Trading on the stock exchange seems to be something complicated and incomprehensible to a person who has never encountered it. How can a beginner start trading on the stock exchange, and even more so, how to make money on it? Let's understand the basics of trading on the stock exchange.

There are 3 types of exchanges: commodity, currency and stock exchanges. In this article we will only look at the stock exchange. Bonds, options, futures, bills, debentures and stocks are traded on stock exchanges. Of the entire list of securities, we will be interested only in shares. Trading shares on the stock exchange is the easiest and most accessible way for a novice investor to start trading on the stock exchange.

Participants in exchange trading are divided into 2 types: traders and investors.

- Traders are active players on the stock exchange. They follow the news and can close and open positions in stocks several times a day. Using borrowed funds for trading is not uncommon for traders.

- Investors prefer to invest in stocks for a long term (from several months to several years). This is where a newbie on the stock exchange should start. If for a trader trading on the stock exchange is a full-time job, then for a private investor it is an opportunity to test their strength and intuition. It is the actions of a novice private investor that we will consider in the context of trading on the stock exchange.

An exchange investor is not directly involved in the purchase and sale of shares. This is done for him by a professional market participant - a broker. The investor only gives instructions to the broker to perform this or that action on the stock exchange. That is, a broker is a person who works in an investment or brokerage company whose specialization is intermediary services when trading on the stock exchange. To pay for their mediation, brokerage companies charge traders and investors some commissions and payments, which will be discussed below.

The general list of actions when trading on the stock exchange is as follows:

- The investor enters into an agreement with a brokerage company and transfers money from his bank account to a special brokerage account, which is provided to him by the brokerage company and from which trading will be carried out.

- If a client wants to buy shares, he gives the appropriate instruction to the broker. When the broker executes an order to purchase shares, funds for this purchase, as well as commissions and payments, are debited from the investor's brokerage account.

- If the client wants to sell shares, then he also gives the corresponding instruction to the broker. When the broker executes an order to sell shares, the investor’s brokerage account receives funds from this sale minus commissions and payments.

- An investor can transfer his funds from a brokerage account to a bank account and vice versa.

We see that a bank account and a brokerage account are involved in this money circulation scheme. A brokerage account is opened for you by a brokerage company. Transferring money from a bank account to a brokerage account and back typically incurs a fee. But it can be avoided. Large brokerage companies usually have subsidiary banks. By opening a current account with such a bank, you can avoid commissions when transferring between a brokerage and bank account.

Direct purchase/sale of shares

We found out that the investor does not directly engage in trading on the stock exchange, but gives instructions to the broker. How can an investor give instructions to a broker?

There are 3 ways to do this:

- Orders through the trading terminal;

- Orders via the web interface;

- Voice order.

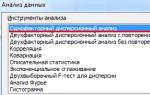

Trading terminal is a special program that is installed on a computer and with which you can monitor quotes, conduct technical analysis and give instructions. For a novice investor, trading terminals are complicated due to the abundance of information and interface congestion.

A monthly fee will be charged to your brokerage account for access to the trading terminal. For trading, as in the following case, you need constant access to a computer and the Internet.

Orders via the web interface

In general, trading through a web interface is similar to trading through an exchange terminal, but does not require the installation of any programs; it is much simpler and more convenient in the initial stages.

In this case, instructions to the broker are given over the phone in a normal conversation. Large brokerage and investment companies, as a rule, have toll-free phone numbers with the 8-800 prefix for these purposes.

Access to the broker is regulated. You can’t just call on the phone and say “Buy Gazprom.” To ensure that your shares and money cannot be managed by just anyone, the broker must identify you. When concluding a brokerage service agreement, the client receives a list of passwords, from which the broker will randomly select a voice password to authenticate you as a client. You will need to introduce yourself, give the brokerage agreement number and say the voice password, which the broker will ask you to identify. After completing this procedure, you will need to inform the broker about the nature of the transaction (purchase or sale), the name of the issuer (which shares this needs to be done with) and the number of shares. To eliminate errors, the broker repeats all this information and, after your confirmation, executes the order. To avoid controversial situations, conversations with brokers are recorded. There is no fee for trading “per voice”.

