Selection financial analysis enterprises in excel tables from various authors:

Excel tables Popova A.A. will allow you to conduct financial analysis: calculate business activity, solvency, profitability, financial stability, aggregated balance sheet, analyze the structure of balance sheet assets, ratio and dynamic analysis based on Forms 1 and 2 of the enterprise’s financial statements.

Tables Excel financial analysis of the enterprise by Zaikovsky V.E. (Director of Economics and Finance of Tomsk Measuring Equipment Plant OJSC) allow, on the basis of Forms 1 and 2 of external accounting reports, to calculate the bankruptcy of an enterprise according to the Altman, Taffler and Lis model, to assess the financial condition of the enterprise based on liquidity indicators, financial stability, state of fixed assets, asset turnover, profitability. In addition, a connection is found between the insolvency of an enterprise and the state’s debt to it. There are graphs of changes in the assets and liabilities of the enterprise over time.

Excel tables for financial analysis from Malakhov V.I. allow you to calculate the balance in percentage form, assess management efficiency, assess financial (market) stability, assess liquidity and solvency, assess profitability, business activity, the company’s position on the market market, the Altman model. Diagrams of balance sheet assets, revenue dynamics, gross and net profit dynamics, and debt dynamics are constructed.

Excel spreadsheets for financial analysis Repina V.V. calculate movements cash, profit-loss, changes in debt, changes in inventories, dynamics of changes in balance sheet items, financial indicators in GAAP format. Allows you to conduct a ratio financial analysis of the enterprise.

Excel tables Salova A.N., Maslova V.G. will allow you to conduct a spectrum - scoring analysis financial condition. The spectrum scoring method is the most reliable method of financial and economic analysis. Its essence is to carry out an analysis of financial ratios by comparing the obtained values with standard values, using a system of dividing these values by zones of distance from optimal level. The analysis of financial ratios is carried out by comparing the obtained values with the recommended standard values, which play the role of threshold standards. The further the value of the coefficients is from the standard level, the lower the degree of financial well-being and the higher the risk of falling into the category of insolvent enterprises.

Country support:

Operating system: Windows

Family: Universal Accounting System

Purpose: Business automation

Financial analysis software

Main features of the program:

Work with money in any currency is supported

All departments of the organization can work in a single information system via the Internet

The program shows current balances in real time for any cash register or bank account

You will be able to keep full financial records: post income, any expenses, see profits and view various analytical reports

You will have a unified database of clients and suppliers with all the necessary contact information

You can plan cases for any client

The program will allow you to plan expenses for a certain period

You will always have all detailed reporting for each cash register or account in any currency “at your fingertips”

All financial movements will be under your control full control. You can easily track what you spend the most money on for any period

The program will show you statistics on savings or excess costs for your items

A clear visualization of profit dynamics will help you easily analyze the company’s activities and profitability

Separation by access rights is supported. Each employee will see only what he is supposed to see

Integration with the latest technologies will allow you to shock your clients and deservedly gain your reputation modern company

Reserve

copying

Payment

terminals

Application

for employees

Application

for clients

You can quickly enter the initial data necessary for the program to work. This is done using convenient manual data entry or import.

The program interface is so easy that even a child can quickly figure it out.

Language of the basic version of the program: RUSSIAN

You can also order an international version of the program, into which you can enter information in ANY LANGUAGE of the world. You can even easily translate the interface yourself, since all the names will be placed in a separate text file.

Financial analysis involves analyzing the financial condition and main results of an enterprise. The results of such financial analysis help managers in making important management decisions in the further development of their business. There are many financial programs that can provide financial analysis of your organization for free. However, now most companies are moving from outdated programs to new, modern financial analysis programs. Financial programs almost completely automate all business processes and speed up interaction between the structures and divisions of the enterprise. Getting rid of routine tasks of filling out large amounts of data and paper documentation increases the efficiency and performance of enterprise employees.

