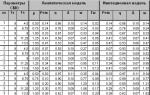

Indicators characterizing the production and economic activities of the enterprise are given in Table 1.

Table 1 - Main technical and operational standards of the enterprise

|

Indicators |

Change over period |

Growth rate, % |

|||

|

Volume of sales of services, rub. |

|||||

|

Cost, rub. |

|||||

|

Profit from sales of services, rub. |

|||||

|

Net profit, rub. |

|||||

|

Number of employees, people |

|||||

|

Output per 1 worker, thousand rubles. |

|||||

|

Average annual cost of fixed assets |

|||||

|

Capital productivity |

Based on the results of the analysis of the main technical and economic indicators, the following conclusions can be drawn.

In 2015, there was an increase in net profit by RUB 298,877 (1,038.3%) compared to 2013. At the same time, the cost level increased by 326,108 thousand rubles. (21.8%).

Also in 2015, there was an increase in the number of employees of the enterprise during the period under review by 1 person due to an increase in the number of workers.

Output per operating enterprise increased by 4,661 rubles. or by 20.4% compared to 2013.

That is, we can conclude that IP “Vasiliev” is a profitable enterprise, its financial condition can be called sustainable.

Product volume is one of the most important indicators characterizing production activities enterprises.

The volume of production is characterized by commercial products, the volume of sales is characterized by sold commercial products. It is taken into account in the wholesale prices adopted in the plan and actually valid in the analyzed period.

Analysis of production volumes begins with an assessment of the dynamics commercial products at comparable prices for 5 years.

Table 2 - Dynamics of commercial products in existing and comparable types

As a basis for comparison, we will take the main type of service - diagnostics and testing, and as a comparable price - the average cost of one technical diagnostic of compressor station piping for the reporting period.

Table 2 shows that during the period under review there has been an annual increase in the volume of commercial products. The only exception is 2012, in which the volume of commercial output decreased slightly compared to the previous year.

The average growth rate (Tr) to the previous year and to the base year is determined by the formula:

Tr1, Tr2, Trn - growth rates for the 1st, 2nd and nth years, units

Trp = 108.3%, Trb = 114.3%.

The dynamics of commercial output by year is characterized by an average annual growth rate of 108.3%, which was achieved as a result of an increase in commercial output in 2013 - 2014 (in 2012 the growth was negative) by 23.4%, 9.3% and 12.7 % respectively, which in absolute terms amounted to 598,700 thousand rubles, 294,735 rubles. and 438,792 rubles.

The dynamics of commercial output compared to the base year 2013 is characterized by an even greater increase in commercial output by 14.3%%, especially in 2015 (37.8%).

Table 3 - Analysis of changes in the volume of use of enterprise revenue

|

Changes, +/- |

Growth rate, % |

|||

|

Cost of sales |

||||

|

Gross profit (loss) |

||||

|

Administrative expenses |

||||

|

Profit (loss) from sales |

||||

|

Interest receivable |

||||

|

Interest payable |

||||

|

Other income |

||||

|

Other expenses |

||||

|

Current income tax |

||||

|

Net profit (loss) |

Directions for using the enterprise's proceeds and their ratio in total volume revenues are presented in table 4.

Table 4. Directions for using the enterprise’s revenue and their ratio in total revenue

|

Name |

||||

|

Cost of sales |

||||

|

Gross profit (loss) |

||||

|

Administrative expenses |

||||

|

Profit (loss) from sales |

||||

|

Income from participation in other organizations |

||||

|

Interest receivable |

||||

|

Interest payable |

||||

|

Other income |

||||

|

Other expenses |

||||

|

Profit (loss) before tax |

||||

|

Current income tax |

||||

|

incl. permanent tax liabilities (assets) |

||||

|

Change in deferred tax liabilities |

||||

|

Change in deferred tax assets |

||||

|

Net profit (loss) |

In the reporting period, relative cost savings were observed, since the growth rate of sales revenue was higher than the growth rate of production costs. Profit before tax increased by RUB 378,073. or by 376.4%. The reason for the increase in profit before tax is a change in the structure: an increase in the share of profit from sales of products and a decrease in the share of losses from other sales. Since profit before tax increased, the level of tax withdrawal increased by 180.1% or by 94,079 rubles. Net profit increased significantly by RUB 298,877. or by 1038.3%.

As can be seen from the presented diagram, in the period from 2013 to 2015. There is a steady increase in profits. This positive point, it shows that the enterprise is developing dynamically, increasing production and sales volumes.