Types of transactions in the stock market

There are long and short positions in stock trading.

- Long position is opened in the expectation that the purchased shares will rise. Investors who trade in a rising market are called bulls.

- Short position opens with the expectation that stocks will fall. The shares are borrowed from the broker, sold at a high price, and when their value declines, they are bought at a low price and returned to the broker. Investors who trade in a falling market are called bears.

A long position is opened by buying and closed by selling shares. A short position, on the contrary, is opened by selling shares borrowed from a broker and closed by buying.

Selling and buying shares at the current market price is called market order. But there are other, much more cunning types of orders on the exchange:

- Limited order means that the investor instructs the broker to buy shares at a price set by the investor below the current one or to sell shares at a price set by the investor above the current one. That is, if an investor is not satisfied with the current purchase/sale price of shares, then he sets the price at which he is ready to buy or sell shares. In this case, the order will be executed only when the set price is reached by the shares. Limited orders on the Moscow Exchange can be submitted both during main trading and during the “pre-market” 15 minutes before the start.

- “Stop” order designed to insure investors and speculators against large losses. For example, if you bought shares in the hope of their growth, but they go negative, a “stop” order will allow you to get rid of these shares automatically if there is a slight minus.

- “Stop”-limit order combines a limit and a stop order. That is, a price is indicated above the current one for buying shares and below the current one for selling them with an open “long” position. For the “short” one, the opposite is true.

The lifetime of orders on the exchange is one trading day. If the application is not executed during the day, it will not be transferred to the next day. You can also withdraw an order if it has not yet been executed by the broker.

Trading time and currency

On the Moscow Exchange, trading in shares begins at 10:00 and ends at 18:40. This is the so-called main trading mode. There are also pre-trading (from 9:45 to 10:00) and post-trading (from 18:40 to 18:50) periods during which you can send limited orders to the exchange. Trading is not conducted on weekends and holidays. The trading currency is Russian ruble.

How and where to monitor stock prices?

Obviously, in order to understand what actions need to be taken to buy and sell shares, you need to know their current price. Russian shares are traded on the Moscow Exchange and their quotes are also presented there. However, price changes are displayed there with a delay of 15 minutes. For long-term investors, this is a completely acceptable delay, but for speculators or traders who make several purchase/sale transactions per day, such a delay is critical. In such cases, special access to the exchange is purchased through a trading terminal.

Mandatory commissions and payments

Few people in our world work for free, and brokerage companies are no exception.

- Brokers charge a commission for executing investor orders. As a rule, this is a percentage of turnover, that is, the amount of purchase or sale of shares. For example, in the companies BCS and Finam, at initial rates the commission is 0.0354% of turnover. It is clear that the higher the turnover, the lower the commission percentage.

- In addition, as mentioned above, for access to online quotes through trading terminals you will need to pay for access to the Moscow Exchange.

- There may also be a fee for maintaining a custodial account (the account that holds records of your shares).

- Depending on the bank, there may be a fee for depositing or withdrawing funds from a brokerage account.

Where are the shares stored?

Usually in our time, shares are not physically printed and are not stored anywhere. The brokerage company has its own securities accounting center, the so-called depository. When concluding a service agreement with a brokerage company, the client receives his depository in this brokerage company (depository account). This deposit account stores all records of the availability and movement of your shares. Also, these records are duplicated by the issuer (the company whose shares you bought).

Dividends

If you are the lucky owner, then dividends will be paid to your brokerage account. They are calculated from the amount per share. In order to receive them, it is enough to be in the register of shareholders at the time of its closure.

Taxes

- The tax rate on income from the sale of shares in Russia is 13%. In this case, the tax amount is calculated from the tax base. The tax base in this case will be the amount of income received from the sale of shares and expenses incurred for their purchase, storage and other commissions. That is, tax must be paid only on the net profit received from the sale of shares. If there was no profit, no tax is paid.

- The tax rate on dividend income is 9%. In this case, the amount of dividends received is taxed.

Your brokerage company will act as your tax agent, so you do not need to file any returns. All taxes due by law on your income, if any, will have to be paid by your brokerage company.