However, finding a decent financial analysis program among so many others is not easy. Financial programs can be for small, medium and large enterprises. Financial programs are also classified depending on operating system on which they will be installed. Some may be intended for analysis budgetary organizations, and others for commercial ones. Financial analysis programs are divided into universal, specialized and highly specialized programs, as well as those operating offline or online. New types of programs for financial analysis of an enterprise are also appearing, intended for top management of various companies. They are intended for analysis economic activity business.

Program for financial analysis economic activity The Universal Accounting System is a modern proprietary development, the main advantage of which is its flexibility. The program for financial and economic analysis has basic functions, which are further supplemented according to the wishes and needs of your business. It is practically finalized individually for each client, and the variety of program functions depends only on the client’s needs. Moreover, in order to try out the program for analyzing your financial condition, there is no need to pay for it. After all, the demo version can be downloaded absolutely free. The USU financial analysis program is convenient because several users can work on it simultaneously, it depends only on the size of the company. At the same time, each employee of the enterprise has his own login and password in the business analysis program, which does not prevent users from working independently of each other. The program for financial analysis and investment analysis has an automatic update of information, which can be done either manually or by setting a timer, with the help of which the database of the financial analysis automation program will be updated every time after a certain amount of time.

That is, this financial program analysis of financial statements speeds up interaction between employees, the company’s activities are practically uninterrupted.

The financial analysis program allows you to generate any necessary internal and external reports for both government bodies, and for company managers. Based on reports in a program for financial analysis of an enterprise, which you can download for free, you can make comprehensive analysis activities of the enterprise. A program for financial analysis, a program for cost analysis can automatically calculate any company efficiency ratios that will be entered into the program in advance.

The monitoring and control program can be used by:

- Any government company;

- Private company;

- Individual entrepreneur;

- Self employed;

- etc.

Video programs for financial analysis

By watching the following video, you can quickly familiarize yourself with the capabilities of the USU program - the Universal Accounting System. If you do not see the video uploaded to YouTube, be sure to write to us, we will find another way to show the demo video!

Possibilities for monitoring and managing financial analysis

- A financial accounting program for analyzing the financial condition of an enterprise can be downloaded for free and can be modified upon individual request, taking into account the specifics of the business;

- Facilitates the maintenance and analysis of accounting and management accounting;

- The program for analyzing financial and economic activities for free USU does not have a subscription fee, you need to buy it once and use it, and use the demo version absolutely free;

- Provides the ability to add users and use it in multi-user mode;

- After installing the financial analysis program, you can receive effective and competent technical support;

- The financial program for analyzing the USU makes it possible to install for free different levels access to the program. For example, full access for managers and limited access for ordinary employees;

- A convenient audit function will help managers at any time check and analyze any transaction performed, see information about the time it was carried out and to whom it was carried out;

- A convenient notification and notification system, with which you can record assignments and tasks for each employee, which will increase productivity and work efficiency;

- The USU financial analysis program has import and export functions for free into various programs such as Excel, etc.;

- The USU financial program can automatically calculate the company’s income and expenses in a convenient form;

- The program for financial analysis of an enterprise has a user-friendly interface that is understandable even for a beginner;

- Financial statements can be automatically created, filled out, printed using this program, and the company logo can be displayed on documents;

- Accounting is maintained in any currency convenient for the enterprise;

- You can download the free version of the USU program right now on the website;

- You receive all individual modifications of the program for free, you only need to pay for hours of technical maintenance;

N academic supervisor- Romanova Elena Valerievna,

Ph.D., Associate Professor, NEFU named after. M.K. Ammosova, Yakutsk

Financial analysis is an integral component financial management in any enterprise or organization. Financial analysis is understood as the process of studying the main indicators, multipliers and ratios, parameters that give an objective assessment of the financial condition of the enterprise.

The financial condition of an enterprise characterizes its solvency, creditworthiness, competitiveness, use of capital and financial resources, fulfillment of obligations to other economic entities and the state.

The key goal of financial analysis is to identify reserves for increasing the market value of an enterprise, as well as increasing the efficiency of its functioning with the help of rational financial policies. The results of financial analysis are the basis for making management decisions and developing strategies further development enterprises.

