In children's preschool educational institution in 2018, from 23 to 27 people worked in different months, in 2019 - 27 people (of which one employee is on maternity leave). In what order should an institution submit to the Social Insurance Fund the information necessary for the appointment and payment of benefits for temporary disability, pregnancy and childbirth, at the birth of a child and other benefits related to maternity: in electronic form or on paper (the institution is located in a constituent entity of the Russian Federation participating in the pilot project)? The buyer - a VAT payer has the right to take advantage of the deduction of the tax presented to him on goods, works, services, property rights if the requirements prescribed in Art. 171 and 172 of the Tax Code of the Russian Federation conditions: the purchase is intended for a transaction subject to VAT and is registered, the buyer has an invoice issued accordingly. However, if this document is received late, the taxpayer may have additional questions. For what period should the deduction be claimed? How can it be transferred to subsequent tax periods and not miscalculate the deadline allotted by the legislator for this event? Is it possible to defer only part of the deduction? Four courts, including the Supreme Court of the Russian Federation, denied citizen Zh. the right to register a new LLC “D”. The formal basis for this refusal was the applicant's failure to provide certain Federal law No. 129‑FZ necessary for state registration documents, namely that the application in form P11001 does not contain information about the person who has the right to act on behalf of the legal entity without a power of attorney, about the address of the permanent executive body legal entity within its location, and there are also signs that the founders do not have - legal entities LLC “P”, LLC “B” and their managers have the opportunity to exercise management in the legal entity being created.

Changing the VAT rate in itself does not seem to cause difficulties for accounting employees. Indeed, you charge large amounts to be paid to the budget and that’s it... However, difficulties may arise during the transition from a lower rate to a higher one. In this article we will provide an overview of the latest explanations from officials on this topic related to the performance of work and the provision of services. In April 2019, an error was identified: depreciation was not accrued for library collection objects accepted for accounting and put into operation in August 2018. What corrective entries need to be made in budget accounting?

Trade by sample is a form of trade in which the buyer purchases goods under a retail purchase and sale agreement concluded on the basis of familiarization with a sample of the goods offered by the seller and displayed at the point of sale.

In an organization that sells goods by sample, premises must be allocated for displaying samples of goods offered for sale. The seller is obliged to bring to the attention of the buyer information about his organization, its mode of operation, the goods and their manufacturers, the conditions for the sale of goods by sample and the services provided ( for assembly, installation, connection, adjustment and servicing of goods, etc.). The buyer has the right to refuse the services offered by the seller upon conclusion of the contract. Installation, connection, adjustment and commissioning of certain technically complex products, for which, in accordance with the technical and operational documentation, it is prohibited for the buyer to independently perform these procedures, as well as mandatory instructions on the rules for using the goods are carried out by the seller’s service departments or other organizations with which the seller has contracts for maintenance the goods he sells.

The provision of these services must be carried out within the time frame specified by agreement of the parties, but no later than 7 calendar days from the date of delivery of the goods to the buyer.

In this form of trade, the seller is obliged to offer the buyer services for the delivery of goods by sending them by post or transportation by any means of transport, as well as for connecting, setting up and putting into operation technically complex goods.

If the buyer has expressed his intention to purchase the goods, the seller is obliged to enter into a written agreement with him, which must necessarily contain information:

- name and location (address) of the seller, last name, first name, patronymic of the buyer or the person indicated by him (recipient), address to which the goods should be delivered;

— name of the product, article number, number of items included in the package of the purchased product, price of the product;

— type of service, time of execution and cost;

— obligations of the seller and buyer.

In addition, if the contract is concluded on the terms of advance payment for the goods, then it must necessarily contain information about the period of its transfer to the buyer. The contract is considered concluded from the moment the seller issues a cash or sales receipt or other document confirming payment for the goods to the buyer at the place of sale or from the moment the seller receives a message about the buyer’s intention to purchase the goods on the terms proposed by the seller.

Please note that in accordance with the requirements (Rules for the sale of goods by sample), approved by the Decree of the Government of the Russian Federation of June 21, 1997. No. 918 (hereinafter referred to as the Rules), the buyer is given the right to refuse the goods only before its transfer and subject to reimbursement to the seller of expenses incurred in connection with the performance of actions to fulfill the contract.

The seller is obliged to transfer to the buyer, in the manner and within the terms established in the contract, goods that fully correspond to the sample, as well as the information brought to the attention of the buyer when transferring the goods (in technical passport on the product, the rules for its use, on the label or tag attached to the product, on the product itself or its packaging). The seller must hand over the technical passport, operating instructions and other documents related to the product simultaneously with the product.