Withdrawal of funds

You cannot withdraw funds directly from your brokerage account. In order to receive money in your hands, you must first transfer money from a brokerage account to a bank account, and then pick it up at the cash desk.

Choosing a brokerage company

What should you pay attention to when choosing a brokerage company?

- Experience. The longer a company operates on the market, the better;

- Having your own bank;

- Presence in your region;

- Service tariffs;

- Reliability rating;

- Reviews.

The most famous brokerage companies in Russia at the moment are:

- "Opening"

- "Finam"

- "BCS"

- "ATON"

- "KIT-Finance"

- "Sberbank CIB"

- "VTB 24 online broker"

- "Uralsib"

Many of them trade shares not only on the Moscow, but also on the London and New York stock exchanges.

Trading on the stock exchange is turning from being the preserve of a select few into a way of investing and earning money for everyone. The development of technology makes it possible for anyone from any corner of the world to engage in trading without leaving home. But any beginner immediately has a lot of questions - how to trade on the stock exchange from scratch, how to understand the terms of the stock exchange? Let's try to give some tips for novice traders.

First steps

A person who decides to trade on the stock exchange is like a traveler in front of a guide stone. Moreover, the stone is covered with completely incomprehensible writing. Therefore, the first step should be to master knowledge about the stock exchange. First, you should understand the theory of trading and master the terminology of stock traders.

There are many books that are written by professional traders for beginners. For example, A. Elder “How to play and win on the stock exchange”, E. Nayman “Small Encyclopedia of the Trader”, E. Lefevre “Memoirs of a stock speculator”, D. Schwager “Stock magicians”, M. Kovel “Turtle traders”, B Steenbarger “Trader's Self-Teacher. Psychology, technique, tactics and strategy,” L. Connors and L. Raschki, “Secrets of stock trading.”

Another resource, completely free, is specialized Internet resources for traders. There you can read articles about trading, go through the basics of training as a trader, chat with colleagues and learn their stories of successes and failures.

If the first educational program did not discourage you from trading on the stock exchange, then you can start investing money in your education. The most effective way remains distance trading courses on the stock exchange. There are a lot of such courses, and the main thing here is not to make a mistake in choosing. After all, making money on knowledge attracts many, including non-professionals who do not have practical trading skills. Therefore, you should first find out who is teaching and whether you should trust him. Professional traders, such as A. Purnov, A. Gerchik, D. Krasnov, have many years of experience in trading on stock exchanges in different countries and with different instruments. They can teach trading and warn against mistakes that stock trading neophytes can make. Therefore, you can only trust experienced traders who have real results.

Having mastered the theory and completed the preparatory courses, the beginner already has his own understanding of trading and is ready for the next step.

What should you do next?

Now a novice trader must answer several questions for himself that should help him decide on trading and choosing an exchange.

- « Where will I trade?“- the very first question is the choice of the exchange where the trader plans to work. Now you can trade not only on domestic exchanges, but also in any country in the world. Most often, the choice falls on Russian, American and European exchanges. Some people prefer exotics in the form of Australian, Asian or African exchanges, but this is very rare. You should choose an exchange based on the trader’s training - knowledge of languages, access to information, knowledge of the realities of the country in which you plan to work.

- « What will I trade?“You can trade anything on exchanges - from grain and cotton to complex derivatives. Bloomberg agency several years ago already broadcast data on 2.5 million products. Therefore, the choice of product is extremely important in order not to drown in this ocean. It is better to master the skill of trading on one product than to scatter your energy and attention on 10-20 objects.

- « Who will I work with?“- it is difficult to trade on the market independently on the stock exchange, and simply impossible for a beginner. To solve this problem, they use the services of brokers - intermediaries between the trader and the exchange. The broker fulfills the trader's orders on the exchange and represents the interests of the trader on the exchange. The choice of a broker is extremely important - the success of trading will depend on his professionalism and support. The issue of commissions is also important - brokers have several tariff options and they should be studied very carefully. The broker also resolves the issue of information support for trading.