The objectives of financial analysis are:

– determination of changes in the values of various financial indicators;

– identifying the most likely trends in changes in the financial condition of the organization;

– identification of factors influencing the financial condition of the organization;

– determination of levers and measures of influence on the organization’s finances in order to achieve a certain desired financial result

Financial analysis in the traditional sense is a method of assessing and forecasting the financial condition of an organization based on its financial statements (quarterly and annual statements - balance sheet(Form No. 1), financial performance report (Form No. 2), etc.). There are 2 types of financial analysis: external and internal.

External analysis is carried out by analysts who are outside the organization (enterprise) (for example, auditors, investors), and the features of this type of analysis are:

– many subjects of analysis, as well as users of information about the activities of the organization (enterprise);

– diversity of interests and goals of the subjects of analysis;

– availability of accounting and reporting standards, standard analysis techniques;

– focus on external, public reporting of the organization (enterprise), resulting in limited tasks;

– the maximum possible openness of the results of financial analysis for users of information about the activities of the organization (enterprise).

Target external analysis for investors, suppliers of financial and material resources is to identify opportunities profitable investment means to ensure maximum profit and eliminate the risk of loss. Internal financial analysis is carried out by company employees (economists, financial managers etc.), the results of internal analysis are used to control, plan and forecast the financial condition of the enterprise. The purpose of internal financial analysis is to establish the systematic receipt of funds and the placement of borrowed and own funds in such a way as to ensure the efficient functioning of the enterprise, maximize profits, and prevent the possibility of bankruptcy of the enterprise. It should also be noted that information base internal analysis is much broader and includes any internal information of the enterprise that may be useful for making management decisions. Consequently, internal financial analysis has much more possibilities, more detailed than the external one.

At the present time, there are many classifications of types of financial analysis. So, according to the opinion of a specialist in the field of analysis of financial statements of an enterprise - V.V. Kovalev, financial analysis can be divided into the following types: express analysis of financial statements, in-depth analysis.

The purpose of express analysis of financial statements is to obtain a clear, prompt and simple assessment of the financial condition and dynamics of development of the enterprise. Express analysis includes the study of financial statements according to formal characteristics (correctness of execution, completeness, accuracy of calculations made, etc.), familiarization with the accounting policies of the enterprise, auditor's report, identification of “sick” items in financial statements, analysis of their changes over time, study of the explanatory note, overall assessment financial and property status according to reporting data, summing up the results of the analysis.

An in-depth analysis is aimed at a detailed description of the financial and property potential of the enterprise, the results of its activities in the past reporting period, and the possibilities for the development of the enterprise in the future. In-depth analysis complements, expands and specifies individual express analysis procedures. In-depth financial analysis includes the following elements:

– a preliminary review of the financial and economic situation of the enterprise – a description of the direction of the financial and economic activities of the enterprise, the definition of “sick” items in the financial statements;

– analysis and assessment of the economic potential of an enterprise – assessment of property potential (formation of an analytical balance, its horizontal and vertical analysis, analysis of qualitative changes in property potential), analysis of financial potential (solvency, liquidity, financial stability);

– analysis and assessment of the results of the financial and economic activities of the enterprise – analysis of the effectiveness of business activity (current activities), analysis of profitability and profit, assessment of the situation on the securities market.

According to the opinions of S.I. Krylov and N.N. Ilyshev distinguishes the following types of financial analysis:

– a preliminary analysis that allows for a simple and visual assessment of the financial condition of the enterprise, as well as an assessment of the financial results of its activities. This analysis includes several stages: the preparatory stage (visual and simple accounting check of the financial statements on the merits and on formal grounds (checking the correctness, clarity, completeness of the financial statements, checking the presence of the necessary details, the correctness of arithmetic calculations), analytical linking and regrouping of balance sheet items for convenience of analysis); preliminary review of financial statements (familiarization with the explanatory note, auditor's report, assessment of qualitative changes in the financial condition of the enterprise over the past period, identification of factors affecting the financial statements); calculation and analysis of analytical indicators that characterize the financial condition of the enterprise;

– in-depth analysis, the purpose of which is to detailed description the financial condition and financial results of the enterprise over the past period, determining the capabilities of the enterprise for the long and short term. This analysis is carried out on the basis of data from all forms of financial statements of the enterprise and includes the following elements: analysis of the enterprise’s balance sheet and income statement, analysis of the cash flow statement, statement of changes in capital, analysis of the explanatory note to the income statement and accounting balance sheet, a comprehensive analysis of the financial condition of an enterprise based on data from its financial statements.