If the contract does not specify the delivery period for the goods and there is no way to determine this period, then the goods must be transferred by the seller within a reasonable time.

An obligation not fulfilled within a reasonable time must be fulfilled by the seller within 7 days from the date the buyer submits a demand for its fulfillment.

The contract is considered fulfilled from the moment the goods are delivered to the place specified in the contract, and if the place of transfer of the goods is not determined by the contract, then from the moment the goods are delivered to the place of residence of the buyer or recipient.

Retail trade by samples

If one of the terms of the contract is the provision of services, the contract is considered fulfilled from the moment these services are performed.

If the delivery of the goods was carried out within the time period established by the contract, but the goods were not transferred to the buyer due to his fault, delivery is made within a new time period agreed with the seller after the buyer has re-paid the cost of this service.

If the delivered goods are transferred to the buyer or recipient at his place of residence or other address indicated by him, the goods are accepted by the buyer or recipient in accordance with the data of the accompanying document (notice, receipt) for the goods.

Be careful, read them carefully before signing the delivery documents.

To exclude the presence of mechanical damage to the product packaging that would compromise its integrity, we recommend that it be opened in the presence of the seller’s representative without fail.

Please note that the Rules stipulate the buyer’s obligation to notify the seller of a violation of the terms of the contract regarding the quantity, assortment, completeness, container and (or) packaging of the goods, no later than 20 days after receiving the goods.

If a defect is discovered in the product, the consumer has the right to present claims to the seller related to the defects of the product, to the extent and in the manner established by the Law “On Protection of Consumer Rights”.

Sales of goods based on samples and catalogs outside the stationary trading network is not recognized as retail trade and is not transferred to the payment of a single tax on imputed income.

In accordance with the Rules for the sale of goods based on samples, approved by Government Decree Russian Federation dated July 21, 1997 N 918 (hereinafter referred to as the Rules for the sale of goods by samples), the sale of goods by samples is the sale of goods under a retail purchase and sale agreement, concluded on the basis of familiarization of the buyer with samples of goods offered by the seller or their descriptions contained in catalogs , prospectuses, booklets, presented in photographs and other information materials, as well as in advertisements about the sale of goods.

When selling goods by sample, the buyer is given the opportunity, independently or with the help of the seller, to familiarize himself with the demonstrated samples, select and purchase the necessary goods, which are transferred to the buyer after their delivery to the place specified by him, unless otherwise provided by the contract.

Information about the seller, goods and their manufacturers, about the conditions for the sale of goods based on samples and the provision of services is provided to the buyer when demonstrating samples of goods at the place of sale of goods.

Demonstration of samples of goods at the point of sale is recognized as a public offer, regardless of whether essential conditions contract, unless the seller has expressly determined that the goods are not intended for sale.

The seller is obliged to enter into an agreement with any person who has expressed an intention to purchase the goods displayed at the point of sale.

According to clause 13 of the Rules for the sale of goods by sample, an organization that sells goods by sample must have premises allocated for displaying samples of goods offered for sale. To familiarize buyers, samples of the offered goods of all articles, brands and varieties, components and devices, accessories and other related products are presented.

Samples of goods offered for sale must be displayed at the point of sale in display cases, on counters, podiums, stands, special consoles, the equipment and placement of which allows buyers to familiarize themselves with the goods.

Thus, the exhibition hall belongs to commercial premises and can be classified as a stationary retail chain facility, since it is designed to serve customers and is equipped appropriately for this purpose.

A similar position is taken by the judicial authorities (for example, Resolutions of the Federal Antimonopoly Service of the West Siberian District dated January 21, 2004 N F04/288-2658/A27-2003, the Thirteenth Arbitration Court of Appeal dated June 25, 2007 N A26-9227/2006, the Seventeenth Arbitration Court Court of Appeal dated December 4, 2007 N 17AP-8299/2007-AK) (Letter of the Ministry of Finance of Russia dated September 17, 2010 N 03-11-11/246).

By virtue of clause 30 of the Rules for the sale of goods by samples, the seller is obliged to transfer to the buyer a product that fully corresponds to its sample or description, the quality of which corresponds to the information provided to the buyer at the conclusion of the contract, as well as the information brought to his attention when transferring the goods (in the technical passport on the product, the rules for its use, on a label or tag attached to the product, on the product itself or its packaging, or in other ways provided for certain types of goods).