- « What do I want to get from trading?“It seems like a simple question - everyone goes to the stock exchange for money. But in fact, the correct answer to this question will indicate the path of the trader - whether he wants to invest his funds effectively - this will be the path of the investor. Whether he wants to increase his capital quickly and with risk - this will be the way of the trader. The answer will also tell you what type of trading to choose - short-term, medium-term or long-term.

These are some of the few important questions for a trader. In the process of work, many more questions will arise, but it is the answer to these that will indicate the path that the trader will take.

What should you avoid?

The path of a stock trader is quite difficult and every mistake on it threatens financial losses. It is impossible to do without losses and mistakes. But you can protect yourself from some of them.

Here are a few steps that beginners don't need to do:

- Hurry up with real trading. There is no need to rush and invest your money in trading right away. If a broker provides a demo account, you need to work with it not for a day or two, but for a month or even more. There's no need to rush.

- Enter Forex. The Internet is full of advertisements from Forex brokers and Forex traders that promise mountains of gold. Meanwhile, Forex is one of the most difficult markets and it will be very difficult for a beginner there. It's better to start with stocks and bonds. And leave Forex until better times.

- Start with positional trading. For beginners, it is better to start with short-term trading - scalping or day trading. This is not easy, but here you can limit yourself to technical analysis.

- Stop studying. You should never stop learning. You always need to learn. There are manuals and courses not only for beginners, but also for experienced traders.

- Give in to the excitement. Experienced traders advise creating trading and behavior rules for yourself. This is especially important when a trader begins to lose and is overcome by excitement - he needs to win back. No need. There must be a limit on drainage. Two or three trades were closed in the negative - that’s it, trading is over for today. And in general, there should be a limit on transactions, even successful ones. Trading is a nervous job and the likelihood of making a mistake after 10-15 trades is very high.

- Trust robots. You should only contact a trading robot when you have a good understanding of trading and the market. Until this moment, you should not believe in such programs.

A trader will still make a lot of mistakes. And you can’t do without financial losses. But all this can be solved, you need to be prepared for this, and analyze all mistakes and defeats and turn them into victories.

The path of a trader is not easy, but very exciting. Any beginner will soon become a master and will be able to give advice on how to trade on the stock exchange from scratch.

What amount should you start trading on the stock exchange with? Is $500 enough or do you need at least $5000? Where is it better to trade – on MOEX or NASDAQ, NYSE, Euronext? These and other questions resulted in a non-boring guide containing a complete set of instructions and explanations on how to start trading on the stock exchange.

Contents of the article:

The very concept of " stock exchange“very general for a specific action, since there are exchanges for working with different types of assets: currency, stock, commodity, derivatives market, etc., each type has its own specifics, so it’s a good idea to first decide what is closer to you and what assets you prefer to work with, for example, trade commodity futures for certain varieties of coconuts or buy mutual fund securities.

This article will talk about how to start trading on the stock exchange and how to buy/sell shares. When asked which exchange to trade on , Usually there are 3 possible answers: RF, EU, USA, and everyone else seems Indian or Australian exchanges immediately cut off.

I believe that this is not entirely correct, since there are no less interesting companies on the Tokyo, Australian and other exchanges, especially since it is even useful for portfolio diversification.

You will learn a little more about how to enter international exchanges below, but for now let’s determine what you need to start trading and how to prepare.

How to start trading on the stock exchange

On stock exchanges you can buy shares of your favorite companies, but the exchange does not work with individuals and all transactions take place only through brokers - intermediary companies. Brokers provide access to certain exchanges, so before you do, find out if they have access to the exchange you need.

If you want to buy shares SONY, then there is no point in contacting a broker who only provides access to the Moscow Exchange, since you need Tokyo.

Also, the purchase of shares is possible only during the trading hours of the exchange from Monday to Friday from 9 to 17:00 on average. For example, the Tokyo Stock Exchange starts working at 3 a.m. Moscow time. True, this does not mean that you need to set your alarm clock for 4 am, you will simply give an order to the broker to buy shares at a time convenient for you, and as soon as the exchange is available for trading, your order will be executed.

Today, all the world's stock exchanges have switched to online trading and settlements, so there is no need to travel and stand in queues; you can open an account with a broker without getting out of bed in a few minutes.