Currently, the following types of financial analysis are used in practice (Fig. 1):

The source of information for these types of financial analysis is the financial statements of enterprises (organizations), while during the analysis of financial ratios the following most important indicators are calculated and evaluated over time:

– liquidity indicators:

– current liquidity ratio – it allows you to determine in what ratio the current assets of the enterprise cover short-term liabilities (the optimal value of the ratio is 1.5-2.5). The coefficient is calculated according to the enterprise’s balance sheet data (Form 1) according to the formula:![]()

, (1)

where p.1200 – total for section II;

p.1510 – borrowed funds;

– the absolute liquidity ratio shows what part of the current short-term debt can be repaid in the near future by the enterprise using cash, as well as financial investments equivalent to them (the optimal value of the ratio is 0.2-0.5). This coefficient is calculated according to the enterprise’s balance sheet (Form 1) according to the following formula:

![]()

, (2)

where p.1240 – financial investments (except for cash equivalents);

p.1510 – borrowed funds;

p.1520 – accounts payable;

p.1550 – other short-term liabilities;

– the critical liquidity ratio shows what part of the company’s short-term obligations can be immediately repaid using cash, settlement proceeds, and short-term securities. The critical liquidity ratio shows how possible it will be to pay off current obligations if the company's situation becomes truly critical; the standard value of this ratio is 0.7-1. The coefficient is calculated according to the enterprise’s balance sheet data (Form 1) according to the following formula:![]()

, (3)

where – p.1240 – financial investments (except for cash equivalents);

p.1250 – cash and cash equivalents;

p.1230 – accounts receivable;

p.1510 – borrowed funds;

p.1520 – accounts payable;

p.1550 – other short-term liabilities;

– indicators of solvency and financial stability (autonomy ratio, financial independence ratio, debt-to-equity ratio, maneuverability ratio equity, coefficient of ratio of mobile and immobilized assets, coefficient of provision of working capital with own sources of financing, coefficient of financial stability, etc.);

– indicators of business activity (turnover);

– profitability indicators(return on sales indicator by gross profit, return on sales by net profit, return on sales by EBIT, etc.);

– indicators of market activity.

When analyzing financial ratios, the following points must be taken into account: the indicators of financial ratios great influence is influenced by the accounting policy of the enterprise, diversification of activities significantly complicates comparative analysis coefficients by industry, since standard values can vary significantly for different industries, while the standard coefficients chosen as a basis for comparison may not be optimal, and may not correspond to the short-term objectives of the analyzed period.

Thus, the list of types of financial analysis is extensive; the choice of one or another type of financial analysis of an enterprise depends on many factors, such as the form of the enterprise, the scope of the enterprise, the goals of the enterprise management for at this stage its development, the economic situation in the region and in the country as a whole, etc.

Achieving the goals of financial analysis is carried out using a variety of methods and techniques. Let's take a closer look at them.

Today the computer market information systems Conducting financial analysis of enterprises and organizations provides a wide selection of various programs with a different range of capabilities, among them there are universal information systems that cover all stages of the process of managing an organization (enterprise), including a module for conducting financial analysis. Examples of such systems are the software systems of Microsoft Corporation at the ball of ERP systems, the corporate information corporation "Galaktika" (St. Petersburg) "Galaktika", BS Integrator of the company "Business Service" (Kiev) and others. These software tools are designed to automate the financial and economic activities of large and medium-sized enterprises.

We will assess the capabilities of some computer information systems popular among Russian enterprises and organizations for conducting financial analysis, and also analyze the features of conducting financial analysis of organizations with their help.

The program "FinEkAnalysis" of the enterprise LLC "YuAK" (Krasnodar) is a professional automated system of comprehensive financial and economic, management analysis financial and economic activities of the organization.

