2.4.

Analysis of capital turnover.

Economic effect from the expected acceleration of capital turnover 2

LIST OF SOURCES AND REFERENCES USED 10

2.4. Analysis of capital turnover. Economic effect from the expected acceleration of capital turnover

Since capital turnover is closely related to its profitability and serves as one of the most important indicators characterizing the intensity of use of an enterprise’s funds and its business activity, in the process of analysis it is necessary to study capital turnover indicators in more detail and establish at what stages of the circulation the slowdown or acceleration of the movement of funds occurred.

The capital turnover rate is characterized by the following indicators:

Turnover ratio (K rev);

The duration of one revolution (P rev). The duration of capital turnover is calculated: P The duration of capital turnover is calculated: , (2.4.)

about = D/K Where

D

– the number of calendar days in the analyzed period.

The turnover of capital, on the one hand, depends on the speed of turnover of fixed and working capital, and on the other hand, on its organic structure: the larger the share of fixed capital, which turns over slowly, the lower the turnover ratio and the longer the duration of the turnover of the entire total capital.

Using the chain substitution method, we will calculate how these indicators have changed due to the capital structure and the rate of working capital turnover. We present the analysis in Table 2.7.

|

Table 2.7. |

Analysis of the duration of capital turnover of OJSC Sitall |

||

|

Index |

|||

|

Deviations |

|||

|

1.Net revenue, thousand rubles. |

|||

|

3. Specific weight of OA in the total amount of capital (line 2.1: line 2) * 100% |

|||

|

4. To rev (page1:page2), revolutions |

|||

|

Including reverse (str1:str2.1) |

|||

|

5.P about (360dn:str4), days |

|||

|

Including negotiable (360 days: line 4.1) |

It can be seen that the acceleration of the turnover of total capital occurred due to a change in the capital structure (increasing the share of working capital in its total amount by 7.339%). Despite the fact that the turnover ratios of both total and working capital decreased, the duration of capital turnover increased by 52 days.

Using the chain substitution method, we will calculate how these indicators have changed due to the capital structure and the rate of working capital turnover. We present the data in Table 2.8.

Table 2.8.

Factors of change in the turnover of the total capital of OJSC Sitall

|

Turnover change factor |

Indicator level |

||

|

Working capital share |

Working capital turnover rate |

||

|

Last year |

Last year |

||

|

Reporting year |

Last year |

||

|

Reporting year |

Reporting year |

||

|

General change Including due to: Capital structures Working capital turnover rates |

|||

The table shows that the acceleration of total capital turnover occurred both due to changes in the capital structure (increasing the share of working capital in its total amount) and due to the acceleration of capital turnover.

During subsequent analysis it is necessary to study the change in working capital turnover at all stages of its circulation, which will allow us to trace at what stages the acceleration or deceleration of capital turnover occurred. For this purpose, the average balances individual species current assets must be multiplied by the number of days in the analyzed period and divided by the amount of sales turnover.

Let us analyze the duration of working capital turnover, which is presented in Table 2.9. The data in this table shows at which stages of the circulation there was an acceleration of capital turnover, and at which there was a slowdown.

Table 2.9.

Analysis of the duration of the working capital turnover of OJSC Sitall

|

Table 2.7. |

Deviations |

||

|

1.Total amount of working capital, thousand rubles. |

|||

|

Including in |

|||

|

1.1.Inventories, thousand rubles. |

|||

|

Raw materials |

|||

|

Finished products |

|||

|

Goods shipped |

|||

|

Deferred expenses |

|||

|

1.3. Accounts receivable, thousand rubles. |

|||

|

1.4.Cash, thousand rubles. |

|||

|

2.Net revenue, thousand rubles. |

|||

|

3.Pob, days |

|||

|

Including in |

|||

|

3.1.Inventories 360 / (line 2:line 1.1), days |

|||

|

Raw materials |

|||

|

Costs in work in progress |

|||

|

Finished products |

|||

|

Goods shipped |

|||

|

Deferred expenses |

|||

|

3.2. |

|||

|

VAT 360/(line 2:line 1.2), days |

|||

|

3.3.Accounts receivable 360/(line 2:line 1.2), days |

The data in this table shows at which stages of the circulation there was an acceleration of capital turnover, and at which there was a slowdown. In 2006, the duration of capital's presence in production inventories decreased, which indicates a reduction in the production cycle. At the same time, the duration of the period of circulation of funds in accounts receivable has increased.