In conclusion of the analysis, I would like to say that in order to increase profits, the company must first reduce costs products sold. Cost and profit are inversely proportional: a decrease in cost leads to a corresponding increase in the amount of profit, and vice versa.

In addition, it is necessary to reduce other expenses to increase the company's balance sheet profit. Most likely, the increase in losses from other sales is associated with losses from the payment of fines arising in connection with some violations. In order to further reduce the amount of fines, it is necessary to establish the reasons for failure to fulfill obligations and take measures to prevent violations.

Profitability analysis begins with studying the dynamics of profitability indicators.

Based on the table and figure, we can conclude that all profitability indicators in IP Vasilyev showed growth during the analyzed period.

The level of profit received per unit of costs for carrying out the operating activities of the enterprise (return on costs) is equal to 15 kopecks in 2013, 19 kopecks in 2014 and 30 kopecks in 2015. That is, the profit from every ruble spent on production and sales of products has increased.

The profitability of an enterprise's operating activities (return on sales) has the same picture. That is, from one ruble of sales, the enterprise receives 11 kopecks in 2013, 16 kopecks of profit in 2014 and 23 kopecks in 2015.

The level of net profit generated by the entire capital of the enterprise in its use (return on capital) has been quite significant in the last two years, that is, the enterprise receives for 1 ruble of all generated capital the enterprise received 7.8 kopecks of profit in 2014 and 16.8 kopecks in 2015.

Profitability level equity, invested in the enterprise is also characterized by a positive value, that is, the enterprise’s profit from 1 ruble of equity capital was 59 kopecks in 2014 and 27 kopecks in 2015.

To assess the solvency of an enterprise in the short term, relative indicators are used that differ in the set of liquid assets considered as covering short-term liabilities.

Let's analyze the company's ability to pay off short-term obligations with its assets by calculating the balance sheet liquidity ratios (Table 8). Let us analyze the coefficients in dynamics and in comparison with the optimal value. Formulas for calculation:

1. The absolute liquidity ratio is calculated as the ratio of the most liquid assets to the total amount of short-term liabilities of the enterprise:

- 2. The intermediate coverage ratio (quick (critical) liquidity) is defined as the ratio of the liquid part current assets to short-term liabilities:

3. The current ratio is calculated as the ratio of the total amount of current assets, including inventories and work in progress, to the total amount of short-term liabilities.

- 4. General indicator of balance sheet liquidity, which is recommended to be used for comprehensive assessment balance sheet liquidity as a whole, shows the ratio of the sum of all liquid funds of the enterprise to the sum of all payment obligations (short-, long- and medium-term), provided that various groups of liquid funds and payment obligations are included in the specified amounts with certain weighting coefficients that take into account their significance with from the point of view of the timing of receipt of funds and repayment of obligations.

The general indicator of balance sheet liquidity - the clarifying coefficient (K ol) is determined by the formula:

Col = (A 1 +0.5A 2 +0.3A 3)/(P 1 +0.5P 2 +0.3P 3) (5)

5. Overall solvency ratio:

6. The liquidity indicator when mobilizing funds (K lm) characterizes the degree of dependence of the enterprise’s solvency on inventories and costs in terms of the need to mobilize funds to pay off its short-term obligations:

K lm = A 3 /(P 1 + P 2) (7)

The recommended values of this indicator are from 0.5 to 1. The need for its calculation is due to the fact that the liquidity of individual components of the working capital of an enterprise, as already noted, is far from the same. If cash can serve as a direct source of payment for current obligations, then inventories and expenses can be used for this purpose only after their sale, which presupposes the presence of not only a buyer, but also the buyer’s funds. This coefficient can have significant fluctuations depending on the material intensity of production and is individual for each enterprise. It is desirable that its dynamics should not have large deviations.

For an in-depth analysis of the liquidity and solvency of an enterprise, it is of interest to analyze the liquidity indicator during the mobilization of funds in dynamics, together with changes in the values of material working capital and short-term liabilities of the enterprise. Such an analysis allows us to identify changes in the economic activity of an enterprise from the point of view of credit policy.

Thus, with a constant credit policy (i.e., with a stable amount of short-term liabilities), a significant increase in Klm will generally indicate a deterioration in the performance of economic activities, in particular about the growth of work in progress, overstocking of raw materials, finished products, etc. With a stable volume of working capital, in the case of a decrease in the values of K lm, we can assume that the situation with the enterprise has worsened. short-term liabilities, i.e. either additional short-term loans were taken out, or debt to creditors increased, or both.