“FinEkAnalysis” is a powerful financial analysis tool that includes several dozen different methods of financial analysis, management assessment and forecasting, financial management, and more than 40 analytical blocks (Appendix 2). "FinEkAnalysis" allows using data accounting and reporting generate reports with graphs, tables and conclusions, automatically calculates many financial ratios. The program is intended for economists, financiers, auditors, accountants, arbitration managers, employees of municipal and regional administrations; with its help, specialists can solve many problems (Fig. 3). "FinEkAnalysis" allows you to model and evaluate the state of the organization according to different categories of factors ( business activity, financial stability, profitability, solvency, liquidity, general condition), assess the extent to which the organization exhibits the characteristics financial pyramid, predict the probability of bankruptcy.

"FinEkAnalysis" allows you to model and evaluate the state of the organization according to different categories of factors ( business activity, financial stability, profitability, solvency, liquidity, general condition), assess the extent to which the organization exhibits the characteristics financial pyramid, predict the probability of bankruptcy.

Having analyzed the features of the financial analysis program, we can highlight the following advantages:the program interface is clear and simple, therefore, the time for a specialist analyst to master the product is reduced to a minimum;

the ability to export data from 1C: Enterprise 8 and earlier versions of software, which reduces the labor intensity of financial analysis;

Based on the accounting reporting forms (forms 1-5), FinEkAnalysis generates analytical text reports (with graphs, tables and conclusions), as well as recommendations for improving the financial condition of the organization;

analysis results are saved in a file format Microsoft Office Word, where they can be edited if necessary;

all calculation methods used in financial analysis are completely open to specialists working with the program;

“FinEkAnalysis” is constantly being improved by specialists from UAC LLC;

availability hotline program support, through which UAC LLC specialists help you install and configure FinEkAnalysis for free, explain how the program works, and answer current questions about email or telephone.Users of "FinEkAnalysis" are: large number various large and medium enterprises(among which are CJSC Yamalgazprom, CJSC Poultry Farm Novorossiysk, CJSC Gelendzhik Sea Port, OJSC Sady Pridonya, CJSC Tbilisi Sugar Plant, OJSC Irkutsk Prefabricated Reinforced Concrete Plant, CJSC Chelyabinsk Experimental Plant, OJSC Murmansk Provincial Fleet, etc.), universities, more than 150 audit firms, more than 200 arbitration managers, departments of subjects Russian Federation and other clients from the Russian Federation, Kazakhstan, Belarus, Armenia, Georgia, Ukraine and Abkhazia.

According to reviews from FinEkAnalysis users, the program is optimal solution, allowing you to quite easily and effectively solve monitoring problems financial activities enterprise, useful, convenient, intuitive, complete in functionality, promising, with the ability to work via the Internet as a software tool for financial analysis. Users consider the disadvantage of the program to be its high cost (as of September 10, 2015 - 6,500 rubles per year, license renewal - less than 50% of the cost of the program).

Thus, we can conclude that “FinEkAnalysis” is a modern software package that allows you to make the financial analysis of enterprises and organizations effective, comprehensive, prompt and convenient, even in conditions of limited time.

The Alt-Finance software of the Alt-Invest LLC enterprise (Moscow) is intended to carry out comprehensive assessment activities of organizations and enterprises, identifying the main trends in their development, calculating various basic standards for planning, forecasting, and assessing the creditworthiness of organizations and enterprises.

Having analyzed the capabilities of the Alt-Finance software, we can conclude that the program is intended for economists, financiers, accountants of enterprises and organizations; with its help, specialists can conduct the following types of analysis: horizontal, vertical, comparative, factor, analysis of the structure of the balance sheet and the dynamics of its articles, analysis of net working capital, analysis of cost structure, profitability, liquidity, financial stability, turnover of assets and liabilities, labor efficiency, profitability. Users also have the opportunity to conduct factor analysis by changing the return on equity indicator, the overall liquidity indicator and other indicators.

The advantages of the program are that users have the opportunity to conduct financial analysis using both old and new forms of financial statements (using a specially written macro, financial statements are automatically transferred from the old to the new format), a simple interface.