Duration of turnover, like everyone else current assets, and individual types (P ob) may change due to the amount of revenue and average balances working capital(Ost). To calculate the influence of factors, the chain substitution method is used:

P rev0 = (Res. 0 t)/BP 0 = (267836 360) /650837 = 148.148 days

P condition = (Ost 1 t)/BP 0 = (561859.5 360) /650837 = 310.784 days

P ob1 = (Ost 1 t)/BP 1 = (561859.5 360)/1013604 = 199.555 days

Hence the change in the duration of working capital turnover due to:

working capital turnover amounts:

ΔP about time = 199.555 – 310.784 = -111.229 days;

average working capital balances:

ΔP about rest = 310.784 – 148.148 = 162.636 days;

Including due to changes in average balances:

a) inventories: 43316 360 / 650837 = 23.959 days;

Raw materials: 28463.5 360 / 650837 = 15.744 days

Costs in work in progress: 626 360 / 650837 = 0.346 days

Finished products: 14145 360 / 650837 = 7.824 days

Goods shipped: 510 360 / 650837 = 0.282 days

Deferred expenses: -428.5 360 / 650837 = -0.237 days

b) VAT: -557.5 360 / 650837 = -0.308 days

c) accounts receivable: 248008 360 / 650837 = 137.2 days;

G) Money and KFV: 3257 360 / 650837 = 1.8 days

The rate of capital turnover varies across different industries. In some it turns around faster, in others - slower, which largely depends on the duration of the production cycle and the circulation process. Production time, as is known, is determined by the technological process, production organization, and technology.

It is possible to accelerate the turnover of capital by intensifying production, making fuller use of labor and material resources, diverting funds into accounts receivable and preventing excess inventories of inventories.

The economic effect as a result of accelerating capital turnover is expressed in relative release funds from circulation, as well as in increasing the amount of revenue and profit.

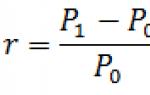

The amount of funds released from circulation due to acceleration (-E) or additionally attracted funds into circulation (+E) in the event of a slowdown in capital turnover is determined by multiplying the one-day sales turnover by the change in the duration of the turnover:

± E = (Actual turnover amount / Days in the period) ×Δ The duration of one revolution (P rev). The duration of capital turnover is calculated: (2.5.)

± E = (1013604 / 360) × (200 – 148) = +146409.47 thousand rubles.

At the analyzed enterprise, due to the slowdown in working capital turnover, additional funds were involved in the turnover in the amount of 146,409.47 thousand rubles. If the capital did not turn over in the amount of 1,013,604 thousand rubles. the enterprise would need to have in circulation not 561859.5 thousand rubles. working capital, and 415,450.03 thousand rubles, i.e. by 146,409.47 thousand rubles. less.

To establish the influence of the turnover ratio on changes in the amount of revenue, you can use the following factor model:

B = K × K The duration of capital turnover is calculated: (2.6.)

Where TO- total amount of capital,

Cob– turnover ratio.

ΔV Kob = K 1 ∆K rev = 561859.5 (1, rub.

ΔV K = ∆K K rev 0 = (561859.5 –267836)

Since profit can be represented as a product of factors (P = K OA = K K rev P pr), then an increase in its amount due to a change in the capital turnover ratio can be calculated by multiplying the increase in the latter by the base level of the return on sales ratio and by the actual

6.025) 561859.5= + 2119137.4 thousand rubles.

Due to the acceleration of working capital turnover in the reporting year, the company additionally received profits in the amount of 2,119,137.4 thousand rubles.

The main measures to accelerate working capital turnover include:

acceleration

location;

increasing the level of services, etc.;

reduction in duration, rub.);

improvement of organization ah.

LIST OF SOURCES AND REFERENCES USED

GOVERNMENT DOCUMENTS

1.Civil Code Russian Federation: parts one and two.