Based on Art. 346.27 Tax Code In the Russian Federation, a stationary trading network that does not have trading floors includes a trading network located in buildings, structures and structures (parts thereof) intended for trading, which do not have separate and specially equipped premises for these purposes, as well as in buildings, structures and structures (parts thereof) used for concluding retail purchase and sale contracts, as well as for conducting auctions. To this category shopping facilities include indoor markets (fairs), shopping malls, kiosks, vending machines and other similar objects.

Thus, the sale of goods according to samples and catalogs under retail purchase and sale agreements through the objects of a stationary trading network is recognized as retail trade, in respect of which a taxation system in the form of a single tax on imputed income can be applied.

Sales of goods based on samples and catalogs not through the objects of a stationary retail chain for the purposes of Ch. 26.3 of the Tax Code of the Russian Federation does not apply to retail trade (Letter of the Ministry of Finance of Russia dated September 21, 2012 N 03-11-11/282).

At the same time entrepreneurial activity in the field of sales of goods based on samples, documentation which is carried out in the office, and the goods are released to customers from the warehouse, for the purpose of applying Ch. 26.3 of the Tax Code of the Russian Federation is not recognized as retail trade, and, accordingly, the taxation system in the form of a single tax on imputed income should not be applied to such activities (Letter of the Ministry of Finance of Russia dated March 14, 2013 N 03-11-11/101).

RETAIL TRADE BY SAMPLES

Retail trade by samples as an alternative to “classical” trade or an addition to it is gaining everything great popularity. Among competitive advantages this form of trade - reduction in costs for the sale of goods, mobility of transactions, the possibility of combining trade operations and advertising, optimization of logistics delivery schemes, etc.

Let us consider the main issues of the activities of organizations that sell goods to the public based on samples.

General provisions

Trade by samples is a form of trade in which the buyer selects goods according to their samples or descriptions (Article 11 of the Law of the Republic of Belarus dated July 28, 2003 N 231-Z “On Trade” (hereinafter referred to as the Law on Trade)). Such trade is carried out according to established rules (Rules for retail trade by samples, approved by Resolution of the Council of Ministers of the Republic of Belarus dated January 15, 2009 N 31 (hereinafter referred to as Rules N 31)).

Retail trade by sample is carried out by demonstrating samples (descriptions) of goods in retail outlets or distributing information sources containing descriptions of goods (catalogues, prospectuses, booklets, photographs, etc.). The buyer studies samples or descriptions, selects and pays for the necessary goods (clauses 3, 4 of Rules No. 31).

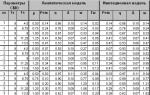

Trade based on samples can be carried out either in shopping facility, and outside it in the ways presented in the diagram.

Rice.

Trading by samples in a retail facility

Samples of goods are displayed in display cases, on counters, podiums, stands and other equipment, the placement of which allows customers to familiarize themselves with the goods (clause 12 of Rules No. 31). In this case, a retail facility should be considered not only the sales floor of a store, but also any premises (office, warehouse, pavilion, showroom) in which, for the purpose of selling goods, their samples (descriptions) are demonstrated, customers are consulted, and retail sales contracts are concluded .

The range of goods sold according to samples is determined by the seller independently, unless otherwise established by law (clause 6 of Rules No. 31). At the same time, for a retail facility it is necessary to develop and approve an assortment list and coordinate it with the local executive and administrative body at the location of the retail facility (clause 5 of the Retail Trade Rules certain types goods and catering, approved by Resolution of the Council of Ministers of the Republic of Belarus dated 04/07/2004 N 384 (hereinafter referred to as Rules N 384); Resolution of the Ministry of Trade of the Republic of Belarus dated January 15, 2009 N 4 “On assortment lists of goods”). Goods included in the assortment list must be on sale constantly (Article 3.4.12 State standard Republic of Belarus STB 1393-2003 "Trade. Terms and Definitions", approved by Resolution of the Committee on Standardization, Metrology and Certification under the Council of Ministers of the Republic of Belarus dated 04/28/2003 N 22).

To familiarize buyers, samples of goods of all articles, brands and varieties, components and devices, accessories and other related products are offered. In order to prevent loss of quality, the displayed samples must be periodically updated.

If goods require familiarization with their structure and operation, samples are demonstrated by the seller’s personnel in assembled, technically sound condition (clause 12 of Rules No. 31).

№ 2/2008

The method of placing orders using samples displayed in a store window is often used, for example, in the retail sale of large goods. In this case, an order is placed in the store, the citizen pays for it, and then receives it at the warehouse. Should the organization, in this case, apply the taxation system in the form of UTII? The answer is in letters from financiers. Let's analyze them.