Disadvantages of the program - lack of ability to work via the Internet, insufficient list of possible types of analysis using the program, lack of a hotline, insufficient functionality, high cost of the program (65,000 rubles for 5 jobs, cost of full support - 30,000 rubles per year), limitations circle of users (only for Russian Federation users).

Users of the program are various enterprises middle and big business in the Russian Federation, commercial banks.

Program "Your financial analyst» auditing firm "Avdeev and Co" is a system predictive analysis financial condition of the enterprise according to the accounting financial statements.

An analysis of the program's capabilities showed that the program does not require the participation of specialist analysts in the analytical process; the program calculates more than 40 different financial indicators, generates an analytical report that is complete in content and form with characteristics, a description of the obtained values, conclusions, tables and graphs.

Using the program, you can perform the following types of analyzes and reports: full financial analysis, full financial analysis of statements according to IFRS or US GAAP, explanatory note to financial statements, assessment of the value of the organization, financial analysis of the debtor, advice on improving financial condition, certificate of financial condition, assessment likelihood of a tax audit.

The advantages of the program are that no prior training is required to work with the program, the participation of specialist analysts in the analytical process is not required, there is convenient information entry, the ability to export accounting data from 1C: Enterprise 8 and earlier versions, a simple and user-friendly program interface , multivariate descriptions, the ability to analyze indicators over time, the ability to customize the program according to your own needs, multilingual program, availability of a hotline, systematic updating of the program.

The disadvantages of the program are the high cost of the program (from 6,400 rubles to 47,500 rubles depending on the version of the program), but the license period of the program is not limited.

Users of the program are more than 2,000 large and medium-sized businesses, commercial banks (including Pulkovo Airport, OJSC "Red October", Svyaz Bank, Pegasus Fly Airlines, Yakutia Airlines, Zamoskvoretsiy Bank, etc.), more than 1,500 different clients from such countries like Kazakhstan, Russia, Belarus, Abkhazia, Georgia, Ukraine, etc.

Thus, having analyzed the capabilities of three programs for financial analysis of enterprises, we can conclude that the most convenient, multifunctional, and best in terms of price/quality ratio of them is software tool"FinEkAnalysis".

- FinEcAnalysis- a powerful tool that implements several dozen different techniques financial analysis, financial management, management assessment and forecasting. Based on financial statements for several periods, the program creates reports with conclusions, tables and graphs, and calculates a large number of financial ratios.

Our company develops automated systems for financial analysis since 1997. The many years of experience of our specialists are embodied in latest version programs for financial analysis - FinEkAnalysis 2020.

Purpose of the program

The main goal of the program is to make financial analysis organizations efficiently, conveniently and quickly, including under limited time conditions.

Problems to be solved

You can use the developed system for:

- constant monthly, quarterly or annual monitoring financial condition of enterprises;

- development of forecast balances and forecast financial results;

- carrying out express analysis of financial condition enterprises in a short time;

- preparing analytical notes for financial statements;

- preparing analytical materials for meetings of shareholders and members labor collectives;

- development of health programs financial condition (rehabilitation) of enterprises for arbitration managers;

- conducting an analysis of the arbitration manager in order to improve the financial condition (reorganization) of enterprises or present analytical materials to the court and other interested parties;

- developing a development strategy for the organization in the medium and long term;

- conducting regulated analyzes in accordance with regulations of regulatory agencies;

- carrying out financial analysis during audit;

- determine possible options further development of the enterprise by drawing up a matrix of financial strategies.

Who is the program for?

Financial analysis software- FinEkAnalysis - saves time, improves the quality of financial and economic analysis of organizations and makes it comprehensive. This is an indispensable assistant for auditor, economist, financier, accountant and arbitration manager, employees of regional and municipal administrations.

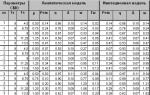

Comparative analysis of software products

for financial analysis of enterprises (organizations)

"Alt-Finance 1.5", "Audit Expert 3.0" and "AFSP 2.2"

Software product "Alt-Finance" developed by the research and consulting company "ALT".