2. Tax Code of the Russian Federation: parts one and two.

BIBLIOGRAPHY

LITERATURE

4. Analysis of the economic activities of an enterprise: Textbook/G.V. Savitskaya. – M.: Infra-M, 2002.

5. Basovsky L.E., Basovskaya V.E. Comprehensive economic analysis of economic activity. - M.: Infra-M, 2005.

6. Blank I.A. Fundamentals of financial management. – K.: Nika, 2005.

7. Gilyarovskaya L.T. Comprehensive analysis of financial and economic results of activities. - M.: ed. Peter, 2005.

8. Ginzburg A.I. Economic analysis. – Peter, 2003.-480 p.

9. Drozdov V.V. , Drozdova N.V. Economic analysis. Workshop. – M.: Unity, 2005.

10. Dranko O.I. Financial management. Enterprise financial management technology. – M.: Unity-Dana, 2004.

11. Ermolovich L.L. Workshop on analyzing the economic activities of an enterprise. – M.: Book House, 2003.

12. Efimova O.V. The financial analysis.-M.: Accounting, 2002.

13. Zimin N.E. Analysis and diagnostics of the financial condition of enterprises: Textbook. – M.:Ekmos, 2002.

14. Kovalev V.V. Analysis of the economic activities of the enterprise. – M.: Prospekt, 2006.

15. Kovalev V.V. Financial statements. Analysis of financial statements (basics of balance sheet). – M.: Prospekt, 2006.

16. Liberman I.A. Analysis and diagnostics of financial and economic activities: Textbook. – M.: RIOR, 2005.

17. Lyubushin N.P. Comprehensive economic analysis of economic activity. – M.: Unity-Dana, 2006.

18. Maksyutov A.A. Economic analysis. – M.: Unity - Dana, 2005.

19. Mironov M.G. Financial management. –M.: Gross-Media, 2004.

20. Pavlova L.P. Financial management. - M.: INFRA-M, 2003.-384 p.

21. Paliy V.F. Fixed capital and current tangible assets. – M.: Berator-press, 2003.

22. Radionov A.R., Radionov R.A. Management: rationing and management of production inventories and working capital of the enterprise. Tutorial. – M.: Economics, 2005.

23. Rusak N.A. Strazhev V.I., Migun O.F. Analysis of economic activities in industry. / Ed. Strazheva V.I. - Minsk: Higher School, 2002.-254 p.

24. Savitskaya G.V. Methodology for comprehensive analysis of economic activity. – M.: Infra-M, 2003.

25. Selezneva N.N. The financial analysis. Financial management. – M.: Unity, 2005.

26. Snitko L.T., Krasnaya E.N. Managing the organization's working capital. – M.: RDL, 2002.

27. Stoyanova E.S. Financial management. – M.: Perspective, 2003.

28. Utkin E.A. Financial management: Textbook for Universities. – M.: Mirror, 2002.

29. Helfert E. Financial analysis technique. – M.: UNITY, 2003.

30. Khotinskaya G.I. Analysis of the economic activities of the enterprise. – M.: Infra-M, 2004.

31. Sheremet A.D. Theory economic analysis. M.: Infra-M, 2005.

32. Sheremet A.D. Comprehensive analysis of economic activities. – M.: Rior, 2006.

33. Sheremet A.D., Saifulin R.S., Negashev E.V. Methodology of financial analysis. Tutorial. – M.: Infra-M, 2001.

PERIODICALS:

34. Druzhilovskaya T.Yu. Change in capital and cash flow //Audit statements. - 2005. - No. 9.

36. Kiperman P. Analysis current assets//Financial newspaper. Regional release. – 2007. – April No. 15.

1

The determination of effectiveness begins with the establishment of criteria, i.e. the main feature of performance assessment, revealing its essence. The meaning of the production efficiency criterion follows from the need to maximize the results obtained or minimize the costs incurred based on the set development goals of the enterprise.

The financial position of an enterprise is directly dependent on how quickly funds invested in assets are converted into real money.

The duration of funds being in circulation is determined by the cumulative influence of a number of multidirectional factors of an external and internal nature. The first should include the sphere of activity of the enterprise (production, supply and sales, intermediary, etc.), industry affiliation, size of the enterprise. The economic situation in the country has a decisive influence on the turnover of an enterprise's assets. The severance of economic ties and inflationary processes lead to the accumulation of reserves, which significantly slows down the process of turnover of funds. Internal factors include price policy enterprises, formation of the asset structure, choice of methodology for assessing inventories.

Current assets represent part of the advanced capital. Its cost includes inventories, work in progress, finished goods, accounts receivable cash. Here, first of all, everything that is connected with labor is reflected - objects, means, payment. It is in the interests of the enterprise to organize work using collective funds in the most rational way, since its financial condition directly depends on this. The system of working capital turnover indicators is based on two interrelated financial ratios: the coefficient of the duration of one turnover and the turnover ratio, which characterize the efficiency of using working capital. The latter affects business activity, capital productivity and also the profitability of assets or activities of the enterprise.