Let's return to the fact that to start trading on the stock exchange, you need to find a broker.

As you already understood, it is better when your broker provides many exchanges in its assets, and not just one. Although many people at the initial stage want to choose one exchange for trading.

But such thoughts are also understandable, because it is easier to stop at one exchange and not know anything else, especially when it comes to choosing a broker.

The fact is that according to the laws of the Russian Federation, only qualified investors with a minimum amount in the account in 6 million rubles.

But this is also why many Russian brokers have subsidiaries registered in the EU.

Based on many factors above, I am not asking which exchange is better to trade on, but rather focusing on which stocks to buy.

How much should I start trading on the stock exchange?

Some say as much as possible, others as little as possible, others name specific numbers, but there are no rules here. You can buy shares Amazon for $1000 or shares Sberbank at $2.5.

If you want to start trading on the stock exchange on the Internet, then don’t look at the amounts, start with what you have.

Each broker has a set minimum deposit size, for example, the minimum first deposit with a professional broker is $250 . For this amount it is already possible, Microsoft or Coca-Cola And Sberbank.

However, you still can’t buy much with $200, so try to replenish your deposit monthly and buy additional shares of different companies, increasing your portfolio not only quantitatively, but also qualitatively. This will be better and more productive than constantly waiting for better conditions, because time and experience are of great importance.

However, you still can’t buy much with $200, so try to replenish your deposit monthly and buy additional shares of different companies, increasing your portfolio not only quantitatively, but also qualitatively. This will be better and more productive than constantly waiting for better conditions, because time and experience are of great importance.

What stocks to buy and how to develop

As in any other business, in trading on the stock exchange, before moving on to serious work on results, you need to understand the market, because you cannot imagine such a situation that, for example, a person who has never studied medicine suddenly begins to engage in neurosurgery, hoping for this for success. What it will look like and what consequences it will lead to is quite obvious.

The truth is that stock trading cannot be learned. More than 90% of millionaires and billionaires have no education.

You can learn what a stock exchange and stocks are, where to click the Buy button in the trading program, but what stocks you should buy and for how long and why - this is not taught. Yes, you can conduct fundamental analysis of a company, technical analysis, but there are thousands of companies and how to choose the right one from them?

For example, Peter Lynch I wrote about how the shares of an American funeral home soared a hundred times, or a plastic processing company. But I am sure that more than 95% of investors do not think about such companies.

Poll: What attracts you to stock exchanges?

Poll Options are limited because JavaScript is disabled in your browser.

Prospect of being wealthy 46%, 89 votes

Opportunity to save money profitably 27%, 53 vote

Desire to create a securities portfolio 14%, 27 votes

Purchase of foreign shares 5%, 10 votes

Purchase of Russian shares 4%, 7 votes

Sources of information

You need to acquire sources of information, these could be financial sites, books, ratings... where you will learn market news, about new business trends, for example, about lithium batteries that Tesla uses.

Among these I would highlight:

Goals determine the nature of the portfolio

The next stage is defining goals. What does it mean? This means that you need to decide for yourself what profitability indicators suit you, for how long you expect to invest, and how much time you can spend on analysis and trading. Having answered these questions, you can move on to choosing the type of strategy, which should determine how to start trading on the stock exchange and depend on:

- your character(are you able to wait a long time or prefer to act quickly);

- desired investment horizons(for example, buying shares cheaply and then selling them at a high price, waiting for weeks and months, making intraday trades or quickly scalping the minimal profit generated);

- acceptable level of risk(conservative strategies based on passive or dividend income, medium-risk based on a mixed selection of assets, or high-risk investments in small-cap firms and startups).

How to trade on the stock exchange the chosen strategy will determine: for a conservative investor this is the choice of the most profitable bonds and the purchase of shares with the highest dividends,

for scalpers - trading in highly volatile assets, for classical investors who consider Warren Buffett their idol - this is buying undervalued, promising shares, with long-term goals and reinvesting profits.

for scalpers - trading in highly volatile assets, for classical investors who consider Warren Buffett their idol - this is buying undervalued, promising shares, with long-term goals and reinvesting profits.