Software product "Audit Expert 3.0" developed by the company "Pro-Invest Consulting".

Software product "Analysis of the financial condition of the enterprise" developed by the company "INEK".

Similarities of software products

Software products "Alt-Finance", "Audit Expert" and "AFSP" are designed to analyze the financial condition of enterprises (organizations). Data from standard forms of accounting statements - Balance Sheet, Statement of Financial Results - are used as initial information for analysis.

Software products allow you to analyze the state of an enterprise (organization) in the following areas:

- balance structure,

- liquidity,

- financial stability,

- profitability,

- turnover,

- profitability,

- labor efficiency analysis.

The calculation results are presented in the form of tabular forms and diagrams.

It is possible to format the calculation results in Russian and English.

"ALT-Finance 1.5" |

"AFSP 2.2" |

"Audit Expert 3.0" |

|

||

| Open software product By openness of the program we mean that the entire calculation algorithm is available for viewing and analysis. If necessary, the calculation formulas can be changed by the user without involving the developer. Additional indicators, coefficients, tabular forms and diagrams without limitation. If necessary, the user can install/remove protection mode calculation formulas from changes. |

Fully enclosed software product. Calculation formulas cannot be changed by the user. These changes can only be made by the developer Calculation formulas are not available for viewing. It is possible to enter additional calculated indicators and diagrams. In this case, only data from reporting forms can be used. It is not possible to enter additional initial information. |

Open software product. The calculation algorithm is available for viewing. Additional “user tables” can be added to the program, which allow you to set additional indicators and coefficients without restrictions. |

|

||

| The number of installations (and simultaneously working copies) within the user organization is not limited by the number of workstations and the number of copies per workstation. There is no security key. |

There is a "one key - one working copy" binding. |

The program comes with a security key. There is a "one key - one working copy" binding with an unlimited number of possible installations. |

Network versions |

||

| It is possible to work with the program online without additional modifications | To ensure network access to the program, you must purchase the network version | To provide network access to the program, you must purchase a network package (implies the presence of the program and a network key) or purchase several local packages |

|

||

| The program is a workbook consisting of sheets of calculation tables and diagrams. There is an automatic transition through tables and diagrams using the work menu. |

The program is implemented as a system of dialog boxes. Dialog boxes are intended for entering initial data, as well as describing individual areas of analysis. |

General control of the program is carried out using dialog boxes. The initial data and final results are presented in the form of tables. |

|

||

| The software product is implemented in a spreadsheet environment Microsoft Excel. To work with the program, you must have the appropriate software. | Independent software product. Designed in accordance with Microsoft interface standards. Working with software product does not require additional software other than the Windows shell. | |

Formation of balance sheet according to GAAP, IAS standards |

||

| Not provided. Modification of the program is possible - automatic translation of data into the IAS standard | It is possible to automatically generate GAAP* and IAS balances | It is possible to automatically generate an IAS balance |

* The automatic conversion of the Russian balance sheet to the GAAP balance sheet is incorrect without additional postings. |

||

| Automatic calculation provided liquidity indicators and financial stability (autonomy) acceptable for a given enterprise in the current operating conditions. | There is a database of recommended values for liquidity and financial stability indicators for various industries. | |

Ability to analyze reporting forms of CIS countries |

||

| There are specialized versions of the program that take into account the specifics of reporting forms in Ukraine and Belarus. | Not provided |

It is possible to analyze the reporting forms of Russia, Ukraine, Belarus and Uzbekistan in a single program. |

Choosing a research horizon |

||

| It is possible to analyze reporting forms from 1995 to the present. Interval duration any analysis, different combinations of interval durations are possible. |

It is possible to analyze reporting forms from 1991 to the present. | It is possible to analyze reporting forms from 1994 to the present. |

Methods of financial analysis used |

||

| Horizontal, comparative and vertical analysis is carried out. Conducted factor analysis indicators of liquidity, profitability and profitability. | Methods of horizontal and comparative analysis are used. There is no factor analysis of indicators. | Methods of horizontal and comparative analysis are used. There is no factor analysis of indicators. The possibility of “disclosing” analytical accounting by components of constant and current assets, as well as accounts payable. |