Asset turnover reflects how many times during a period the capital invested in the assets of the enterprise is turned over, i.e. it evaluates the intensity of use of all assets, regardless of the sources of their formation. On the other hand, it shows how much of the company’s revenue has cash invested in assets

A high turnover rate, as a rule, indicates the efficient use of capital and a favorable environment within the company: a low level of inventory reduces the risk of unsold products remaining in the warehouse. However, if the coefficient is significantly higher than the industry average, then there is a shortage of purchased goods and materials and, as a result, the risk of causing customer dissatisfaction.

The following are the general indicators of turnover of current assets of an enterprise:

1. The turnover ratio of current assets (turnover of current assets in times), which characterizes the rate of turnover of current assets and shows the number of turnovers made by current assets during the period, and is calculated using the formula:

Kob=VRn/OBsr,

where Kob is the turnover ratio of current assets; VRn - revenue (net) from sales; OBav - average balances of current assets for the period.

2. The average duration of one turnover of current assets (turnover of current assets in days), characterizing the duration of the turnover of current assets, showing the average time spent by current assets in the process of circulation in days and determined by the formula:

Toba=(OBav∙D)/VRn=OBav/VRd,

where Toba is the average duration of one turnover of current assets (in days); VRn - revenue (net) from sales; OBav - average balances of current assets for the period; D - number of days in the period; VRD - average daily revenue (net) from sales.

As can be seen from the above formulas, the turnover ratio and the average duration of one turnover of current assets are inversely proportional, i.e. The higher the turnover rate of current assets, the shorter its duration. In other words, the intensification of the use of current assets implies an increase in the first indicator and, accordingly, a decrease in the second.

3. The economic effect of changes in the turnover of current assets, which characterizes their release from circulation as a result of an increase in its speed or their additional attraction into circulation as a result of a slowdown in its speed and is calculated using the formula:

(+/-)E=(Toba1 - Toba0)∙VRd1,

where (+/-)E is the value economic effect from changes in turnover of current assets; Toba1 and Toba0 - the average duration of one turnover of current assets (in days) in the reporting and previous periods, respectively; ВРд1 - average daily revenue (net) from sales during the reporting period.

In this case, the following three situations may occur related to the value of the economic effect from changes in the turnover of current assets:

1.Toba1 < Тоба0 > E < 0, т.е. произошло высвобождение оборотных активов из оборота в результате повышения интенсивности их использования.

2.Toba1>Toba0>E>0, i.e. There was an additional attraction of current assets as a result of a decrease in the intensity of their use.

3.Toba1=Toba0>E=0, i.e. there was no release or additional attraction of current assets into circulation, since the intensity of their use remained at the same level.

The release of current assets from circulation should be considered as a positive phenomenon, since a smaller amount of them began to be required to ensure a given level of current activity commercial organization, additional attraction of current assets is considered a negative phenomenon, since in order to ensure a given level of current activity of a commercial organization, a large amount of them began to be required.

Bibliographic link

Nurullaeva E.R., Franchuk M.V. ECONOMIC EFFECT FROM CHANGES IN ASSET TURNOVER // Advances in modern natural science. – 2012. – No. 4. – P. 154-155;URL: http://natural-sciences.ru/ru/article/view?id=29962 (access date: 02/09/2020). We bring to your attention magazines published by the publishing house "Academy of Natural Sciences"

The economic effect as a result of accelerated turnover is expressed in the relative release of funds from circulation, as well as in an increase in the amount of revenue and profit.

The amount of funds released from circulation due to acceleration (-E) or additionally attracted funds into circulation (+E) when the turnover of current assets slows down is determined by the following formula:

t=41 src="images/referats/24337/image007.png">

(turnover period of current assets of the reporting year – turnover period of the previous year) (1)

Let's calculate the economic effect for 2005:

. (27.40-22.22) = + 7042.78 thousand. rub.

