38 of the Law on the Contract System.

Secondly, determining the required volume of purchases from small businesses and socially significant non-profit companies. They must account for at least 15% of the SGOZ; if the figure is less, the customer faces a fine.

Thirdly, to calculate the volume of goods and services purchased from the supplier. Small purchases from a food supplier can be carried out in the amount of 5% of the SGOZ, no more than 50 million rubles.

Fourth, to calculate the volume of purchases by requesting quotations. Using this method, you can make purchases in an amount of no more than 10% of the SGOZ for an amount of up to 10 million rubles.

The customer must include the calculated indicator in the schedule. For this purpose, methodological recommendations of the Government of the Russian Federation are used.

According to Law No. 44-FZ, you are required to purchase 15 percent of SGOZ from SMP and SONO. You must post a report on purchases from small businesses by April 1. Now the deadline for the next report is approaching. Check the calculator to see if you have selected the required minimum volume - it will take a few seconds.

Calculation of SGOP for different methods of determining a supplier

Let's look at examples for different cases. Let's take purchases from a food supplier. The first part of Article 93 of the Law on the Contract System establishes the following limits (one of them is optional). The volume of purchases from the supplier should not exceed:

- 2 million rub. per year;

- 5% of the SGOZ and should not exceed 50 million rubles. per year.

Example. Let’s say the state customer’s state contract is 3 million rubles. According to the law, he can make purchases from the food supplier for 150 thousand rubles. (5% of SGOZ). This amount is not enough, so it is more profitable to use the second method of calculating limits - no more than 2 million rubles. per year.

Let us also consider the methodology for calculating the SPP for suppliers related to SMP and SONKO. They need to purchase at least 15% of the annual volume. This can be done in two ways: establish a restriction on the participation in the procedure of only SMP and SONCO, or oblige them to be involved as subcontractors.

The rules here are similar. Let's calculate the volume of purchases from SMP and SONKO using the data from our example. If the SGOZ is 3 million rubles, you need to purchase from small enterprises and socially oriented non-profit organizations in the amount of 450 thousand rubles.

Please note that since 2019, when calculating the total volume of purchases, procedures with the supplier carried out after failed tenders, requests for quotation and requests for proposals in electronic form are taken into account.

To avoid penalties, calculate the SSPP correctly and submit reports on time.

Customer contracts:

1) in 2018 in the amount of 800,000 rubles. Of these, 500,000 rubles. paid in 2018 and 300,000 rubles. moved to 2019;

2) in 2019 in the amount of 900,000 rubles. with full payment in 2019;

3) in 2019 in the amount of 1 million rubles. with partial payment in 2019 (RUB 700,000). And 300,000 rubles. The customer will pay in 2020.

SGDO in 2019 will be 1.9 million rubles: 300,000 rubles. + 900,000 rub. + 700,000 rub.

Determining the volume of purchases means finding optimal order size(ORZ), i.e. the level at which maximum use of warehouse space is achieved, inventory storage costs are minimized, and conditions for repeat orders are optimized. All these factors are closely interconnected. ORZ can be calculated using the formula

ORZ=(2*V*P)/(C*S)

where: V is the annual volume of consumption;

P - cost of one order (administrative costs, labor costs

personnel);

C is the cost of a unit of product from the ordered batch;

S is the cost of storing a unit of product in a warehouse.

Product A: high cost - small storage volume

Product B: average cost - average storage volume

Products C: low cost - large storage volume

Let's say a company uses 1000 units of products per year (V) for 5000 rubles. each (C). Office work, telephone conversations, staff maintenance in terms of one order amount to 20,000 rubles. (P). Storing one unit of product in a warehouse will cost 500 rubles. (5). Then:ORZ=(2*1000*20000)/(5000*500)=16

The optimal order in this case will be 16 units. During the year you will have to make 62.5 such orders (1000/16), that is, every 5-6 days one order of 16 units - this is optimal under these conditions.

Since the company's capital is deadened when stored in a warehouse, it is necessary to keep records of purchases and analyze inventories according to the ABC rule.

Product A the most valuable, which accounts for approximately 75-80% of the total value of inventory in the warehouse, but makes up only 10-20% of the total quantity of products located in it.

Product B average in cost (approximately 10-15% of the cost of inventories), but in quantitative terms it makes up 30-40% of stored products.