7. Maneuverability coefficient:

K m =A 3 /((A 1 +A 2 +A 3)-(P 1 +P 2))

8. Equity ratio:

To the public sr-mi = (P 4 -A 4)/(A 1 +A 2 +A 3)

9. Share of working capital in assets:

d OA = (A 1 + A 2 + A 3)/VB, (8)

where VB is the balance sheet currency

During the analysis of balance sheet liquidity, each of the considered liquidity ratios is calculated at the beginning and end of the reporting period. If the actual value of the coefficient does not correspond to the normal limit, then it can be estimated by its dynamics (increase or decrease in value).

The absolute liquidity ratio, which characterizes the solvency of the enterprise as of the balance sheet date, is below the recommended value throughout the entire period under review.

At the end of 2014, 3.8% of short-term debt can be covered absolutely liquid assets versus 3% in 2013.

The quick liquidity ratio satisfies the standard indicator, which reflects the enterprise’s ability to pay, subject to possible settlements with debtors. The company can repay 105% of short-term debt in 2014 with cash and receivables. In dynamics, there is an increase in this coefficient by 20.8%.

Current ratio, showing the extent to which current assets cover short-term liabilities. In our case, the enterprise has a ratio below the norm, but since the ratio is greater than one, the enterprise can be considered solvent. The excess of current assets over current liabilities provides a reserve stock to compensate for losses that the company may incur. The larger this reserve, the more confidence the company gains from creditors. But from the point of view of the enterprise itself, this reduces its efficiency, since a significant accumulation of inventories and large accounts receivable reduce the turnover of working capital.

The overall liquidity indicator does not correspond to the norm during the study period. Shows that the company does not have enough total liquid funds to cover all payment obligations. But in dynamics there is an increase in this indicator by 0.161.

In dynamics, the liquidity indicator during the mobilization of funds, the maneuverability indicator and the share of working capital in assets - these indicators are decreasing, but do not meet their standards. In dynamics, the maneuverability coefficient increases and does not correspond to the norm.

Based on the results of the analysis, the enterprise cannot be called solvent, and the balance sheet of the enterprise is not liquid.

Enterprise as a subject economic activity has a complex and multi-level architecture, including a significant number of divisions and departments. So, in the structure of the enterprise, in addition to production workshops may include administrative, financial, marketing, research and other types of units. Each of these divisions carries out its functions within the competencies and boundaries defined for them in the structure of the enterprise. Taken together, they are all part of a single organizational and economic mechanism that creates products. The activity of this mechanism has its own patterns and established terminology.

The terminology used by economists when naming certain concepts and functions in the economic sphere of an enterprise allows them to significantly simplify the processes of cooperation and interaction when managing these functions. Like any professional environment, enterprise economics needs this terminology insofar as the use of specialized terms also simplifies the process of solving specific problems within the enterprise, as well as the processes of modeling and presenting various problem situations.

One of the basic categories in the economics of an enterprise is the structure enterprise capital. Its total capital is divided into equity and debt. TO equity refers to that part of the property, financial and material resources of the enterprise that legally fully belongs to this structure and can be used by it at will, taking into account the interests of the organization and its employees. TO borrowed capital, in turn, includes that part of the funds that is attracted by the enterprise within the framework of various credit schemes and loans: borrowed financial resources, leasing equipment, etc. The use of this part of the enterprise’s funds, as a rule, is not completely free and has certain target limits agreed upon with creditors or lessors. These conditions are described in an agreement or contract, where the company undertakes to comply with them in full, and in case of violation of the rules for the use of borrowed capital, various penalties may be applied.

The second important gradation of an enterprise’s capital is its division according to the principle of fixed and working capital (Fig. 2.2).

Rice. 2.2.

The presented diagram reflects the capital structure of the enterprise from the position of its use in the economic cycle, according to which it is divided into non-negotiable And working capital. Non-current capital is understood as that property that operates for a period exceeding one cycle (turnover) of production, namely:

- buildings;

- structures;

- equipment and power machines;

- working machines;

- computer technology and high-tech equipment;

- vehicles of various types (forklifts, cars and trucks road transport, electric cars, etc.);

- other equipment and machinery.

All of the listed types of property and equipment have a long service life and wear out gradually, transferring their value to the cost of production by depreciation. Under working capital refers to those funds and property of the enterprise that are fully used within one production cycle (turnover), transferring their value to the cost of production in full. The working capital of an enterprise includes two main groups: circulation funds And working production assets. Circulation funds include:

- cash in the cash register of the enterprise and in bank accounts;

- finished products shipped to the customer and not paid for;

- finished products in the enterprise warehouse;

- accounts receivable.