Great value in analysis business activity has a duration of operating and financial cycles (Table 3)

Table 3 Calculation and dynamics of turnover indicators

|

Indicators |

Source information or calculation method |

Last Year (2005) |

Reporting year (2006) |

Change |

|

1. Revenue from the sale of goods, works and services, thousand rubles. |

Initial data | AAAAAAAAAAAAAAAAAAAAAAAA | ||

|

2. Cost of goods, works, services sold |

Initial data | |||

|

3.Average amount of accounts receivable, thousand rubles. |

Initial data | |||

|

4.Average inventory and costs, thousand rubles. |

Initial data | |||

|

5. Average amount of accounts payable, thousand rubles. |

Initial data | |||

|

Turnover ratios | ||||

|

1. Accounts receivable turnover ratio | ||||

|

2. Duration of receivables turnover, days. | ||||

|

3. Inventory turnover ratio | ||||

|

4. Duration of inventory turnover, days. | ||||

|

5. Duration of the business cycle (operating cycle), days. | ||||

|

6. Accounts payable turnover ratio | ||||

|

7. Duration of accounts payable turnover, days. | ||||

|

8.Duration of the financial cycle |

The table shows that in the period under review there is a decrease in the turnover ratios of receivables, inventories and accounts payable, as a consequence of an increase in the duration of turnover.

A decrease in the inventory turnover ratio and an increase in the duration of inventory turnover indicates a slow turnover of goods or a decrease in demand. In general, the lower the inventory turnover rate, the more funds are tied up in this least liquid item, the less liquid the working capital structure is and the less stable financial position enterprises. The organization is interested in reducing the turnover period of inventories and receivables and increasing the turnover period of accounts payable in order to reduce the turnover period of working capital.

For financial condition It is favorable for an enterprise to receive a deferred payment from suppliers, employees of an enterprise, or the state, since a deferred payment gives additional source financing. It is unfavorable to freeze part of the funds in reserves and provide deferred payments to customers. This creates the need for financing for the enterprise. The accounts receivable turnover ratio decreases due to an increase in the amount of accounts receivable. The decrease in the inventory turnover ratio was influenced by an increase in the amount of inventories and costs. As a result, the duration of the business cycle increases by 15.38 days. The decrease in the accounts payable turnover ratio is caused by an increase in the amount of accounts payable in to a greater extent, which increased the cost. The duration of the financial cycle in 2005 has a value of 16.56, but in 2006 it increases by 15.38.

An important indicator of the intensity of use of working capital is the speed of their turnover. Working capital turnover is the duration of one complete circulation of funds, starting with the first and ending with the third phase. The faster working capital goes through these phases, the more products an enterprise can produce with the same amount of working capital.

In different economic entities, the turnover of working capital is different, as it depends on the specifics of production, conditions of sales of products, the solvency of the enterprise, on the features in the structure of working capital and other factors.

The turnover rate of working capital is calculated using three interrelated indicators: the duration of one turnover in days, the number of turnovers per year (half year, quarter), as well as the amount of working capital per unit products sold. The calculation of working capital turnover can be carried out both according to plan and actually.

The planned turnover can be calculated only for standardized working capital, the actual turnover can be calculated for all working capital, including non-standardized ones. A comparison of planned and actual turnover reflects the acceleration or deceleration of the turnover of standardized working capital.

When turnover accelerates, working capital is released from circulation; when it slows down, there is a need for additional involvement of funds in turnover. The duration of one revolution in days is determined based on formula 1.

O = Co: (T: D), (1)

or formula 2.

O = (Co × D) : T (2)

where O is the duration of one revolution, days;

Сo - average annual working capital balances, rub.;

T - volume commercial products(at cost), rub.;

D - number of days in the reporting period

The turnover ratio shows the number of turnovers made by working capital per year (six months, quarter), and is determined by formula 3.

Ko = T: Co, (3)

where Ko is the turnover ratio, i.e. number of revolutions.

The working capital utilization ratio is an indicator inverse to the turnover ratio. It characterizes the amount of working capital per unit (1 ruble, 1 thousand rubles, 1 million rubles) of products sold, calculated using formula 4.

Kz = Co: T, (4)

where Kz is the working capital load factor.

This indicator may indicate rational, efficient or, conversely, ineffective use of working capital only in comparison over a number of years and based on the dynamics of the coefficient. Turnover can be general or private. General turnover characterizes the intensity of use of working capital as a whole across all phases of the circulation, without reflecting the characteristics of the circulation of individual elements or groups of working capital. The overall turnover indicator seems to neutralize the process of improving or slowing down the turnover of funds in individual phases. Accelerating the turnover of funds at one stage can be minimized by slowing down the turnover at another stage and vice versa.