In addition to fundamental analysis, someone can focus on the technical levels of the moving average (MA) with periods of 200 and 50, which show how overvalued the stock is or vice versa, and other graphical analysis tools.

Your goals will determine your stock portfolio and the areas in which you will focus more than others.

However, I do not see any limitations or obvious strategies in successful investors. All successful stock market players buy everything that is undervalued, cheap and has prospects. And here it is impossible to limit yourself to one industry or market. Each of them has enormous potential.

I usually find something very cheap that makes a positive difference and buy it.

– Jim Rogers - co-founder of George Soros' investment fund Quantum

After the start of trading, after the first purchase of shares, you will immediately understand that the process itself is no more complicated than ordering pizza on the Internet. This way you will begin to repeat your purchases and over time you will collect a decent portfolio of shares that will please not only your eyes, but also your financial component.

Instructions: how to trade on the stock exchange

Let's summarize all of the above into a simple sequence of actions. To start buying and selling shares on the stock exchange, you need to:

The best brokers for trading and investment

TOP CFD Binary options Forex stocks

| Broker | Type | Min. deposit | Regulators | View |

|---|---|---|---|---|

| Binary options | $250 | TsROFR | ||

| Stocks, investments, Forex, Crypto | $500 | ASIC, FCA, CySEC | ||

Inexperienced traders think that trading in the stock market is a tricky science, accessible only to a select few. But in fact, figuring it out is easier than it seems. All you need is to stock up on money (at first a small amount is enough) and spend some time on self-education. Moreover, you will learn the most basic information about how to trade stocks today - from this article.

Stock trading: where to start

If you want to become a successful trader, don’t throw yourself into the deep end. Your task is to sequentially go through seven important steps:

1. Obtain basic knowledge from reliable sources. First, you need to get acquainted with the principles of operation of stock exchanges and the basics of technical analysis, and then study quotes and other characteristics of financial instruments directly on the websites of trading platforms.

2. Choose a market to work on: Russian or foreign. Among foreign markets, the American one is considered the most promising.

3. Choose a broker and open an account. You cannot do without an intermediary - individuals do not have direct access to exchanges. There are two ways to conclude an agreement with a broker: in person at the company’s office or remotely through the State Services portal. Immediately after the conclusion of the agreement, a brokerage account will be opened in the name of the future investor.

4. Install a trading terminal on your computer. To learn how to trade stocks, you need special software. The choice of a trading terminal, as a rule, depends on the choice of broker - each of them offers its own version of the program. You can do without a terminal (we’ll tell you how below), but most traders prefer to trade this way.

5. Perform a trial trading operation. For example, the Moscow Exchange website offers novice investors to connect to a test trading server and make their first deal in trial mode.

6. Select an object for attachment. You should invest in securities of those companies whose risk of bankruptcy is minimal.

7. Buy shares. To get started, you need to deposit the required amount into your brokerage account - through a bank cash desk or online services. Once the money is credited to your account, you can start trading.

Before you is a general plan of action. Now let's talk in more detail about the most important points.

How to get basic knowledge?

You can get information literally from anywhere: from books, specialized forums, seminars, video tutorials and articles. And the best thing is to combine all of the above.

The main tip for dummies who want to learn the secrets of stock trading is to master the basics of technical analysis. This is a base that you can’t do without. Anyone who masters technical analysis makes much fewer mistakes in the process.

There are many useful books on the basics of stock trading. For example, by A. Elder, W. J. O'Neill, L. Goch. And finally, the easiest way to learn how to trade stocks is to watch video lessons for beginners, which cover all the questions that interest beginners in simple and understandable language.

Selecting an attachment object

How do traders decide which stocks to invest in? Conduct technical or fundamental analysis of the stock market. Both of these approaches have the same goal, which is to make a profit. But nevertheless, there are significant differences between technical and fundamental analysis.

Traders who use technical analysis methods in their work study charts of market price movements, look for patterns and, based on them, determine the moment to buy or sell shares. At the same time, they don’t care where the market is moving: they can make money both on rising and falling prices.