Working production assets include:

- materials, raw materials, semi-finished products;

- fuel;

- spare parts and components;

- small production tools with a short service life;

- work in progress;

- deferred expenses.

From the given lists of elements included in the circulation funds and circulating production assets, one can see that these two subsystems complement each other in the dynamics of the production process. Circulation funds in this sense are those internal sources financing an enterprise that is already available or will appear in the foreseeable future (in the case of accounts receivable). At the same time, both subsystems function interconnectedly, providing the production process with the necessary material and financial resources.

Next, we should consider such basic economic categories that are often encountered in the process of managing the activities of an enterprise, such as income Andexpenses. According to the definition accepted in the economic environment, under income refers to an increase in economic benefits for an enterprise due to the influx of new assets and repayment of obligations from counterparties, contributing to the growth of the enterprise’s capital. It should be noted that the income of an enterprise does not include contributions from its founders and participants, as well as funds received in the form of a deposit, advance payment, agency agreements, as well as repaying the loan to the company. In accounting, income is divided into two groups:

- income from ordinary activities – revenue from the core activities of the enterprise (sales finished products, provision of specialized services);

- other income – a group of enterprise income, including penalties, penalties, fines, and proceeds to compensate for losses caused to the enterprise; profit of previous years identified in the reporting year; positive exchange rate differences; amounts of accounts payable for which the statute of limitations has expired; profit from collaboration with another organization; proceeds from the transfer of rights to use patents, as well as rights to use the assets of the enterprise; the totality of the enterprise’s income that was received as a result of emergency circumstances (fire, natural disasters, man-made disasters): compensation for material losses from the state, insurance compensation, the value of valuables remaining after the write-off of unusable assets, etc.

The second basic category of an enterprise's economy is its expenses. Under expenses of an enterprise is understood as a decrease in its economic benefits in the process of outflow of assets (financial and material resources) and/or the emergence of liabilities, which leads to a decrease in the level of capital of the enterprise (excluding a decrease in deposits by decision of the owners of the enterprise). Expenses include the same two groups:

- expenses for ordinary activities – costs for the manufacture of products or the provision of services that are the core activity of the enterprise (in particular, the costs of raw materials, supplies, as well as the organization and support of the production process);

- other expenses – expenses of the enterprise, including penalties, penalties, fines, proceeds to compensate for losses caused by the enterprise (for example, environment); losses from previous years; amounts of receivables for which the statute of limitations has expired; expenses associated with the provision of enterprise assets for use for a fee; from joint work with another organization, etc.

For tax purposes, income is divided into sales income And non-operating income, and expenses - for costs associated with production and sales, And non-operating expenses. The essence of these economic categories is clear from their names.

One of key indicators, reflecting the degree of profitability of the enterprise, is profitability. Under profitability of the enterprise is understood as a value that reflects the efficiency of using the enterprise's funds and represents the ratio of profit to the average cost of fixed and current assets. In addition to enterprise valuation, profitability as economic category covers quite a lot of areas, forming the following indicators:

- product profitability;

- profitability of fixed assets;

- profitability of sales;

- personnel profitability;

- return on assets;

- return on equity;

- return on invested, permanent capital, etc.

When assessing the efficiency of an enterprise and its business processes Cost-benefit analysis is one of the most common methods due to its high accuracy and ease of practical use.

Next we should consider the concept depreciation, also being a very important category in the field of enterprise economics. Under depreciation refers to the gradual transfer of the cost of basic production assets on created products through systematic depreciation charges in order to accumulate funds at the enterprise for their subsequent renewal. Any equipment, buildings, structures, computer technology - all these funds are subject to gradual wear and tear due to the influence of the time factor and their constant use in production process. Excessive wear and tear of fixed assets leads to a partial or complete inability of the enterprise to maintain the same volume of production, quality of products, introduce innovations, etc. With the accumulation of experience in the functioning of enterprises in the economic environment, based on observations and analysis of statistical data, universal indicators (coefficients) were developed - depreciation rates for various types equipment, buildings, electric motors, etc. Examples of some coefficients are given in table. 2.1.