The second turnover indicator - the number of turnovers made by working capital during the reporting period (turnover ratio) can be obtained in two ways:

1) sales of products minus value added tax and excise taxes to the average balance of working capital, i.e. according to formula 5.

OR = P/CO, (5)

where СО - number of revolutions

P - sales of products

CO - average balance of working capital

2) the number of days in the reporting period to the average duration of one revolution in days, i.e. according to formula 6.

HO = B/P (6)

B - number of days in the reporting period,

P is the average duration of one revolution in days.

The third indicator of turnover (the amount of employed working capital per 1 ruble of products sold - this is the working capital load factor) is determined in one way as the ratio of the average balance of working capital to the turnover of product sales for a given period, i.e. according to formula 7.

This figure is expressed in kopecks. It gives an idea of how many kopecks of working capital are spent to obtain each ruble of revenue from product sales.

The most common first indicator of turnover, i.e. average duration of one revolution in days.

The annual turnover is most often calculated.

When the turnover of working capital slows down, additional involvement in turnover occurs; when it accelerates, working capital is released from circulation. The amount of working capital released as a result of accelerated turnover or additionally attracted as a result of a slowdown is determined as the product of the number of days by which turnover accelerated or slowed down by the actual one-day sales turnover.

The economic effect of accelerating turnover is that an organization can produce more products with the same amount of working capital, or produce the same volume of products with a smaller amount of working capital.

Accelerating the turnover of working capital is achieved by introducing into production new technology, progressive technological processes, mechanization and automation of production. Such measures help to reduce the duration of the production cycle, as well as increase the volume of production and sales of products.

To speed up turnover, it is important to: rational organization logistics, sales finished products, compliance with the regime of savings in production costs for the sale of products, the use of forms of non-cash payments for products that help speed up payments, etc.

To study the reasons for changes in the rate of turnover of funds, consider the indicators of general turnover and indicators of private turnover. They relate to certain types of current assets and give an idea of the time spent by working capital at various stages of their circulation. These indicators are calculated in the same way as inventories in days, but instead of the balance (inventory) on a certain date, the average balance of a given type of current asset is taken.

Private turnover shows how many days on average working capital is in a given stage of the circulation. For example, if the private turnover of raw materials and basic materials is 10 days, this means that on average 10 days pass from the moment the materials arrive at the organization’s warehouse to the moment they are used in production.

As a result of summing up the indicators of private turnover, we will not obtain an indicator of total turnover, since different denominators (turnovers) are taken to determine indicators of private turnover. These indicators make it possible to establish what influence the turnover of individual types of working capital has on the indicator of total turnover.

In analytical practice, the inventory turnover indicator is used. The number of turnovers made by inventories for a given period is calculated using the following formula:

Proceeds from the sale of products, works and services (minus value added tax and excise taxes) are divided by the average value under the item “Inventories” of the 2nd asset section of the balance sheet.

Acceleration of inventory turnover indicates an increase in the efficiency of inventory management, and a slowdown in inventory turnover indicates their accumulation in excessive amounts and ineffective inventory management. Indicators are also determined that reflect the turnover of capital, that is, the sources of formation of the organization’s property. For example: turnover equity, is calculated using the following formula:

Product sales turnover for the year (minus value added tax and excise taxes) is divided by the average annual cost of equity capital.

This formula expresses the efficiency of using equity capital (additional, authorized, reserve capital, etc.). It gives an idea of the number of turnovers made by the organization’s own sources of activity per year.

This indicator characterizes the efficiency of using funds invested in the development of the Technopark OJSC enterprise. It reflects the number of turnovers made by all long-term sources during the year.

When analyzing the financial condition and use of working capital, it is necessary to find out from what sources the financial difficulties of the enterprise are compensated. If assets are covered by stable sources of funds, then the financial condition of the organization will be stable not only at a given reporting date, but also in the near future. Sustainable sources should be considered own working capital in sufficient amounts, balances of carry-over debt to suppliers on accepted payment documents, the payment terms of which have not arrived, constantly carry-over debt on payments to the budget, part of other accounts payable, unused fund balances special purpose(accumulation and consumption funds, as well as social sphere), unused balances of targeted financing, etc.