When an activity falls under a special regime

So, it is necessary to switch to a special regime in the form of paying UTII in relation to retail trade, which is carried out, in particular, through shops and pavilions with a sales area of no more than 150 square meters (if this regime has been introduced in the relevant territory by a regulatory act of a representative body). This is stated in subparagraph 6 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

Let us recall that the area of the sales floor, that is, a physical indicator that determines the responsibility itself trade organization to apply UTII and the amount of tax is established on the basis of inventory and title documents. But the area of utility, administrative, as well as premises for receiving, storing and preparing goods for sale, in which customers are not served, does not apply to the area of the trading floor. This is stated in Article 346.27 of the Tax Code of the Russian Federation.

The types of goods prohibited for this purpose will also hinder the use of UTII. For example, regardless of the size of the store, this special tax regime cannot be applied to the retail sale of passenger cars, regardless of engine power. The fact is that the sale of excisable goods is not subject to UTII.

Subparagraph 6 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation states that excisable goods are recognized as cars and motorcycles with engine power over 150 horsepower.

However, according to Article 193 of the Tax Code of the Russian Federation, passenger cars with any engine power are considered excisable. Only if the car engine has a power of less than 90 horsepower, the excise tax rate of 0 rubles is applied. This was confirmed by the Russian Ministry of Finance in a letter dated September 11, 2007 No. 03-11-04/3/360.

You can easily sell jet skis, ATVs and snowmobiles at retail. These types of vehicles in accordance with All-Russian classifier fixed assets OK 013-94 (approved by Decree of the State Standard of Russia dated December 26, 1994 No. 359) do not apply to cars, trucks and special vehicles “prohibited for UTII.” This opinion was expressed by the Russian Ministry of Finance in a letter dated January 28, 2008 No. 03-11-04/3/29.

Samples displayed in the store

Article 346.27 of the Tax Code of the Russian Federation establishes exceptions for certain methods of selling goods that are not recognized as retail trade transferred to UTII. Thus, the sale of goods based on samples and catalogs outside a stationary distribution network does not apply to retail trade. This type of activity includes parcel trade (in the form of postal items), as well as sales through teleshopping and computer networks.

In our situation, the buyer chooses goods based on samples that are displayed in store windows. It can be assumed that the display cases are located in a store room specially designed for this purpose. And there is probably a sales consultant there who helps the buyer make the right choice. It is this employee who enters into an agreement with the buyer and accepts payment from him.

Let us now turn to GOST R 51303-99 “Trade. Terms and definitions". It gives the following definition of retail trade: it is the trade in goods and the provision of services to customers for personal, family, and home use not related to business activities.

It also contains a definition of trade service, which is the result of interaction between the seller and the buyer, as well as own activities seller to satisfy the buyer's needs when buying and selling goods.

Therefore, when a retail sales contract is drawn up in the sales area of a store where samples of goods are presented, and payment is made in the same premises, the main part of the trading service is provided by the retailer here.

Therefore, according to the author, this method retail sales goods are transferred to payment of UTII if the area of the store with samples of goods does not exceed 150 square meters. In this case, the area of the warehouse from where goods are actually released to the buyer does not matter. This was confirmed by the Russian Ministry of Finance in a letter dated January 24, 2008 No. 03-11-04/3/16.

After all, the size of the area of other premises not related to trading floor(including the area of the warehouse from which large goods are sold to customers) does not play a role in calculating UTII.

Exceptions for switching to UTII

This special regime does not apply if the company sells at retail:

– excisable goods specified in subparagraphs 6–10 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation;

– gas in cylinders;

– trucks and special vehicles, different types trailers, buses;

– goods based on samples and catalogs outside the stationary distribution network;

– transmits to the population medicines with discounted or free prescriptions;

– products own production(manufacturing).

This is provided for in Article 346.27 of the Tax Code of the Russian Federation.

Buyer status and transition to “imputation”

As for the status of the buyer (organization) for the purposes of applying “imputation,” this is an ambiguous issue.

Financiers tirelessly repeat that the defining feature of a retail purchase and sale is the fact of the sale of goods for personal, family, household or other use not related to business. But they also say that the seller is not at all obligated to control how the buyer actually uses his purchase.

If, when selling goods, the buyer was given a commodity and cash receipts, but the delivery note and invoice have not been issued, then the seller has the right to apply UTII regardless of the buyer’s status. Of course, subject to other mandatory “imputed” conditions. Confirmation of this is contained in letters of the Ministry of Finance of Russia dated December 18, 2007 No. 03-11-05/296 and dated August 30, 2006 No. 03-11-04/3/393.