Table 2.1

Depreciation rates by type of fixed assets of the enterprise (as a percentage of the book value of assets)

|

Types of fixed assets of an enterprise |

Depreciation rate |

|

Multi-storey buildings (more than 2 floors), single-storey buildings |

|

|

Wooden hydraulic structures |

|

|

Overhead power lines with voltages of 35–220, 330 kV and higher on metal reinforced concrete supports |

|

|

Stationary hot water boilers |

|

|

Stationary acid batteries |

|

|

Machines with manual control(universal, specialized, special) |

|

|

Metal-cutting machines with CNC, including machining centers, automatic and semi-automatic machines without CNC |

|

|

Flexible production cells, robotic technological complexes, flexible production systems, including assembly, adjustment and painting equipment |

Based on the data given in the table, we can, for example, determine that it will take 20 years to completely wear out a manually operated machine, and just over 14 years to completely wear out a CNC machine. Such standard values allow the enterprise not to conduct its own research on equipment wear, but to immediately include these values in the cost of production. There is also the practice of accelerated depreciation of equipment, which involves increasing the depreciation rate in order to more quickly transfer the cost of equipment to products. Accelerated depreciation is used in cases where we are talking about wear and tear of high-tech equipment and computer technology. The economic meaning of this measure lies in the enterprise’s desire to more frequently update high-tech equipment in order to maintain a sufficiently high computing and innovative potential of the enterprise.

Let's consider the composition and structure of trade turnover. These indicators make it possible to draw the first and main conclusions about the management of commercial work at the enterprise. The most rational way is to consider the indicators over 3 years.

Table 1. - Composition and structure of trade turnover:

|

Indicators: |

2010 By 2008, % |

||||||

|

1. Revenue from the sale of goods, products, works, services, thousand rubles. |

|||||||

|

2. Incl. non-food products: |

|||||||

|

Decorative cosmetics: |

|||||||

|

Perfumery: |

|||||||

|

Stationery: |

|||||||

|

Household goods: |

|||||||

|

Household goods: |

The increase in revenue was generally achieved due to an increase in prices, expansion of the range and growth in sales volumes of goods.

Perfumery takes first place in the sale of goods; it brings in the largest revenue, which increased by 1.01% during the analyzed period.

Revenue from the sale of office supplies also increased by 1.12%, and synthetic detergents by 1.06%. The table shows that revenue increases every year, thereby bringing big profit to the store.

Table 2. - Composition and structure inventory at the end of the year:

|

Indicators |

2010 to 2008 |

||||||

|

Non-food products. |

|||||||

|

Synthetic detergents: |

|||||||

|

Decorative cosmetics: |

|||||||

|

Perfumery: |

|||||||

|

Stationery: |

|||||||

|

Household goods: |

|||||||

|

Household goods: |

|||||||

The most popular products are: for the home 84.4%, decorative cosmetics 60.5% and synthetic detergents 78.5% are characterized by a significantly low price; accordingly, they are the most accessible to consumers and are in great demand.

An increase in inventory is certainly associated with an increase in turnover, but ideally, to increase the competitiveness of a company, it should reduce the volume of stored inventory, compensating for this by increasing the turnover of goods. Moreover, the company's policy is aimed at expanding warehouse space in order to expand the range of goods from new manufacturers. And this, in turn, will entail an increase in the cost of storing products and will affect the cost of production.

Table 3. - Composition and structure of the enterprise’s distribution costs:

|

Cost items. |

2010 By 2008 |

||||||

|

1. Transport costs |

|||||||

|

2. Labor costs |

|||||||

|

3. Contributions for social needs. |

|||||||

|

5. Depreciation of fixed assets |

|||||||

|

6. Property insurance |

|||||||

|

7. Fuel and electricity costs |

|||||||

|

9. Communication services |

|||||||

|

10. Renting premises |

|||||||

|

11. Water costs |

|||||||

|

12. Security |

|||||||

|

13. Medical services |

|||||||

|

14. Other expenses |

|||||||

|

Total costs. |

Another factor influencing price setting is the amount of distribution costs. wholesale company: And again, the general increase in distribution costs (138.9%) is associated with an increase in trade turnover. The greatest increase is observed in labor costs (303.8%). This is a positive and at the same time negative point. There is also an increase in advertising costs (140.1%). These costs include: participation in exhibitions, advertising on radio, television and in magazines. The increase in fuel and electricity costs (143.2%) is inadequate, apparently due to the increase in the number of jobs. The maintenance of buildings and equipment (144.1%), as well as property insurance (116.9%) are associated with an increase in their market value. The increase in transport costs (143.7%) directly depends on the increased volume of traffic. Other expenses decreased (41.5%) - this is also quite a positive moment for the organization. As noted above, changes in the structure and total amount of distribution costs are associated with an increase in the number of personnel.