If the financial breakthroughs of the enterprise, Technopark OJSC are covered by unstable sources of funds, on the date of reporting it is solvent and may even have free funds in bank accounts, but financial difficulties are expected in the near future. Unsustainable sources of working capital available on the 1st day of the period, the balance sheet date, but absent on dates within this period include: non-overdue debt for wages, contributions to extra-budgetary funds (above certain sustainable values); unsecured debt to banks for loans against inventory items; debt to suppliers for accepted payment documents, the payment terms of which have not yet arrived; in excess of amounts attributed to sustainable sources; debt to suppliers for supplies; arrears of payments to the budget in excess of amounts attributed to sustainable sources of funds.

It is necessary to draw up a final calculation of financial breakthroughs, i.e. unjustified expenditure of funds and sources to cover these breakthroughs.

Based on the above, we can conclude that an important indicator of working capital is the speed of their turnover. When comparing planned and actual turnover, you can see the acceleration or deceleration of the turnover of normalized working capital.

When the turnover of working capital slows down, they are additionally involved in turnover.

When turnover accelerates, working capital is released from circulation, i.e. An organization can produce more products with the same amount of working capital or the same volume of production with a smaller amount of working capital.

Currently, the total amount of the company's receivables is about 1,474 thousand rubles. In 2009 - 2010 the balance of short-term accounts receivable at the end of the year tends to decrease, which makes it possible to increase the cash component of working capital and accelerate their turnover. To further reduce accounts receivable, it is planned to: increase the share of prepayment and intensify work legal service to collect the overdue portion of the debt.

Also, to increase the efficiency of using working capital (by reducing the turnover period), it is recommended to develop measures for the sale and write-off of stale materials, since their presence leads to the “death” of working capital, increased storage costs, etc.

Let us calculate the effectiveness of the proposed measures. We present the data for calculations in the form of table 22.

Table 22. Initial data for analysis

In the reporting year 2010, revenue increased 1.5 times compared to the previous 2009, when it amounted to 12,941,694 thousand rubles, therefore, in the base period it is planned to increase revenue by 1.65 times, which will amount to 33,090,560 thousand rubles. (see table 22).

In addition, it is planned to reduce accounts receivable, according to the proposed measures, by 4 times, which will amount to 168,523 thousand rubles.

Due to the doubling of revenue, there should be an increase in inventory turnover, which in turn should be due to a decrease in inventories and materials in warehouses.

Let us analyze the dynamics of the economic potential of the enterprise for 2009-2011, taking into account planned indicators.

The analysis is shown in Table 23.

Table 23. Dynamics of the economic potential of KAMAZ-DIZEL OJSC for the period 2009-2011 (taking into account planned indicators), thousand rubles.

The following ratio of tempo indicators is optimal:

> > > 100%, (14)

where, - respectively, the rate of change in profit from sales of products, revenue from sales and the total cost of products sold.

Throughout 2009-2010. This inequality is observed to be fulfilled, despite the fact that the financial condition of the enterprise is not stable, there was a decrease in losses, and the profit growth rate was 167.39%. Inequality indicates that, compared with the increase in economic potential, sales volume increases at a faster rate, that is, the organization’s resources are used more efficiently, the return on every ruble invested in the company increases, since the rate of revenue growth outpaces the rate of cost growth, which cannot be said about the rate of profit growth. If the revenue growth rate increases by 10%, revenue will increase by 1.65 times. It is necessary that in the planning year the rate of profit growth be greater than the rate of revenue growth, which should increase the economic potential of KAMAZ-DIZEL OJSC. In order for profits to increase at a faster pace, it is necessary to have a relative reduction in production and distribution costs in the reporting period as a result of actions aimed at optimizing technological process and relationships with counterparties.

Thus, with a planned reduction in losses by 88 times, sales revenue will increase by 1.65 times, and full cost 1.62 times and the inequality will be respected. Consequently, it is planned to increase the economic potential of KAMAZ-DIZEL OJSC.

Inventory circulation time is expressed in days of turnover and is calculated using formula (15)

OT = Z * T: Q (15)

Ot - average stock;

T - number of days in the period;

Q - sales revenue.

Let's calculate the inventory circulation time for the enterprise OJSC KAMAZ-DIZEL for 2010.

From = 1127103 * 365: 20054885

This means that in 2010 the company had enough supplies for 20 days. It is necessary to plan a decrease in inventory levels, therefore, according to formula (15), in the planned year 2011, the inventory circulation time should decrease due to an increase in sales revenue, which will entail a decrease average annual cost negotiable production assets.