Fundamental analysis works differently. Traders who use it do not need charts. Their main goal is to find a dynamically developing company with sufficient financial stability. It is also desirable that the shares be undervalued by the market, that is, their market value is lower than their real value. Investors using fundamental analysis look for long-term returns (minimum 5 years). Therefore, they carefully study the company itself: its niche in the industry, financial stability, development prospects, and so on.

How to choose an exchange?

Shares are bought and sold on stock exchanges. Those, in turn, are trading platforms whose main activity is to provide optimal conditions for the circulation of securities, determine their market value and maintain high professionalism of market participants.

There are about 200 exchanges in the world, but the largest ones are only a few dozen. Among them are the Moscow and St. Petersburg exchanges. The main difference between them is that Russian shares are traded on the Moscow Exchange, while American shares are traded on the St. Petersburg Exchange.

You can trade shares on both exchanges from one brokerage account. As a result, portfolio management, diversification, and transferring money from exchange to exchange becomes much easier.

Transaction methods

How to buy shares on the stock exchange? There are three main ways:

Via the Internet. In this case, a trading terminal provided by the broker is used. The software must be installed on the investor's personal computer and configured properly.

By phone. In broker slang this is called “voice orders”. After concluding an agreement, the brokerage company provides the investor with a list of voice passwords and a special multi-line telephone number. When a person wants to make a transaction, he dials the required numbers, states the brokerage agreement number and password, and then, when authentication is completed, voices his order.

Via web interface. This is almost the same as a trading terminal, but the functionality and interface are simpler.

How and where to monitor stock prices?

Quotes of Russian shares are presented on the Moscow Exchange website. True, changes in their prices are displayed with a slight delay of a quarter of an hour. But for long-term investors this is not critical. And those who make many transactions a day monitor quotes through the trading terminal.

Are you afraid or don’t have time to study?

There is also a way out of this situation. Especially for those who want to invest, but are afraid to do it themselves, there is a trust management service. Its essence is that the selection and implementation of a trading strategy is not carried out by the investor himself, but by a specialized company acting on his behalf and in his interests.

All that is required in this case from a private individual is to enter into an agreement with a management company and deposit a certain amount of money into a brokerage account. The company, in turn, will regularly provide reports with which the investor can monitor the condition of his assets. The cost of the trust management service is an agreed percentage of the profit on shares.

Nowadays, accessing stock exchanges is not something difficult. Any person who decides to engage in trading can afford to buy and sell shares in order to make a profit.

However, for any trading on the stock exchange, as well as for trading in the foreign exchange market, you must have a certain knowledge base. To understand how to start trading stocks, there are many books and videos that can provide all the information you need about stock trading and trading in general. The stock is an organization that provides funds through the buying and selling process. Moreover, trading takes place using the most developed electronic trading systems. Thus, stock exchanges are, as it were, an indicator of the development of the economies of states and the world economy as a whole. Top five stock exchanges:

So how do you start trading stocks? First of all, you need to choose a broker (of course). The broker provides the opportunity for traders to trade in real time. And you need to choose for the reason that an individual does not have direct access to trading on the stock exchange.

So how do you start trading stocks? First of all, you need to choose a broker (of course). The broker provides the opportunity for traders to trade in real time. And you need to choose for the reason that an individual does not have direct access to trading on the stock exchange.

A broker is an intermediary. When choosing one, you should pay attention to the commission, the quality of service, in general, and no less important, what kind of analytical platform this intermediary is ready to provide. Fortunately, there are currently many programs from which you can choose the one that is most convenient.

Of course, before you start trading shares, you need to open a deposit into your trading account. But you shouldn’t immediately rush into it and try to earn a lot of money. The approach here is slightly different than, for example, in the foreign exchange market.

Of course, before you start trading shares, you need to open a deposit into your trading account. But you shouldn’t immediately rush into it and try to earn a lot of money. The approach here is slightly different than, for example, in the foreign exchange market.

Firstly, shares are an instrument that can be bought or sold only during a certain period of time. At the end of the day, it will close. This means that the frequency of gaps is 5 times greater than in the currency market. It matters.

The second is the role of stock indices, which act as the first indicators of stock market dynamics.