Table 4. - Efficiency of use labor resources:

|

Indicators |

2010 to 2008 % |

|||

|

2. Average headcount workers, people |

||||

|

3. Payroll fund, thousand rubles. |

||||

|

4. The level of the wage fund as a percentage of revenue. |

||||

|

5. The average annual wage of 1 employee is only thousand rubles. |

||||

|

6. Trade turnover per 1 ruble, labor costs, rub. |

||||

|

7. Profit (loss) from sales, thousand rubles. |

||||

|

8. Gross income, thousand rubles. |

||||

|

9. Gross income per 1 ruble of labor costs. |

||||

|

10. Accounted for per 1 employee, thousand rubles: |

||||

|

Proceeds from the sale of goods, products, works, services. |

||||

|

Gross income. |

||||

|

11. Labor intensity, pers., calculated h/rub. |

Based on the data in Table 4, we can conclude that the company pays attention to working with personnel, as labor productivity increases.

Important indicators of labor force analysis are the number of employees.

The number of people in 2010 increased by 52.9% compared to 2008.

In 2010 wages employees increased by 98.7% compared to 2008.

Table 5. - Basic economic indicators activities of a commercial organization:

|

Indicators |

2010 To 2008 % |

|||

|

1. Revenue from the sale of goods, works, services. Thousand rub. |

||||

|

2. Cost of goods, products, works, services, thousand rubles. |

||||

|

3. Costs per 1 ruble of revenue. Rub. |

||||

|

4. Gross profit or loss thousand rubles. |

||||

|

5. Selling and administrative expenses, thousand rubles. |

||||

|

6. Profit (+), loss (-) from sales, thousand rubles. |

||||

|

7. Net profit, thousand rubles. |

||||

|

8. Average number of employees, people. |

||||

|

9. Average annual cost of fixed production assets, thousand rubles. |

||||

|

10. Capital productivity, rub. |

||||

|

11. Average annual cost of working capital, thousand rubles. |

||||

|

12. Working capital turnover ratio. |

||||

|

13. Payroll fund, thousand rubles. |

||||

|

14. Average annual salary of an employee, thousand rubles. |

||||

|

15. Net profit received, thousand rubles. |

||||

|

Per employee |

||||

|

For one turnover of working capital. |

Examining the indicators in Table 5, we can conclude that from 2008 to 2010 the enterprise operated successfully, because revenue from sales of goods increased in 2010 by 79.6%. Hence, gross profit and net profit increased.

Analyzing the dynamics of the number, it should be noted that the average number of employees in 2010 increased compared to 2008 by 9 people, which is associated with the introduction of additional positions due to an increase in the need for new personnel. Every year the wage fund grows, and accordingly the wages of workers increase, the enterprise has created favorable conditions labor. The capital productivity indicator has an upward trend; in 2010 it increased by 46.8%. Return on assets in 2010 amounted to 5.99 rubles, i.e., per ruble of invested fixed assets, 5.99 rubles were received. cash proceeds.

Over the analyzed periods of time, turnover accelerated, the turnover ratio of working capital increased by 8.9%. This has a beneficial effect on financial situation organizations. In 2009, there was a decrease in such indicators as the profitability of fixed assets and working capital. This was due to a decrease in net profit by 2.3% and an increase average annual cost fixed production assets. But by 2010, net profit increased and working capital increased.

1.2.3 Main economic indicators of the enterprise’s activities

The performance of the enterprise can be characterized by the following indicators:

Economic effect;

Profitability indicators;

Capital payback period;

Break-even point of farming.

Economic effect is an absolute indicator (profit, sales income, etc.) characterizing the result of an enterprise’s activities:

Pr = Vpr - Zpr,

where Pr is profit from sales of products;

Vpr - revenue from sales of products;

ZPR - costs of production and sales of products.

The disadvantage of this indicator is that based on this indicator it is impossible to draw a conclusion about the level of profitability of the enterprise.

Economic efficiency is a relative indicator that compares the effect obtained with the costs that caused this effect, or with the resources used to achieve this effect.

The degree of profitability of an enterprise can be assessed using profitability indicators. The following main indicators can be distinguished:

a) product profitability ( individual species) (Rp) is calculated as the ratio of profit from sales (Pr) to the costs of its production and sale (Zpr).

b) profitability of core activities (Rod) is calculated as the ratio of profit from sales of products to the costs of production of sold products.

where Pr.v.p - profit from the sale of all products;

Zpr.v.p - costs of production of manufactured products;

c) return on assets (Ra) is calculated as the ratio of book profit to the total of the average balance sheet (Ksr). This indicator characterizes how effectively the enterprise's fixed and working capital is used. This indicator is of interest to credit and financial institutions; business partners etc.

d) return on fixed capital (Rok) - the ratio of book profit (Pb) to the average cost of fixed capital (Ofs.g).

e) return on equity (Rск) is the ratio of net profit (Пч) to the average cost of equity capital (Ксс).