Products C the cheapest (approximately 5-10% of the cost of inventory) and the most widespread (40-50% of the total storage volume).

Based on inventory accounting, it is possible to construct an ABC analysis curve (Fig. 7).

|

Share of products in total production cost and storage, % | |||||||||||

|

Product B |

Products C |

||||||||||

|

Product A | |||||||||||

|

Product A: high cost – small storage volume | |||||||||||

|

Product B: average cost – average storage volume | |||||||||||

|

Product C: low cost – high storage capacity | |||||||||||

|

Number of units in stock (% of total storage) |

|||||||||||

Rice. 7. ABC analysis curve

Inventory accounting and the ABC analysis curve allow us to draw important conclusions:

Product A must be under strict control. Regular accounting and, possibly, frequent adjustments in plans for its use are necessary. The products of this group are the main ones in your business.

Product B requires routine monitoring, well-established accounting and continuous attention. Usually these are constantly used auxiliary materials.

Products C requires periodic checking of stock levels. This includes tools, simple equipment, and spare parts.

Knowing all this, you can create the optimal order. However, an order compiled on the basis of ABC analysis will be truly optimal if the demand for your company’s products does not change, prices and trends remain unchanged, and also if production is not affected by seasonality. If consumer demand fluctuates, then a method should be used to smooth out such fluctuations. Smoothing is achieved by comparing actual consumption in the previous period and forecast values calculated for the same period.

A relatively new term in jurisprudence, introduced in 2013 by the federal law on the contract system. The meaning of this term is interpreted at the very end of Article 3, where it is said that the total annual volume of purchases (AGP) is the total volume of financial support focused on the implementation of purchases in the current year, and contracts concluded in the previous year, payment for which is carried out in the current financial year. year.

The term is used quite often in the law on the contract system; let’s study its main features and where it occurs.

How to calculate the total annual volume of purchases?

contracts signed last year for payments incurred this year

+

contracts signed this year and fully payable this year

+

contracts signed this year for this and subsequent years, in terms of financial obligations of the current year.

What is not taken into account when calculating the SGOD?

SGPO consists exclusively of payments that the customer spends on the implementation of procurement procedures for goods, works, and services.

Thus, the SGOZ does not include:

- expenses for wages of employees, travel and other payments provided for by regulations of the Russian Federation;

- payment of taxes, fees and other obligatory payments to the budget system;

- compensation for damage caused by the customer during the implementation of activities is not taken into account when calculating the SSP;

- received from income-generating activities and other funds with which the customer pays for contracts under Law No.

Procurement plan, schedule

The norms of the law and the functionality of the Unified Information System in the field of procurement stipulate that the customer must write down the SGOZ forms, which will later help in the preparation of reports and other calculations required for the work.

Report on small businesses

The legislator has established the customer’s duty to carry out purchases among small businesses in quantities exceeding fifteen percent of the public health reserves. But there are exceptions. When calculating the volume of purchases from small businesses, the SGOZ does not summarize the procedures carried out under Part 1 of Article 93 of 44-FZ to ensure the defense capability and security of the state, services for providing loans, work in the field of nuclear energy and procedures carried out in a closed way .

Thus, the share of purchases from small businesses should exceed fifteen percent of the sum of the initial (maximum) prices of all competitive procedures (with rare exceptions) carried out by the customer.

Contract service

If the customer’s SGOZ exceeds 100 million rubles, he is entitled to create a contract service. This opportunity is not an obligation, therefore the creation of the specified structural unit is only the right of the customer. Therefore, in the case of SGOZ exceeding 100 million rubles, the customer has the right to limit himself to the appointment of a contract manager.

Quote requests

Article 72 of 44-FZ establishes the possibility for the customer to conduct purchases in the form of a request for quotation. At the same time, the amount of the annual volume of purchases in the form of requests for quotation should not exceed ten percent of the SGOZ and amount to more than 100 million rubles.

Purchasing from a single supplier

Everyone’s favorite “direct contracts”, or purchases up to 100 thousand rubles. The legislator prudently provided such an opportunity - to purchase in small volumes without carrying out procedures. But at the same time, he strictly limited it to no more than five percent of SGOZ or no more than 2 million rubles.

Thus, the concept of the total annual volume of purchases does not appear very often in the law on the contract system, but it greatly influences the activities of the customer.