So, in 2011 we have according to plan:

From = 985650 * 365: 33090560

This means that with a decrease in inventory levels by 1.14 times, in the planned year the inventory circulation time is reduced by 2 times, which can increase the speed and reduce the time of commodity circulation, increase sales revenue with smaller sizes inventory, which has an impact on reducing the costs of storing goods, reducing commodity losses, etc.

Firms strive to increase inventory turnover in order to obtain the largest sales volume and, consequently, profit with a smaller warehouse area and lower inventory holding costs. High inventory turnover requires stricter inventory control.

Achieving high turnover is not an easy task for large enterprises, since they are forced to store part of the inventory of items with irregular demand in warehouses.

If for cost-effective trade it is necessary to maintain a high level of inventory turnover, then to ensure demand for any product included in the trade range, it is necessary to store a wide range of rarely sold goods, which slows down the overall inventory turnover.

Inventory turnover is an important criterion that needs to be analyzed carefully.

As a result of all measures, the average annual cost of working production assets should decrease by 1.5 times.

To estimate working capital turnover, formula (16) is used:

Turnover ratio

Kob = Vp / CO (16)

where Cob is the turnover ratio (in revolutions);

Vр - revenue from sales of products (works, services), thousand rubles;

SO - average working capital, thousand rubles.

The duration of one revolution is calculated using formula (17):

L=T/Kob (17)

where Dl is the duration of the circulation period of working capital, in days;

T - reporting period, in days.

In 2009 Kob 0 = 20054885/ 2653719 = 7.56

For 0 = 365/7.56 = 78.28 days.

In 2010 Kob 1 = 33090560/1822700 = 18.15

For 1 = 365/18.15 = 20.11 days.

The calculation shows that the duration of the circulation period of working capital is reduced by 4 times, which indicates an acceleration of its turnover, which is a positive effect of planning.

The amount of absolute savings (attraction) of working capital can be calculated in two ways.

1. The release (attraction) of working capital from circulation is determined by formula (18)

D CO = (CO 1 -CO 0)* Kvp (18)

where CO is the amount of savings (-), attraction (+) of working capital;

CO 1, CO 0 - the average amount of the organization's working capital for the reporting and base periods;

Kvp is the coefficient of product growth (in relative units).

D SO = (1822700-2653719) * 1.65 = - 1371181 thousand rubles.

2. The release (attraction) of working capital as a result of a change in the duration of turnover is calculated using formula (19)

DSO = (Dl 1 - Dl 0) * V 1odn, (19)

where Dl 1,Dl 0 - the duration of one turnover of working capital, in days;

V 1one - one-day sales of products, million rubles.

DSO = (20.11-78.28)*91 = - 5293 million rubles.

The increase in production volume due to the acceleration of working capital (all other things being equal) can be determined using the method of chain substitutions:

D Vр = (Kob 1 -Kob 0) * CO 1

D Vр = (18.15-7.56) * 985650 = 10,438,033 thousand rubles.

The increase in production volume in the planned year will amount to 10,438,033 thousand rubles.

The influence of working capital turnover on the increase in DR profit is calculated using formula (20)

D R = P 0 * (Kob 1 / Kob 0) - P 0 (20)

where P 0 - profit for the base period;

Kob 1, Kob 0 - working capital turnover ratios for the reporting and base periods:

DR= -4160*(18.15/7.56)-(-4160)= -5824 thousand rubles.

From calculations of the effectiveness of the proposed measures, it is clear that in the future, after their implementation, it is necessary to slow down the turnover of working capital again, since the base year value of 18.15 is high and the enterprise will increase its loss.

The slowdown in turnover will be accompanied by the diversion of funds from economic circulation and their relatively longer deadening in inventories, work in progress and finished products, which will help strengthen the financial condition of the KAMAZ-DIZEL OJSC enterprise.

Thus, as the calculations show, at the KAMAZ-DIZEL OJSC enterprise, measures are being taken to effectively use working capital (namely, reducing the level of inventories to optimal level, timely collection of receivables and taking measures to reduce the level of debt in the future), leads to a reduction in the enterprise’s losses, and as a result of increasing the efficiency of using working capital, improving the financial condition of the enterprise and increasing the business activity of the enterprise.