This indicator characterizes how much profit each ruble invested by the owner of the capital gives;

e) the payback period of capital (T) is the ratio of capital (K) to net profit (Pch).

Shows how many years will it take for the funds invested in a given enterprise to pay off under constant conditions of production and financial activity.

Break-even point

The concept of "break-even farming" can be expressed in simple question: how many units (Q) of products need to be sold in order to reimburse the semi-fixed costs incurred (U.Pos).

Accordingly, prices for products (P) are set in such a way as to reimburse all semi-variable costs (U.Per) and receive a premium sufficient to cover semi-fixed costs and make a profit (Pr).

As soon as the number of units of production (Qcr) sufficient to compensate for the semi-fixed and semi-variable costs (full cost) is sold, each unit of production sold in excess of this will make a profit.

Moreover, the amount of increase in this profit depends on the ratio of semi-fixed and semi-variable costs in the structure full cost.

Thus, once the volume of units sold reaches minimum value sufficient to cover the full cost, the company makes a profit, which begins to grow faster than the growth in volume. The same effect occurs in the case of a reduction in volumes economic activity, that is, the rate of decline in profits and increase in losses outpaces the rate of decrease in sales volumes.

Table No. 3.

Main economic indicators of the enterprise's activities.

| Indicators | GO forms | 2006 | 2007 | 2007 As a percentage compared to 2006. |

| 1. VP at current prices – total, thousand rubles. | 6 agro-industrial complex | 15752 | 18084 | 114,8 |

| 2. Average number of workers employed in agricultural production, people. | 5 agro-industrial complex | 189 | 190 | 100,5 |

| 3. Revenue from sales of products – total, thousand rubles. | 7 agro-industrial complex | 10056 | 11784 | 117,2 |

| 4. Cost of products sold, thousand rubles. | 7 agro-industrial complex | 10325 | 13136 | 127,2 |

| 5. Profit from sales of products, thousand rubles. | 2 agro-industrial complex | -269 | -1352 | 502,6 |

| 6. Level of profitability of the enterprise, %. | - | - |

Having assessed the main economic indicators of the enterprise, we can come to the conclusion: Gross output at current prices in 2006. amounted to 15,752 thousand rubles, and in 2007 - 18084 thousand rubles. It follows from this that gross output at current prices increased by 14.8%. The average number of workers employed in agricultural production in 2006. amounted to 189 people, and in 2007. their number increased by 0.5%, amounting to 190 people. Revenue from product sales in 2006 amounted to 10,056 thousand rubles in 2007. - 11,784 thousand rubles, an increase of 17.2%. The cost of products sold amounted to 10,325 thousand rubles. in 2006, and in the reporting year 13,136 thousand rubles. It increased by 27.2%. Loss from product sales in 2006 amounted to 262 thousand rubles, and in 2007. 1352 thousand rubles. The loss increased by 402.6%. The analyzed enterprise is not profitable.

Squares. Capital-labor ratio in agriculture is determined by the ratio of the average annual cost of fixed agricultural production assets per worker. The economic efficiency of using fixed production assets in agriculture is characterized by a system of indicators. The main cost performance indicators...

Costs provided to the farm third parties; consider the possibility of renting out individual plots of land. Section 2. Efficiency of use of the enterprise's fixed production assets 2.1 The essence and classification of fixed production assets An indispensable condition for the production process are the means of production, which consist of means of labor and objects...

Equipment (30.8%) has a service life of over 20 years. Water pipelines with a service life of more than 20 years make up 26.5%, collectors – 33.3%. 2.3 Indicators for assessing the efficiency of using fixed production assets An analysis of the study of the movement and technical condition of the industrial production facility is important; for this we calculate the following indicators using formulas (1.7), (1.8), (1.9), (1.10), (1.11), ...

The performance of the enterprise can be characterized by the following indicators: - economic effect; - performance indicators; - capital payback period; - break-even point of farming.