Preparation of text conclusions |

||

| The software package includes an example of a detailed analytical note on conducting an analysis of the financial condition of an enterprise (printed publication). | The program contains a layout of an express report based on the results of an analysis of the financial condition of the enterprise. | |

Supporting documentation |

||

| The program package includes a user manual, methodological literature on the methodology for assessing the financial condition of an enterprise, and an example of an analytical note. The program contains comments on the calculations of various indicators. |

The software package includes a user manual. The program contains comments on the calculations of various indicators. |

|

Comparative analysis of software products

for evaluating investment projects "Alt-Invest" and "Project Expert"

The software product "Alt-Invest" was developed by IKF "ALT".

The software product "Project Expert" was developed by a consulting firm "Pro-Invest Consulting".

Similarities of software products

Software products are designed to carry out a comprehensive assessment of investment projects, and allow the calculation of the entire set of efficiency and solvency indicators necessary for preparing a business plan for an investment project.

The software products are based on the methodology for evaluating investment projects developed by the United Nations Industrial Development Organization (UNIDO). At the same time, software products take into account the specifics of the Russian economy (taxation, inflationary processes).

Software products allow:

- form a budget investment project subject to changes external environment(inflation, refinancing rates of the Central Bank of the Russian Federation),

- assess the financial viability of the project (calculate profitability, turnover and liquidity indicators),

- evaluate economic efficiency investments,

- generate basic forms of financial reporting (cash flow statement, profit statement, balance sheet),

- receive calculation results in tabular and graphical form,

- draw up calculation results in Russian and English.

Software products provide for an analysis of the sensitivity of the project to changes in its main parameters.

Working with these software products involves two stages. At the first stage, data on the project is entered, then the main indicators are automatically calculated and graphs are drawn to analyze the attractiveness of the investment project.

Main differences between software products

"ALT-Invest" |

"Project Expert" |

Availability of the calculation algorithm for viewing and changes |

|

| Open software product The calculation algorithm is available for viewing; If necessary, it can be adjusted. Adaptable software product Using openness, the user has the opportunity to adapt it to the specifics of a particular industry, enterprise and project (both in terms of entering initial information and in terms of the calculation algorithm). |

Fully enclosed software product. Calculation formulas and the principle of specifying initial data cannot be changed by the user. These changes can only be made by specialists from Pro-Invest Consulting. |

| Protection of calculation formulas from changes can be installed/removed at the request of the user of the software product. In formula protection mode, only source data input cells are available for changes. Working with Alt-Invest does not require additional password entry. |

Work possible only when availability the user has a special password - key. Without a password, the user of the software product can only perform the first step - entering data; the module for calculating investment performance indicators will not be available to him. |

Number of installations (installations) |

|

| Number of installations (copies) of the software product within the user organization unlimited. | Implemented only one installation software product for personal computer user. |

Organization of the user interface |

|

| The software product implements an integrated documentation system. The principle of an integrated documentation system assumes that when the initial data of a project changes, it is possible to quickly monitor the impact of this change on the performance indicators and financial solvency of the investment project. |

"Project Expert" is implemented as a system of sequential windows. These windows are intended for entering initial data for the project, or for displaying the final indicators of the project. |

Specific program features |

|

| It is possible to assess the budgetary efficiency of the project from the point of view of federal and municipal authorities (version 3.0), as well as taking into account the requirements of SNiP. | . |

| It is possible to build network graphics GANTT with a description of the stages of the investment project | |

| The possibility of accounting and optimization of leasing operations is provided (version 3.0). | |

| There is a version that allows you to combine several projects into a group and evaluate integrated indicators for the group of projects as a whole. | It is possible to combine several projects into a group and view integrated performance indicators for the group as a whole (version 5.0). |

Need for additional software |

|

| Implemented in Microsoft Excel spreadsheet environment. To work with the program, you must have the appropriate software. | It is an independent software product developed in accordance with Microsoft interface standards. Working with the software product does not require additional software other than the Windows shell. |