Economic effect- this is an absolute indicator (profit, sales income, etc.) characterizing the result of the enterprise’s activities. The main indicator characterizing the economic effect of the activities of a manufacturing enterprise is profit. The order of profit generation is shown in Figure 3.7.

|

Profit from sales of products (from core activities) (P r) |

|

Profit from other sales (P pr) |

|

Profit from non-operating operations (P in) |

|

Balance sheet (gross) profit P b = P r + P pr + P vn |

|

Taxes and fees (deductions) |

|

Net profit P h = P b - deductions. |

|

Dividends (DV) |

|

Interest on loans (percent) |

|

Retained earnings P nr = P h - DV- percent. |

Rice. 3.7. The procedure for generating profit

Profit P r from sales of products (sales) is the difference between sales revenue (V r), costs of production and sales of products (full cost of Z pr), the amount of value added tax (VAT) and excise taxes (ACC):

P r = V r - Z pr - VAT - ACC.

Profit from other sales (P pr) is the profit received from the sale of fixed assets and other property, waste, and intangible assets. It is defined as the difference between revenue from sales (V pr) and the costs of this sale (Z r):

P pr = V pr - Z r.

Profit from non-operating operations is the difference between income from non-operating operations (D inn) and expenses on non-operating operations (R in):

P in = D in - P in.

Income from non-operating operations is income from equity participation in the activities of another enterprise, dividends on shares, income on bonds and other securities, income from the rental of property, fines received, as well as other income from operations not directly related to the sale of products.

Expenses on non-sales operations are the costs of production that did not produce products.

Balance sheet profit: P b = P r + P pr + P int. Net profit: Pch = Pb - deductible. Retained earnings: Pnr = Pch -DV - percent.

Profit distribution procedure

Profit can be distributed in the directions indicated in Fig. 3.8.

Rice. 3.8. Profit distribution

A reserve fund is created by an enterprise in case of termination of its activities to cover accounts payable. The formation of a reserve fund for enterprises of certain organizational and legal forms is mandatory. Contributions to the reserve fund are made in accordance with current regulations.

The accumulation fund is intended for the creation of new property, the acquisition of fixed and working capital. The size of the accumulation fund characterizes the enterprise's capabilities for development and expansion.

The consumption fund is intended to carry out activities for social development and material incentives for the company’s personnel.

The limitation of economic effect indicators is that they cannot be used to draw conclusions about the quality level of resource use and the level of profitability of the enterprise.

Economic efficiency- this is a relative indicator that compares the effect obtained with the costs that determined this effect, or with the resources used to achieve this effect:

Some of these indicators were considered. For example, these are capital productivity indicators and the working capital turnover ratio, which characterize, respectively, the efficiency of using fixed assets and working capital.

The degree of profitability of an enterprise can be assessed using profitability indicators. The following main indicators can be distinguished:

A) product profitability(certain types) (R p) is calculated as the ratio of profit from the sale of products (P r) to the costs of its production and sale (Z pr):

b) profitability of core activities(R od) - the ratio of profit from the sale of products to the costs of its production and sale:

where P r.v.p - profit from the sale of all products;

Z pr.v.p - costs of production and sales of manufactured products;

V) return on assets(Ra) - the ratio of book profit to the total of the average balance (K avg). This indicator characterizes how effectively the enterprise's fixed and working capital is used. This indicator is of interest to credit and financial institutions, business partners, etc.:

G) return on fixed capital(R o.k) - the ratio of book profit (P b) to the average cost of fixed capital (Of s.g):

![]()

d) return on equity(R s.k) - the ratio of net profit (P h) to the average cost of equity capital (K s.s):

This indicator characterizes how much profit each ruble invested by the owner of the capital gives;

e) capital payback period(T) is the ratio of capital (K) to net profit (P h).

This parameter shows how many years will it take for the funds invested in this enterprise to pay off under constant conditions of production and financial activity.

Break-even point for farming. The concept of breaking even can be expressed as a simple question: how many units of output must be sold to recover the costs incurred.

Accordingly, prices for products are set in such a way as to reimburse all semi-variable costs and obtain a premium sufficient to cover semi-fixed costs and make a profit.

As soon as the number of units of production (Q cr) is sold sufficient to compensate for the semi-fixed and semi-variable costs (full cost), each unit of production sold in excess of this will make a profit. Moreover, the amount of increase in this profit depends on the ratio of semi-fixed and semi-variable costs in the structure of the total cost.

Thus, as soon as the volume of units sold reaches a minimum value sufficient to cover the full cost, the company makes a profit, which begins to grow faster than this volume. The same effect occurs in the case of a reduction in the volume of economic activity, that is, the rate of decline in profits and increase in losses outpaces the rate of decrease in sales volumes. The definition of the break-even point of farming is shown in Fig. 3.9.

Rice. 3.9. Determining the break-even point of farming